Is Now The Time To Put Crayon Group Holding (OB:CRAYN) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Crayon Group Holding (OB:CRAYN). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Crayon Group Holding

How Fast Is Crayon Group Holding Growing Its Earnings Per Share?

Crayon Group Holding has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, Crayon Group Holding's EPS shot from kr1.33 to kr2.37, over the last year. It's not often a company can achieve year-on-year growth of 79%. That could be a sign that the business has reached a true inflection point.

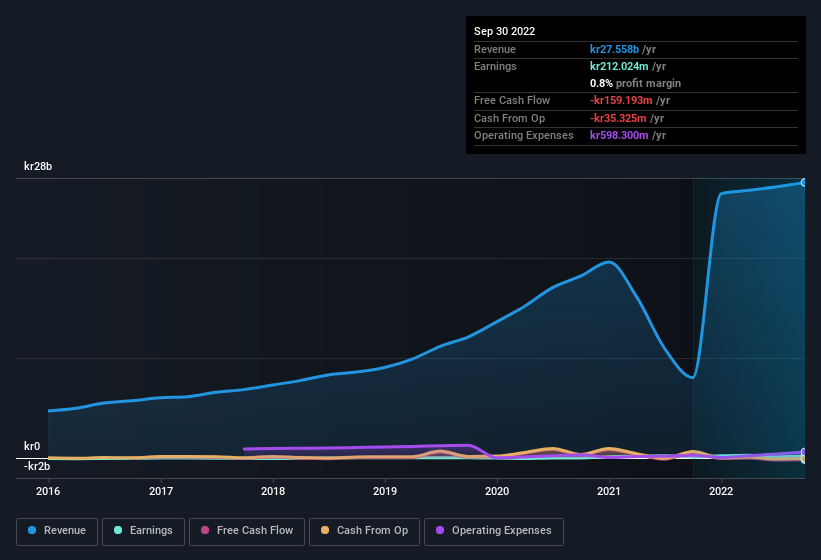

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, Crayon Group Holding has done well over the past year, growing revenue by 243% to kr28b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Crayon Group Holding.

Are Crayon Group Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Crayon Group Holding insiders refrain from selling stock during the year, but they also spent kr743k buying it. That's nice to see, because it suggests insiders are optimistic.

It's commendable to see that insiders have been buying shares in Crayon Group Holding, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Crayon Group Holding, with market caps between kr4.1b and kr16b, is around kr6.4m.

Crayon Group Holding offered total compensation worth kr4.0m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Crayon Group Holding Deserve A Spot On Your Watchlist?

Crayon Group Holding's earnings have taken off in quite an impressive fashion. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests Crayon Group Holding may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Crayon Group Holding (at least 1 which is a bit concerning) , and understanding these should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Crayon Group Holding isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:CRAYN

Crayon Group Holding

Operates as an IT consultancy company in the Nordics, Europe, the Asia-Pacific, the Middle East and Africa, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives