Exploring None And 2 Other High Growth Tech Stocks With Potential

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations driven by tariff uncertainties and mixed economic indicators, with U.S. stocks ending lower amid concerns over new trade policies and a cooling labor market. Despite these challenges, manufacturing activity has shown signs of recovery, while strong earnings reports from major companies have provided some support to investor sentiment. In this environment, identifying high-growth tech stocks with potential involves looking for companies that demonstrate resilience through innovation and adaptability in response to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 1215 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Crayon Group Holding (OB:CRAYN)

Simply Wall St Growth Rating: ★★★★★☆

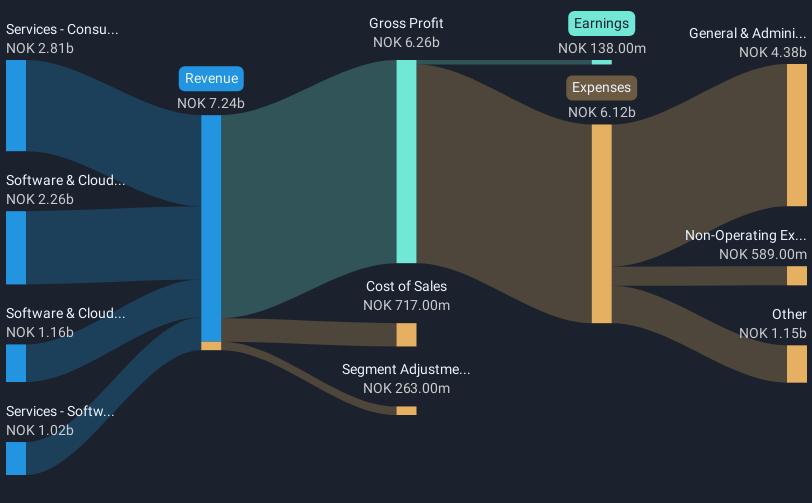

Overview: Crayon Group Holding ASA, along with its subsidiaries, functions as an IT consultancy company and has a market capitalization of NOK9.55 billion.

Operations: Crayon Group Holding ASA generates revenue primarily from its Services and Software & Cloud divisions, with Consulting services contributing NOK2.81 billion and Software & Cloud Direct adding NOK2.26 billion. The company also benefits from its Software & Cloud Economics and Channel segments, which bring in NOK1.02 billion and NOK1.16 billion respectively.

Crayon Group Holding ASA, amidst a transformative merger with SoftwareONE, is poised for significant growth. The deal, valued at NOK 11.6 billion, offers Crayon shareholders a substantial 36% premium over the undisturbed share price and includes both stock and cash components. This strategic move not only enhances Crayon's market position but also promises substantial earnings accretion of around 25%, factoring in synergies and implementation costs by 2026. Additionally, the recent appointment as an AWS Authorized Distributor in multiple European regions underscores Crayon's expanding influence and capability in cloud solutions, further solidifying its growth trajectory in the tech sector.

Zhejiang Wazam New MaterialsLTD (SHSE:603186)

Simply Wall St Growth Rating: ★★★★★☆

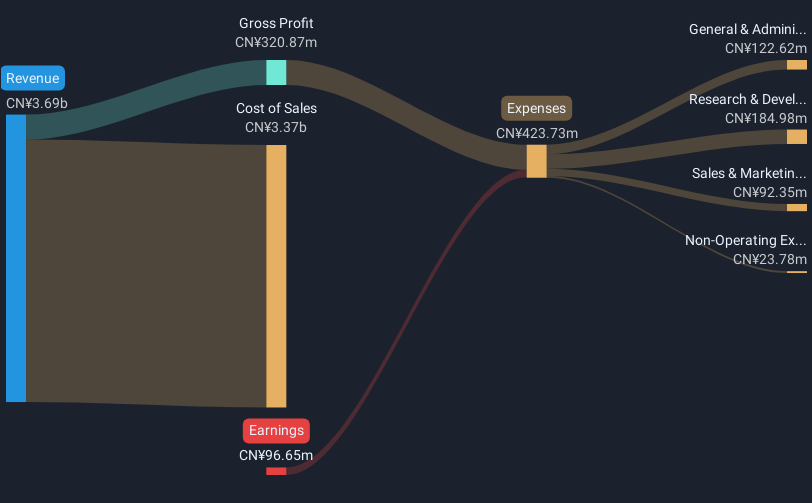

Overview: Zhejiang Wazam New Materials Co., LTD. focuses on the research, development, design, production, and sale of copper clad plates, composite materials, and membrane materials with a market capitalization of CN¥3.63 billion.

Operations: The company generates revenue primarily through the production and sale of copper clad plates, composite materials, and membrane materials. It operates with a market capitalization of CN¥3.63 billion.

Zhejiang Wazam New Materials Co., LTD., poised for a robust growth trajectory, is expected to see its revenue surge by 25.9% annually, outpacing the CN market's 13.5% growth. This impressive expansion is complemented by an anticipated leap in earnings, forecasted to grow at a staggering rate of 188.15% per year over the next three years, signaling potential profitability ahead. Despite current unprofitability and challenges in debt coverage by operating cash flow, the company's aggressive focus on R&D and strategic initiatives like the recent extraordinary shareholders meeting highlight its proactive approach to scaling operations and enhancing shareholder value in the competitive materials sector.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★☆☆

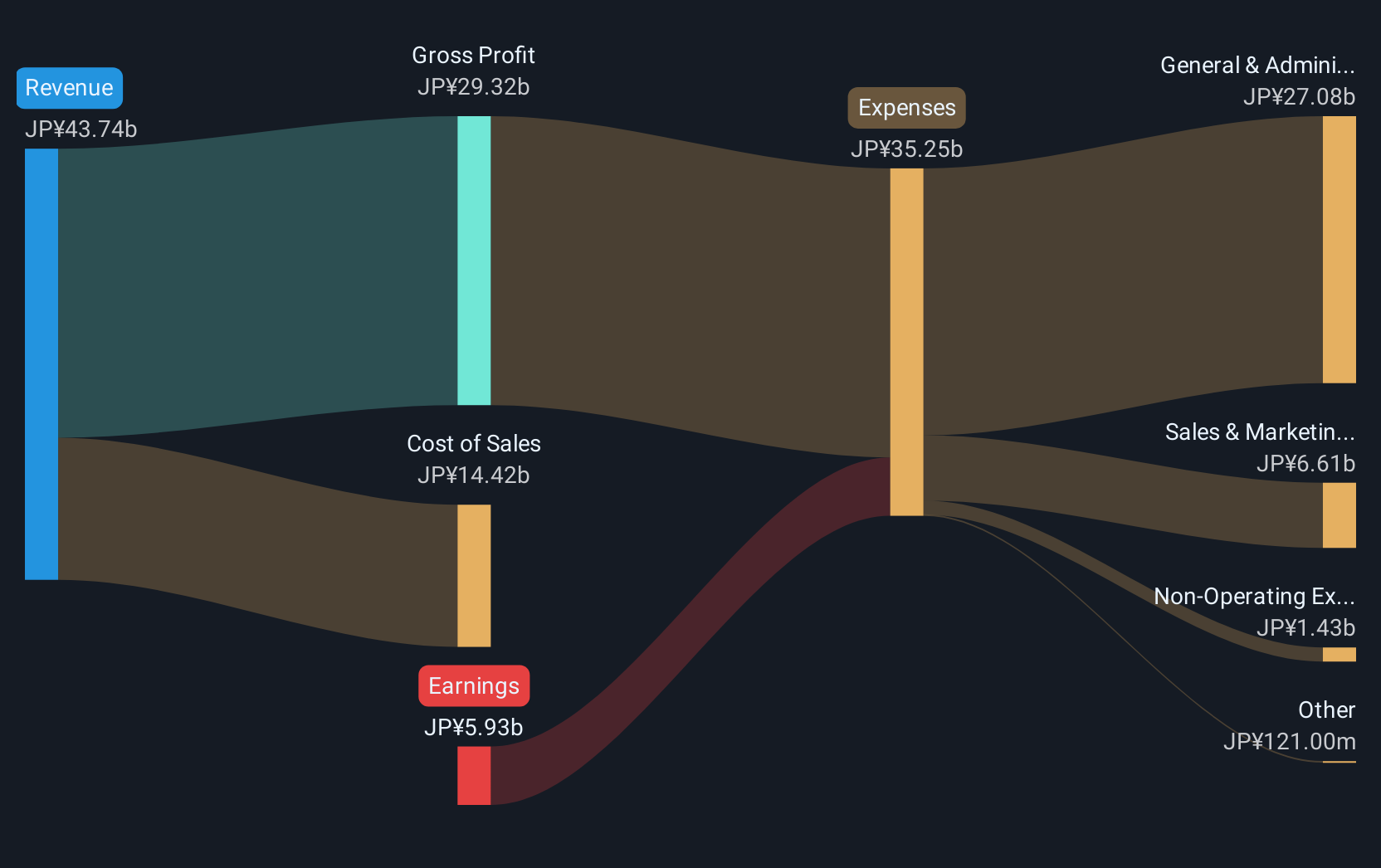

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of ¥245.17 billion.

Operations: The company generates revenue primarily from its Platform Services Business, which contributes ¥40.36 billion.

Money Forward, a player in the tech sector, is navigating its growth with strategic agility. Recently, the company projected net sales between JPY 50 billion and JPY 52.6 billion for FY2025, reflecting robust revenue dynamics amid evolving market demands. With earnings expected to surge by 58.72% annually, Money Forward is reinforcing its financial trajectory through significant R&D investments and corporate restructuring, including a recent company split aimed at enhancing operational efficiencies. These maneuvers not only underscore its commitment to innovation but also position it favorably within a competitive landscape marked by rapid technological advancements and shifting consumer preferences.

- Click here and access our complete health analysis report to understand the dynamics of Money Forward.

Gain insights into Money Forward's historical performance by reviewing our past performance report.

Taking Advantage

- Click this link to deep-dive into the 1215 companies within our High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CRAYN

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives