- Sweden

- /

- Consumer Services

- /

- OM:ACAD

European Undervalued Small Caps With Insider Activity For May 2025

Reviewed by Simply Wall St

As European markets continue to navigate a complex landscape, the pan-European STOXX Europe 600 Index has shown resilience, rising for a fourth consecutive week amid optimism over easing trade tensions between China and the U.S. This positive sentiment is bolstered by strong performances in Germany and Italy, despite mixed results across other major indexes. In this environment, identifying stocks that are potentially undervalued can be particularly appealing to investors looking for opportunities in small-cap companies with insider activity.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Savills | 24.8x | 0.6x | 40.75% | ★★★★☆☆ |

| Tristel | 30.7x | 4.3x | 17.41% | ★★★★☆☆ |

| FRP Advisory Group | 11.7x | 2.1x | 19.48% | ★★★★☆☆ |

| SmartCraft | 41.0x | 7.3x | 35.45% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 47.80% | ★★★★☆☆ |

| Eastnine | 18.1x | 8.7x | 39.59% | ★★★★☆☆ |

| Absolent Air Care Group | 23.8x | 1.9x | 46.40% | ★★★☆☆☆ |

| Italmobiliare | 11.7x | 1.5x | -207.90% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.7x | 38.02% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.4x | 45.30% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

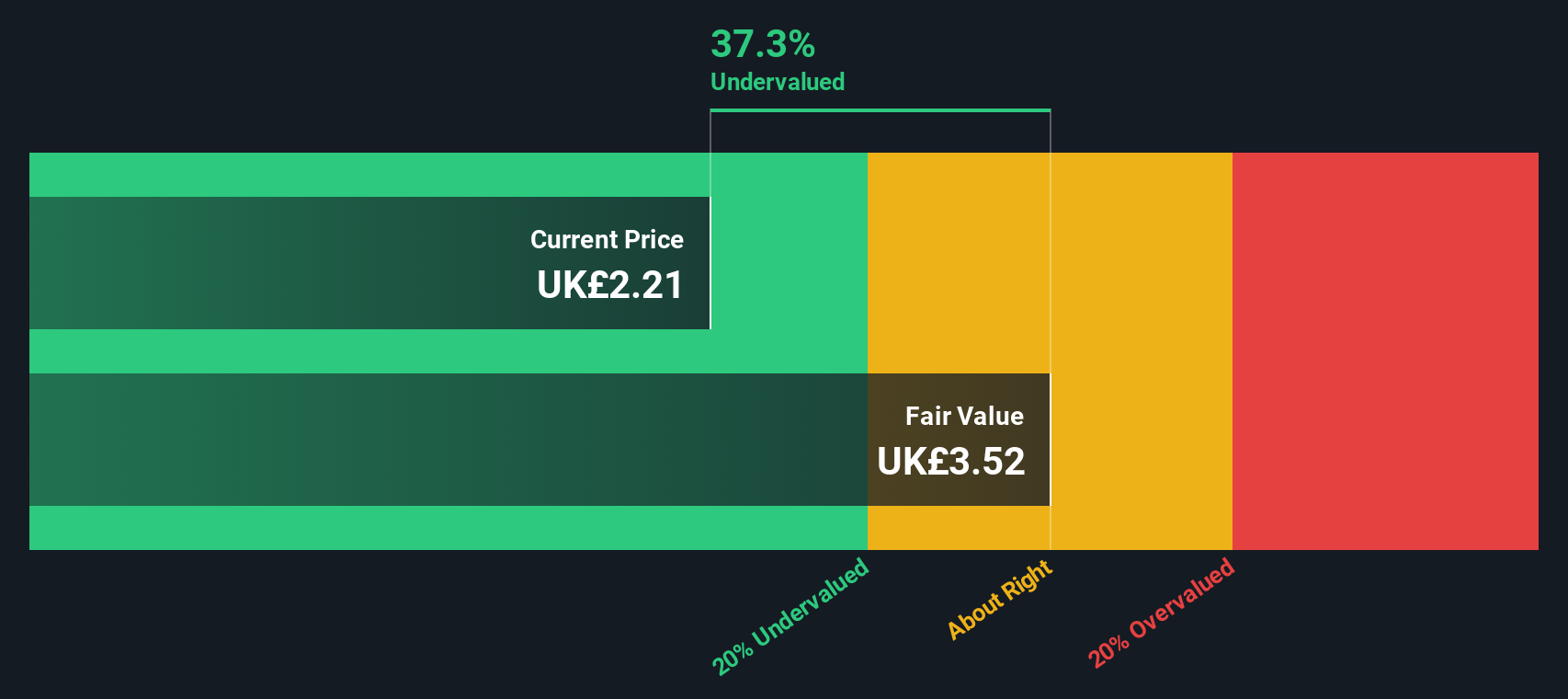

MONY Group (LSE:MONY)

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group is a diversified company operating in sectors such as money services, travel, cashback programs, insurance, and home services with a market capitalization of £1.56 billion.

Operations: The company's revenue is primarily driven by its Insurance segment, generating £235.60 million, with additional contributions from Money (£97.80 million) and Cashback (£60.80 million). Over recent periods, the gross profit margin has shown a declining trend from 80.20% to 66.17%. Operating expenses are significant, with General & Administrative Expenses consistently being the largest component within operating costs.

PE: 14.0x

MONY Group, a smaller European company, is drawing attention due to its potential for growth and shareholder-focused strategies. Recent insider confidence was demonstrated through share purchases in March 2025. The company has announced a £30 million share repurchase program, reflecting their commitment to sustainable returns while maintaining a clean balance sheet after paying off the Quidco term loan. With net income rising to £80.6 million in 2024 from £72.7 million previously and earnings per share increasing, MONY appears poised for continued expansion with ongoing plans for M&A and organic growth investments.

- Click here and access our complete valuation analysis report to understand the dynamics of MONY Group.

Review our historical performance report to gain insights into MONY Group's's past performance.

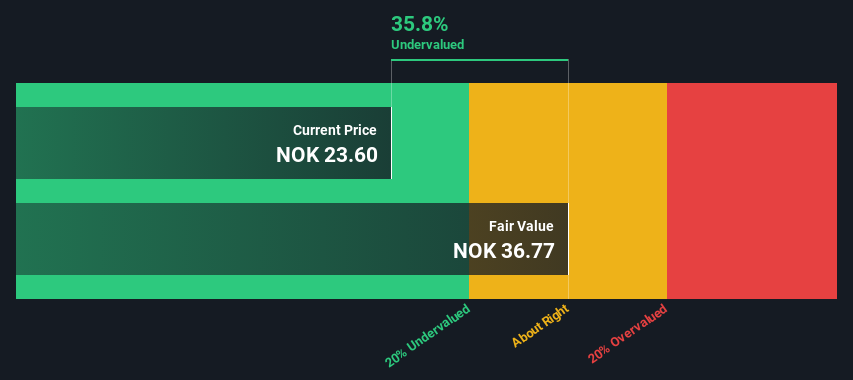

SmartCraft (OB:SMCRT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SmartCraft is a technology company specializing in providing software solutions for the construction industry, with a market capitalization of approximately NOK 2.34 billion.

Operations: SmartCraft generates revenue primarily from its operations, with a notable increase in revenue from NOK 74.05 million in 2017 to NOK 537.98 million by March 2025. The company's cost of goods sold (COGS) has also risen alongside revenue, impacting gross profit margins, which have fluctuated but reached a peak of 55.99% as of March 2024 before declining to 51.29% by March 2025. Operating expenses and non-operating expenses contribute significantly to the overall cost structure, affecting net income outcomes across the periods observed.

PE: 41.0x

SmartCraft, a European tech company in the construction sector, presents intriguing investment potential despite recent challenges. Their Q1 2025 earnings showed sales of NOK 136.96 million, up from NOK 109.74 million last year, yet net income declined to NOK 22.06 million from NOK 31.85 million due to lower profit margins and higher funding risks linked to external borrowing. The company recently launched Congrid's integrated BIM feature, enhancing construction site efficiency through improved data management and collaboration tools. Insider confidence is evident with share purchases by key executives over the past six months, suggesting optimism about future growth prospects despite current volatility and leadership changes as CEO Gustav Line prepares to step down later this year after seven years at the helm.

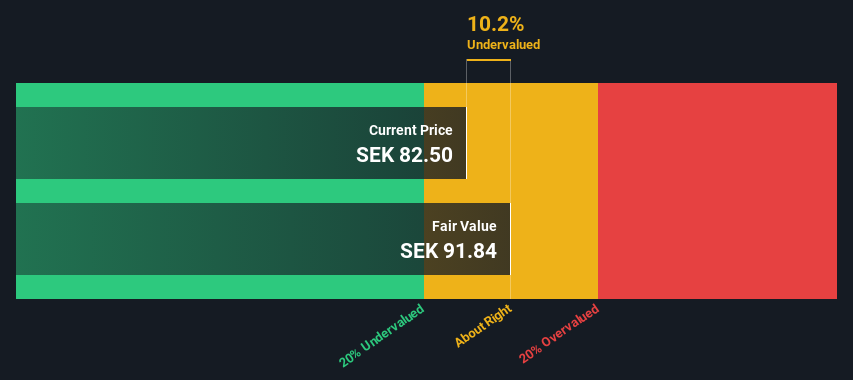

AcadeMedia (OM:ACAD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: AcadeMedia is a leading educational services provider in Northern Europe, offering a wide range of educational programs from preschool to adult education, with a market cap of approximately SEK 5.68 billion.

Operations: AcadeMedia's revenue primarily stems from its educational services, with recent figures showing SEK 18.34 billion in revenue for the quarter ending December 2024. The company's cost structure is significantly impacted by COGS and operating expenses, which include general and administrative costs that reached SEK 1.78 billion in the same period. Notably, AcadeMedia's gross profit margin has shown a trend of over 31% in recent quarters, reflecting its ability to manage production costs relative to revenue generation effectively.

PE: 10.9x

AcadeMedia, a European education provider, recently reported solid financial performance with third-quarter sales of SEK 5.04 billion and net income of SEK 241 million, reflecting growth from the previous year. Insider confidence is evident as key figures have been purchasing shares in recent months. Expanding its footprint in Germany with new preschools underscores strategic growth ambitions. Despite relying on external borrowing for funding, projected earnings growth of 15.61% annually suggests potential for future value creation within the sector.

- Delve into the full analysis valuation report here for a deeper understanding of AcadeMedia.

Gain insights into AcadeMedia's past trends and performance with our Past report.

Make It Happen

- Delve into our full catalog of 70 Undervalued European Small Caps With Insider Buying here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ACAD

AcadeMedia

Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

Solid track record and good value.

Market Insights

Community Narratives