As the European markets experience a mix of cautious optimism and economic resilience, driven by tentative trade deal progress with the U.S. and steady monetary policy from the European Central Bank, investors are increasingly focused on identifying stocks that might be trading below their estimated value. In such an environment, a good stock is often characterized by strong fundamentals, potential for growth despite market uncertainties, and alignment with broader economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Westwing Group (XTRA:WEW) | €9.20 | €18.21 | 49.5% |

| STMicroelectronics (ENXTPA:STMPA) | €22.245 | €43.94 | 49.4% |

| RVRC Holding (OM:RVRC) | SEK46.12 | SEK91.42 | 49.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.55 | €109.69 | 49.4% |

| KebNi (OM:KEBNI B) | SEK2.75 | SEK5.43 | 49.4% |

| Echo Investment (WSE:ECH) | PLN5.36 | PLN10.70 | 49.9% |

| ATON Green Storage (BIT:ATON) | €2.13 | €4.22 | 49.5% |

| Atea (OB:ATEA) | NOK142.40 | NOK282.80 | 49.6% |

| adidas (XTRA:ADS) | €198.95 | €393.88 | 49.5% |

| Absolent Air Care Group (OM:ABSO) | SEK242.00 | SEK482.63 | 49.9% |

We'll examine a selection from our screener results.

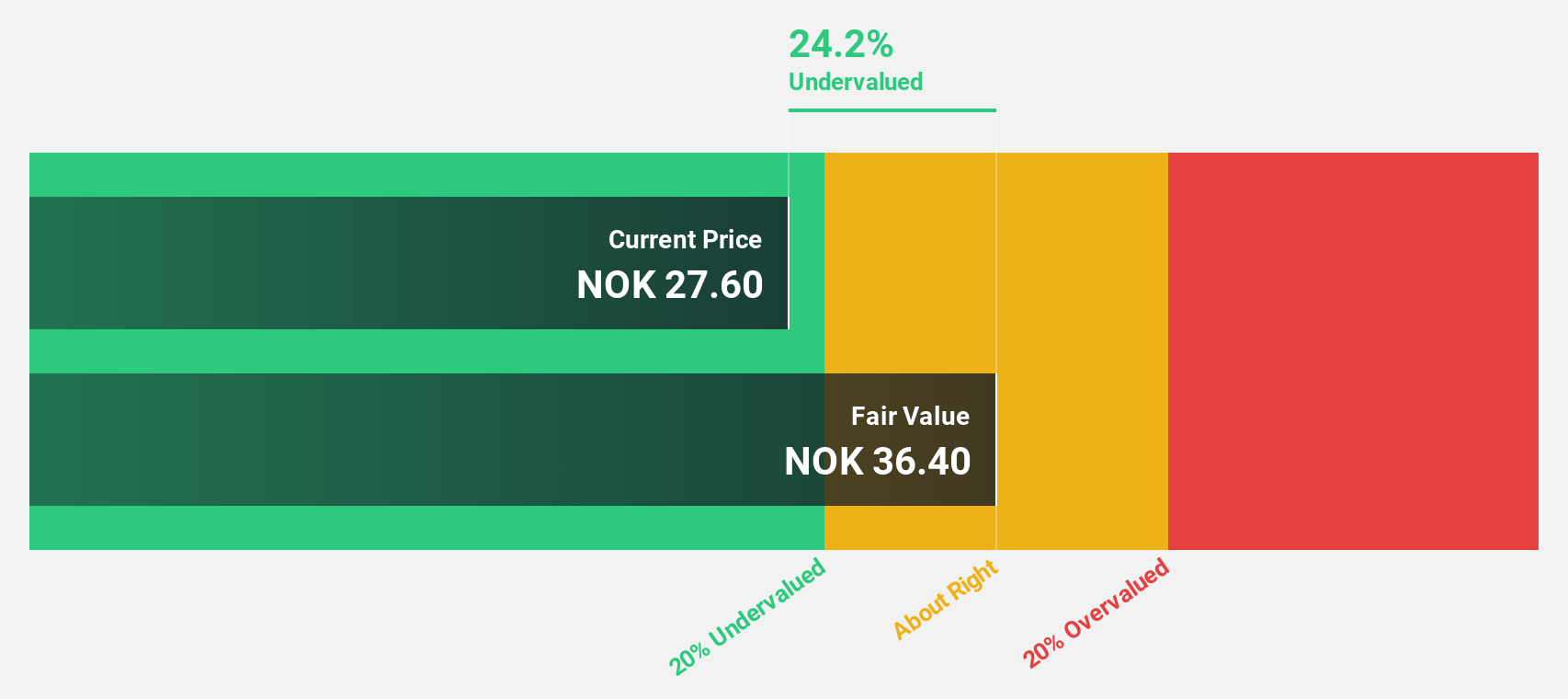

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry across Norway, Sweden, Finland, and the United Kingdom, with a market capitalization of NOK4.67 billion.

Operations: SmartCraft ASA generates revenue through its software solutions designed for the construction sectors in Norway, Sweden, Finland, and the United Kingdom.

Estimated Discount To Fair Value: 26.9%

SmartCraft is trading at NOK 28.2, over 26% below its estimated fair value of NOK 38.55, suggesting it may be undervalued based on cash flows. Despite recent volatility in share price and a decline in profit margins from last year, the company anticipates significant earnings growth of over 27% annually, surpassing the Norwegian market average. Recent strategic initiatives include launching new digital solutions like SmartCraft Spark for electricians and enhancing construction site workflows with Congrid's BIM feature.

- Our expertly prepared growth report on SmartCraft implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of SmartCraft here with our thorough financial health report.

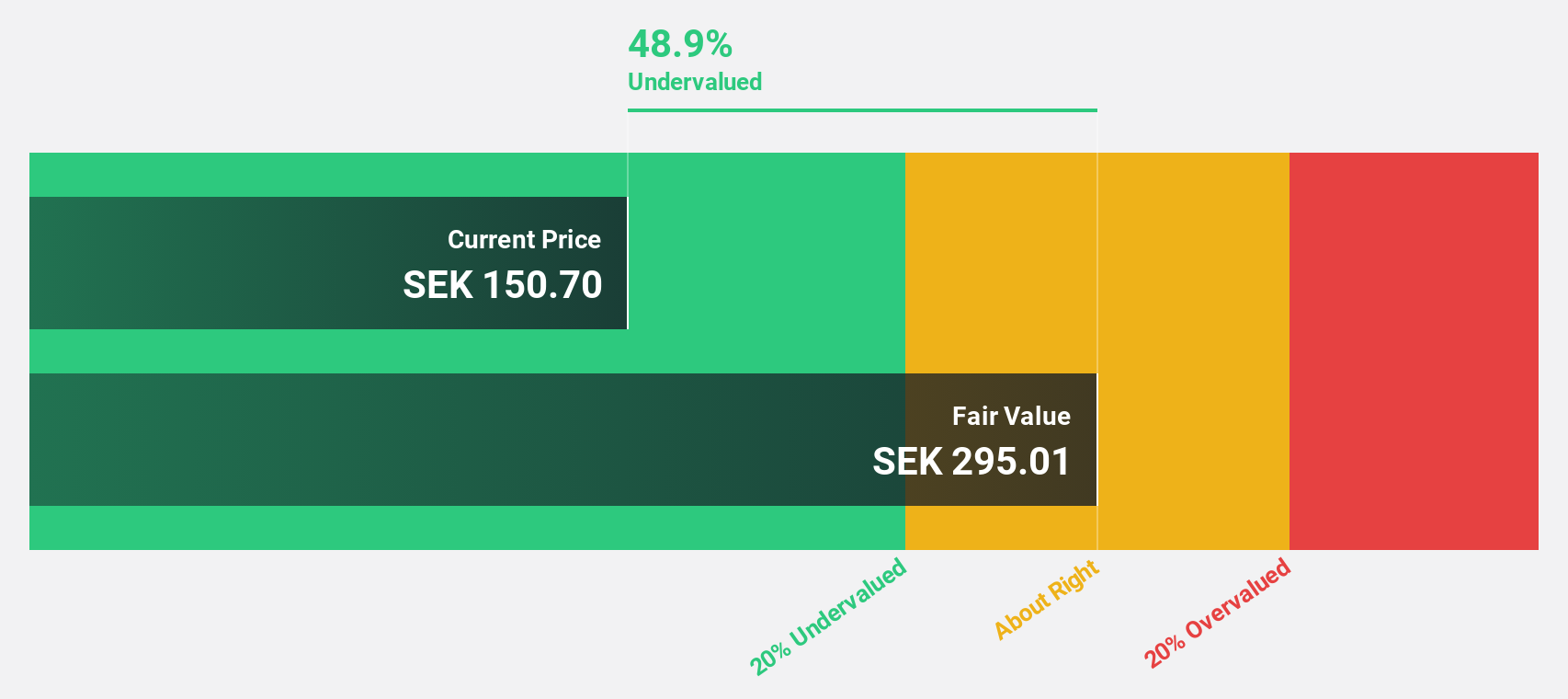

Surgical Science Sweden (OM:SUS)

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of SEK8.05 billion.

Operations: The company's revenue is derived from two main segments: Industry/OEM, contributing SEK460.22 million, and Educational Products, generating SEK486.31 million.

