As the pan-European STOXX Europe 600 Index rose by 3.44% amid easing tariff concerns and economic growth in the eurozone accelerated to 0.4% in the first quarter, investor optimism in European markets has been buoyed despite mixed indicators of business and consumer sentiment. In this environment, high-growth tech stocks that demonstrate strong innovation potential and resilience to economic fluctuations are particularly noteworthy for investors looking to capitalize on Europe's evolving technological landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

Indra Sistemas (BME:IDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indra Sistemas, S.A. is a global technology and consulting company specializing in aerospace, defense, and mobility sectors with a market cap of €5.25 billion.

Operations: Indra Sistemas generates revenue primarily from its technology and consulting services across aerospace, defense, and mobility sectors. The company focuses on delivering innovative solutions to enhance operational efficiency for its clients globally.

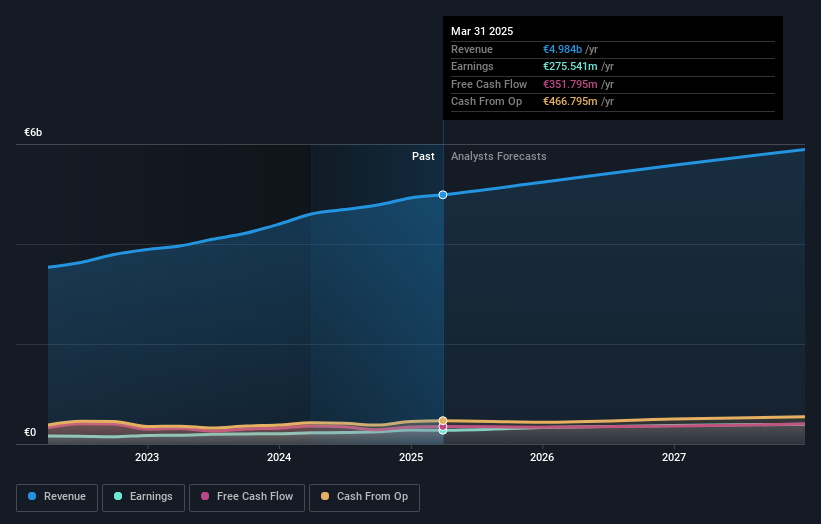

Indra Sistemas, a Spanish defense and technology firm, has demonstrated robust financial performance with a 23.4% increase in earnings over the past year, outpacing the IT industry's growth of 1.3%. This growth is underpinned by strategic contracts like the €13 million deal with Canada's DND to enhance air traffic and defense communications systems. Looking ahead, Indra anticipates surpassing its previous revenue of €4.91 billion and aims for an EBIT above €490 million in 2025, reflecting confidence in its operational strategy and market position despite not pursuing expansion via acquisition as seen in recent M&A discussions around Iveco Group’s defense unit.

- Get an in-depth perspective on Indra Sistemas' performance by reading our health report here.

Understand Indra Sistemas' track record by examining our Past report.

Crayon Group Holding (OB:CRAYN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Crayon Group Holding ASA is an IT consultancy company operating across the Nordics, Europe, Asia-Pacific, the Middle East and Africa, and the United States with a market cap of NOK11.59 billion.

Operations: Crayon Group Holding generates revenue primarily through its Services and Software & Cloud segments, with Consulting services contributing NOK2.87 billion and Software & Cloud Direct adding NOK2.29 billion. The company also derives income from the Software & Cloud Channel (NOK1.18 billion) and Software & Cloud Economics (NOK1.02 billion).

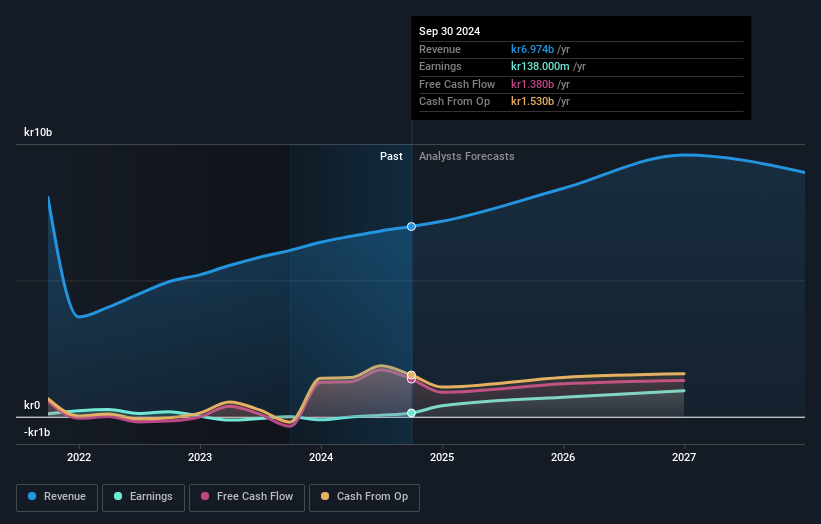

Crayon Group Holding has pivoted impressively, reporting a shift from a net loss to a net income of NOK 43 million in its latest quarterly results, showcasing significant recovery with sales increasing to NOK 1,843 million. This turnaround is supported by an earnings forecast growth of 35.8% annually, outpacing the Norwegian market's average of 6.1%. The company's commitment to innovation is evident in its R&D investments, aligning with industry trends towards enhanced software solutions and services. With revenue growth also expected to exceed local market trends at 12.2% annually, Crayon is positioning itself as a resilient contender in the European tech landscape despite previous financial setbacks.

- Click to explore a detailed breakdown of our findings in Crayon Group Holding's health report.

Evaluate Crayon Group Holding's historical performance by accessing our past performance report.

Hemnet Group (OM:HEM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hemnet Group AB (publ) operates a residential property platform in Sweden with a market cap of approximately SEK32.41 billion.

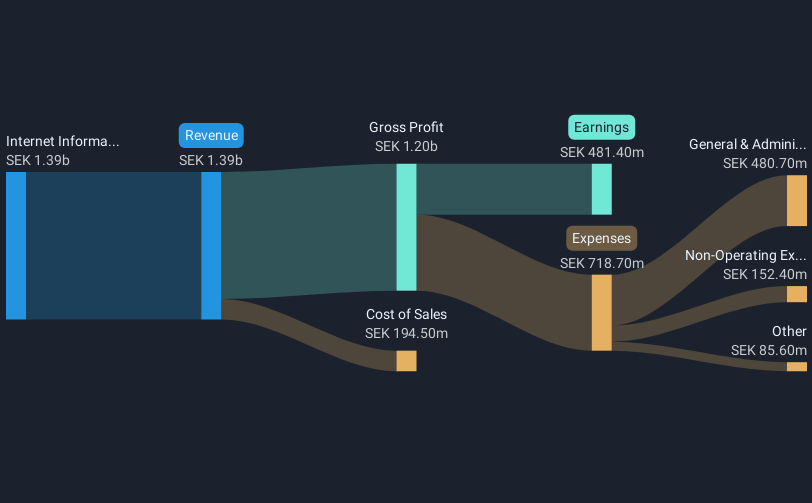

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to SEK1.47 billion.

Hemnet Group AB is distinguishing itself in the European tech sector with a notable 42% earnings growth over the past year, outperforming its industry's -1.6% downturn. This momentum is underpinned by robust forecasts, expecting revenue and earnings to surge by 19.5% and 23.7% annually, respectively—well above Sweden's market averages of 4.3% and 16.4%. Recent strategic moves include a dividend affirmation of SEK 1.70 per share and a proactive share buyback program, reinforcing its financial health amidst aggressive expansion efforts in interactive media services.

- Click here and access our complete health analysis report to understand the dynamics of Hemnet Group.

Assess Hemnet Group's past performance with our detailed historical performance reports.

Taking Advantage

- Reveal the 224 hidden gems among our European High Growth Tech and AI Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives