3 Stocks That May Be Priced Below Their Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets show signs of resilience with cooling inflation and strong bank earnings propelling U.S. stocks higher, investors are increasingly attentive to value opportunities amid shifting economic dynamics. In this environment, identifying stocks that may be priced below their intrinsic value can offer potential for growth as these equities might benefit from broader market trends and sector-specific strengths.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY38.94 | TRY77.88 | 50% |

| Aidma Holdings (TSE:7373) | ¥1810.00 | ¥3616.14 | 49.9% |

| Tabuk Cement (SASE:3090) | SAR13.46 | SAR26.85 | 49.9% |

| Fevertree Drinks (AIM:FEVR) | £6.595 | £13.12 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$92.60 | NT$183.67 | 49.6% |

| CYND (TSE:4256) | ¥1055.00 | ¥2100.49 | 49.8% |

| Mentice (OM:MNTC) | SEK25.10 | SEK49.91 | 49.7% |

| Greenworks (Jiangsu) (SZSE:301260) | CN¥14.00 | CN¥27.77 | 49.6% |

| Verra Mobility (NasdaqCM:VRRM) | US$26.08 | US$52.02 | 49.9% |

| Shinko Electric Industries (TSE:6967) | ¥5879.00 | ¥11701.41 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

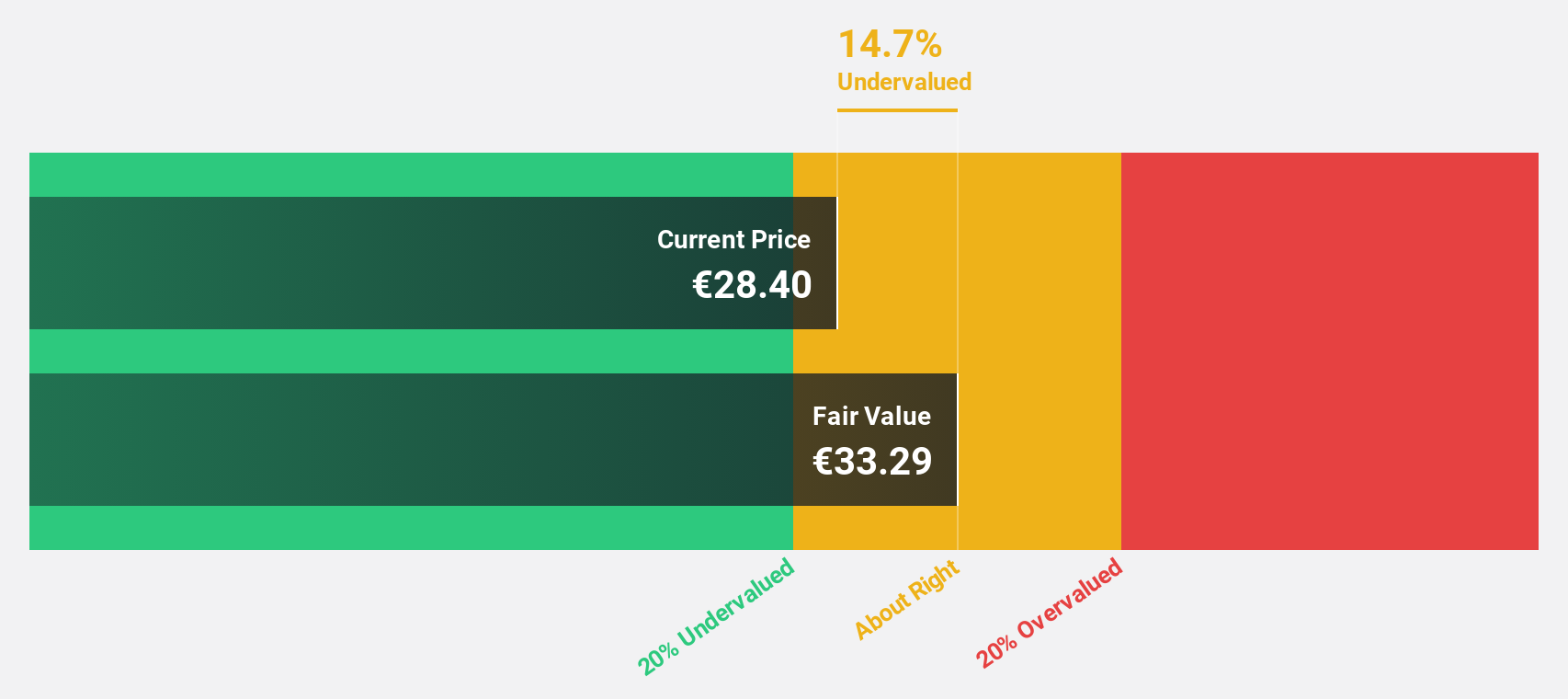

Ponsse Oyj (HLSE:PON1V)

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations in Northern Europe, Central and Southern Europe, North and South America, and internationally, holding a market cap of €582.08 million.

Operations: The company's revenue is primarily derived from its Forest Machines and Maintenance Services segment, generating €769.72 million.

Estimated Discount To Fair Value: 45.2%

Ponsse Oyj is trading 45.2% below its estimated fair value of €37.96, indicating significant undervaluation based on discounted cash flow analysis. Despite recent earnings volatility, with nine-month sales at €526.93 million and net income dropping to €0.322 million from €11.28 million a year ago, the company's earnings are forecast to grow significantly at 48.92% annually over the next three years, outpacing both Finnish market revenue growth and profit expectations.

- Insights from our recent growth report point to a promising forecast for Ponsse Oyj's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Ponsse Oyj.

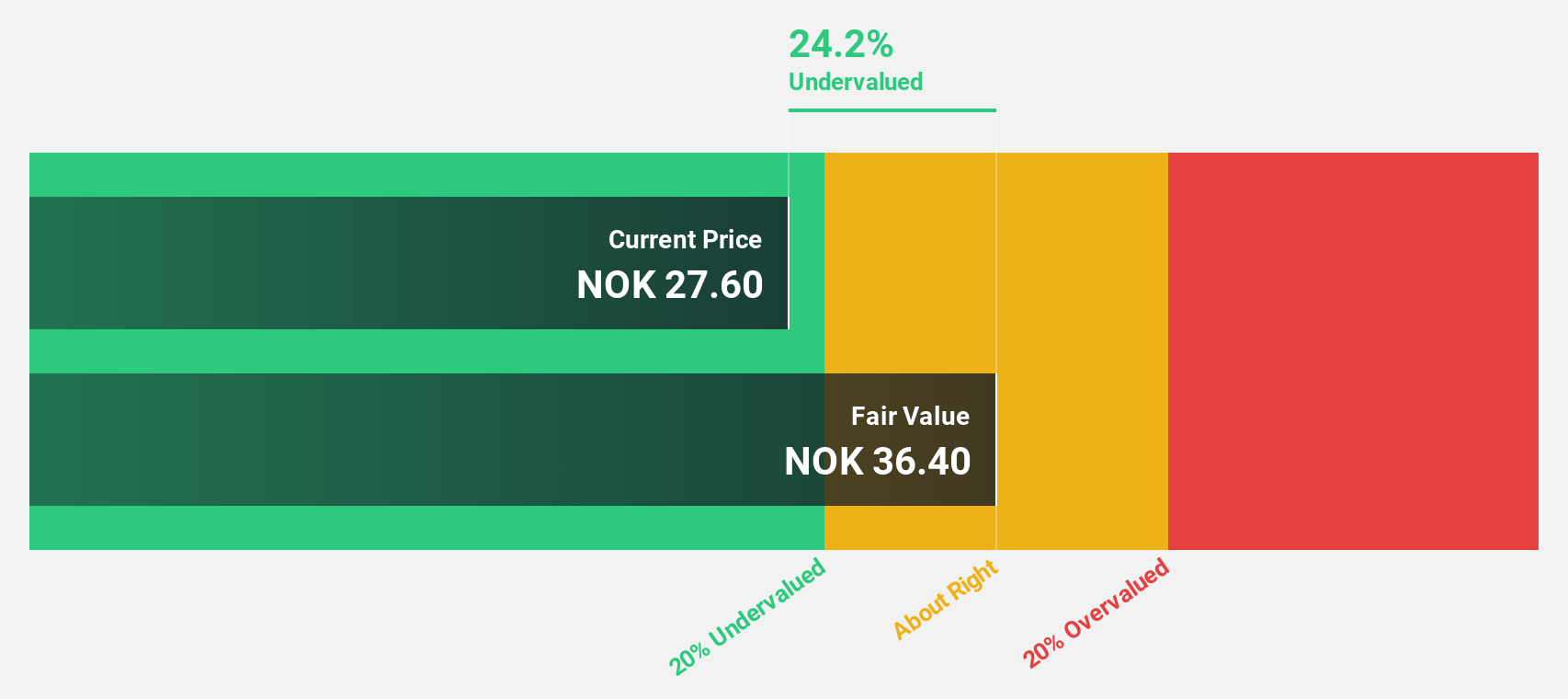

SmartCraft (OB:SMCRT)

Overview: SmartCraft ASA offers software solutions tailored for the construction industry in Norway, Sweden, and Finland, with a market capitalization of NOK4.76 billion.

Operations: SmartCraft ASA's revenue segments include software solutions for the construction industry across Norway, Sweden, and Finland.

Estimated Discount To Fair Value: 24.7%

SmartCraft ASA is trading at NOK 28.5, below its estimated fair value of NOK 37.87, highlighting undervaluation based on cash flow analysis. Despite a dip in recent net income to NOK 21.76 million for Q3 2024, earnings are projected to grow significantly at 26% annually over the next three years, surpassing Norwegian market expectations. Revenue growth is forecasted at a healthy rate of 15.3% per year, supporting its potential for future expansion.

- The analysis detailed in our SmartCraft growth report hints at robust future financial performance.

- Get an in-depth perspective on SmartCraft's balance sheet by reading our health report here.

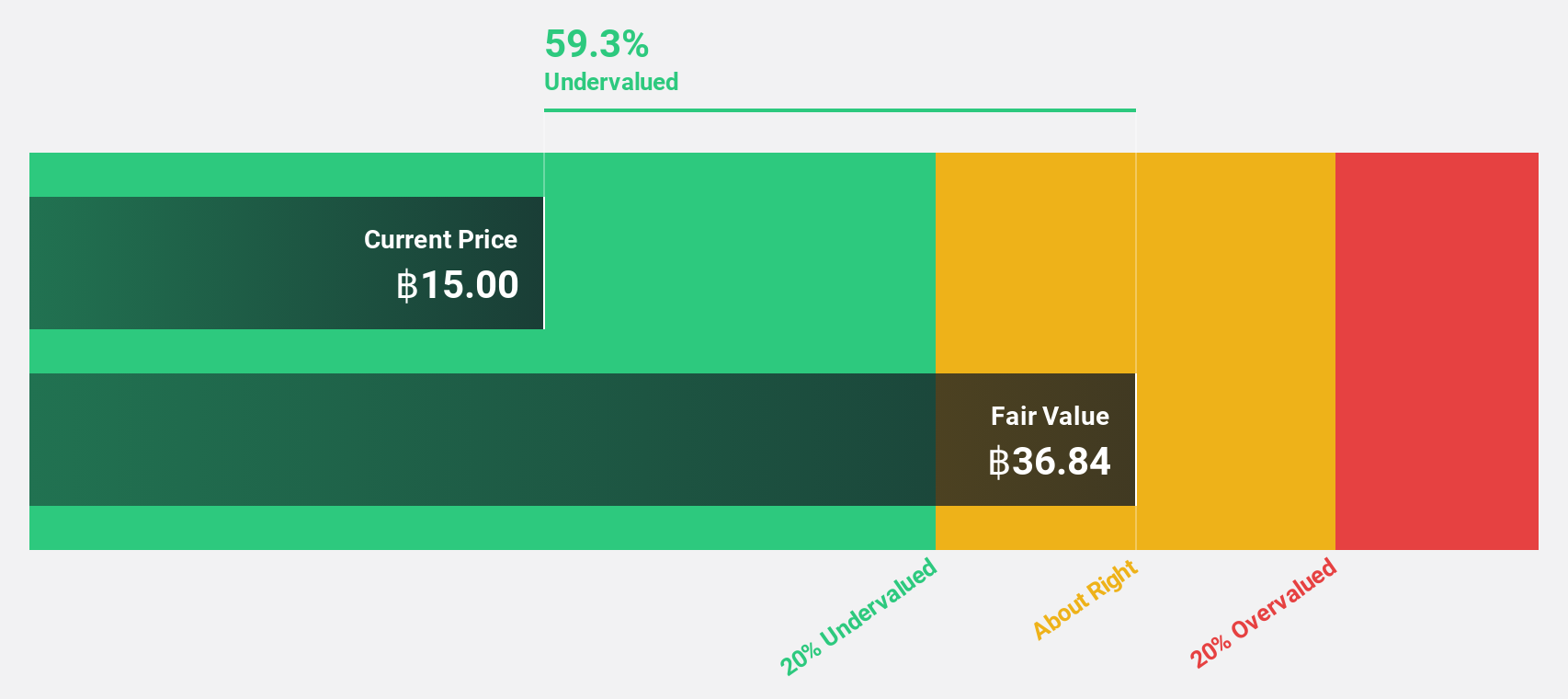

SISB (SET:SISB)

Overview: SISB Public Company Limited offers educational services and has a market cap of THB24.68 billion.

Operations: The company's revenue primarily comes from its International School segment, generating THB2.32 billion.

Estimated Discount To Fair Value: 41.5%

SISB is trading at THB 26.25, significantly below its estimated fair value of THB 44.84, suggesting undervaluation based on cash flows. Recent earnings for Q3 2024 showed robust growth with revenue at THB 606.02 million and net income rising to THB 218.23 million from the previous year. Forecasts indicate annual earnings growth of 17.2%, outpacing the Thai market average, while revenue is expected to grow by 12.3% annually.

- The growth report we've compiled suggests that SISB's future prospects could be on the up.

- Click here to discover the nuances of SISB with our detailed financial health report.

Next Steps

- Dive into all 878 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SMCRT

SmartCraft

Provides software solutions to the construction industry in Norway, Sweden, and Finland.

Excellent balance sheet and good value.