Estimated Discount To Fair Value: 46.5%

Surgical Science Sweden, trading at SEK 157.8, is significantly undervalued with an estimated fair value of SEK 295.21. Despite a decrease in profit margins from last year, the company expects substantial earnings growth of over 32% annually, outpacing the Swedish market average. Recent first-quarter results showed an increase in sales to SEK 250.69 million and net income to SEK 33.24 million compared to the previous year, reflecting robust financial performance amidst executive changes.

- Upon reviewing our latest growth report, Surgical Science Sweden's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Surgical Science Sweden with our detailed financial health report.

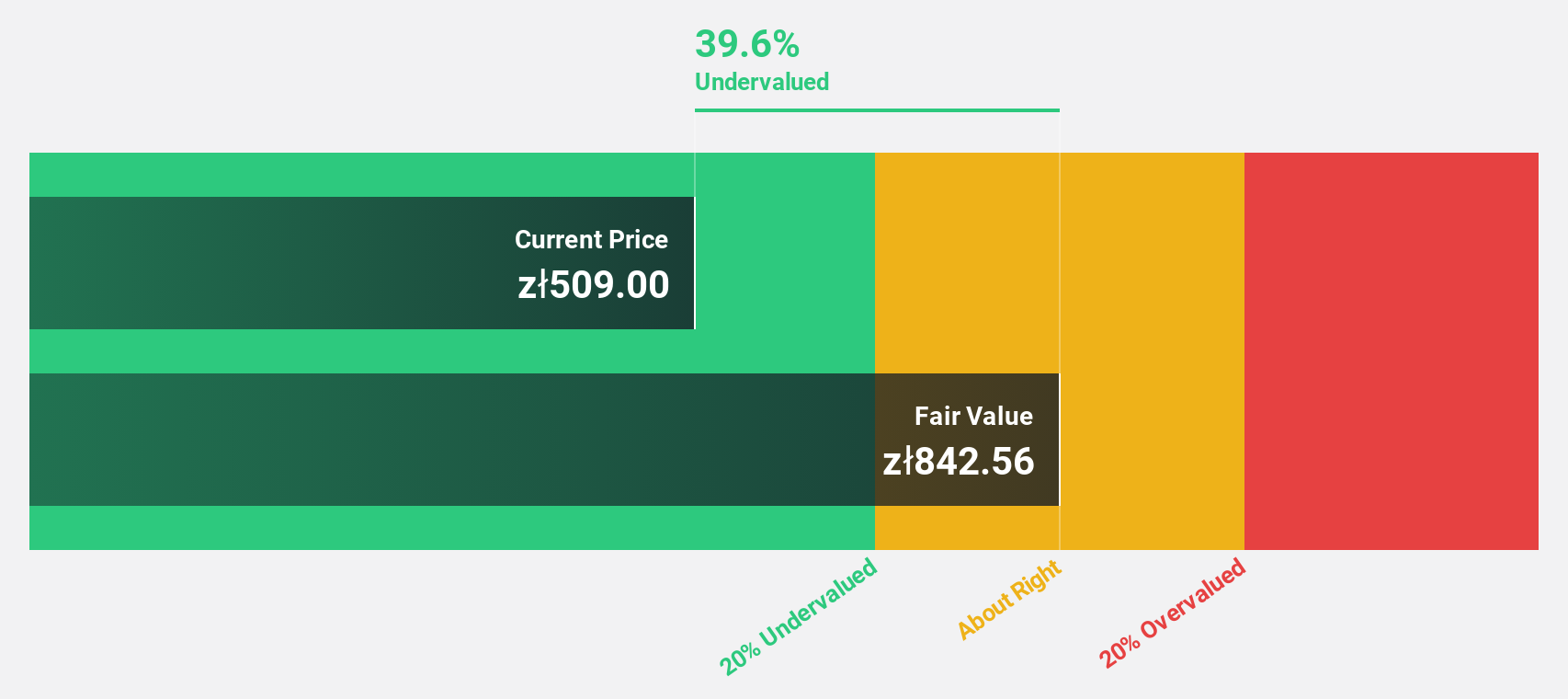

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN50.20 billion.

Operations: Dino Polska generates revenue primarily through sales in its retail network and online platform, amounting to PLN29.72 billion.

Estimated Discount To Fair Value: 39.3%

Dino Polska, trading at PLN 512, is undervalued relative to its fair value estimate of PLN 843.81. The company reported Q1 sales of PLN 7.35 billion and net income of PLN 311.25 million, showing growth from the previous year. With revenue forecasted to grow at 15.1% annually and earnings expected to rise by 18.4%, Dino Polska's financial outlook surpasses the Polish market average, despite not reaching significant profit growth levels above 20%.

- Our earnings growth report unveils the potential for significant increases in Dino Polska's future results.

- Delve into the full analysis health report here for a deeper understanding of Dino Polska.

Key Takeaways

- Gain an insight into the universe of 197 Undervalued European Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, Finland, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives