Volue ASA (OB:VOLUE) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

Volue ASA (OB:VOLUE) shareholders have had their patience rewarded with a 28% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

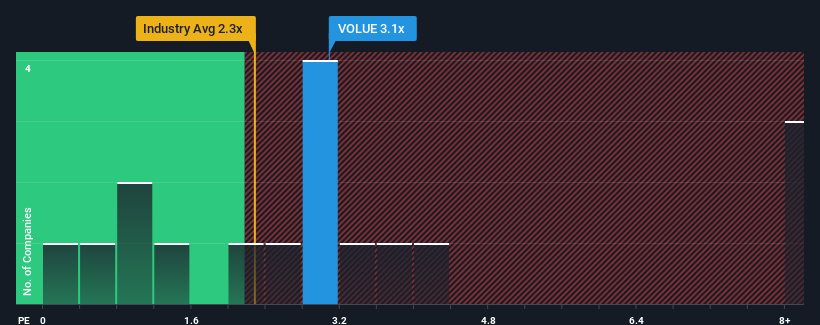

Although its price has surged higher, there still wouldn't be many who think Volue's price-to-sales (or "P/S") ratio of 3.1x is worth a mention when the median P/S in Norway's Software industry is similar at about 2.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Volue

How Has Volue Performed Recently?

Recent times have been advantageous for Volue as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Volue's future stacks up against the industry? In that case, our free report is a great place to start.How Is Volue's Revenue Growth Trending?

In order to justify its P/S ratio, Volue would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. The latest three year period has also seen an excellent 67% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 15% as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 25% growth forecast for the broader industry.

In light of this, it's curious that Volue's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Volue appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Volue's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Volue with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VOLUE

Volue

Engages in the provision of software and technology solutions for the energy, power grid, and infrastructure markets worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives