Top Undervalued Small Caps With Insider Activity In October 2024

Reviewed by Simply Wall St

In October 2024, global markets have been marked by significant movements, with the S&P 500 Index advancing and small-cap indices like the Russell 2000 outperforming amid a backdrop of fluctuating oil prices and shifting economic indicators. The European Central Bank's rate cuts and stronger-than-expected U.S. retail sales have also influenced market sentiment, providing a complex landscape for investors focusing on small-cap stocks. In this environment, identifying promising small-cap stocks often involves looking at those with strong fundamentals and potential insider activity that could indicate confidence in future growth prospects.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Columbus McKinnon | 20.6x | 0.9x | 43.53% | ★★★★★★ |

| Hanover Bancorp | 9.6x | 2.2x | 46.74% | ★★★★★☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.68% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -44.98% | ★★★★☆☆ |

| Freehold Royalties | 14.0x | 6.5x | 49.70% | ★★★★☆☆ |

| Guardian Pharmacy Services | 79.6x | 1.0x | 41.41% | ★★★☆☆☆ |

| Essentra | 722.6x | 1.4x | 26.93% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -111.76% | ★★★☆☆☆ |

| Industrial Logistics Properties Trust | NA | 0.6x | -192.80% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

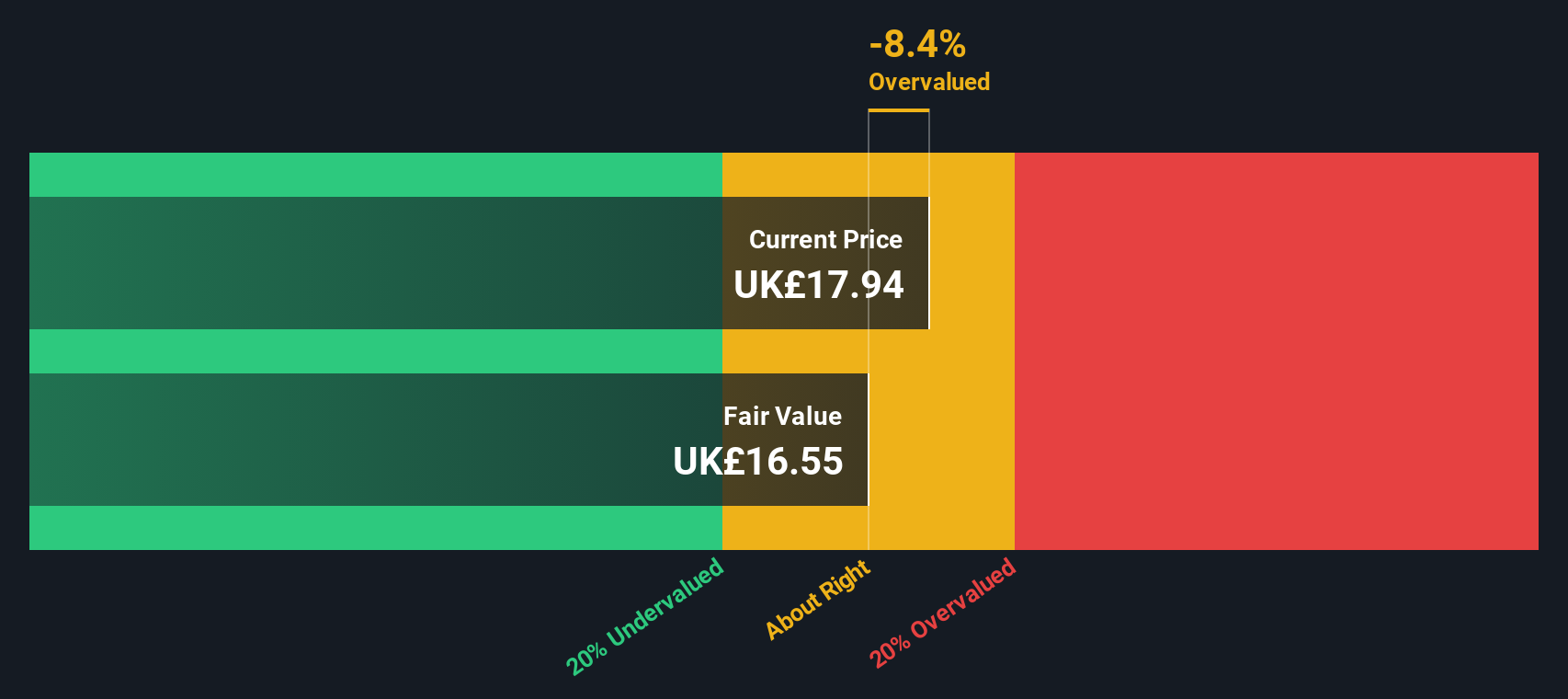

Oxford Instruments (LSE:OXIG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Oxford Instruments is a company specializing in the development and supply of high-technology tools and systems for industry and research, with a market capitalization of approximately £1.58 billion.

Operations: Oxford Instruments generates its revenue primarily from three segments: Materials & Characterisation (£252.20 million), Research & Discovery (£142.10 million), and Service & Healthcare (£76.10 million). The company's gross profit margin has seen fluctuations, reaching 52.24% in September 2023, indicating a focus on cost management and operational efficiency to enhance profitability over time.

PE: 24.2x

Oxford Instruments, a smaller company in its sector, has been active in industry events like the Geotechnologist Symposium and Faraday Institution Conference this year. Despite relying solely on external borrowing for funding, which carries higher risk compared to customer deposits, they are projecting a 10.45% annual growth in earnings. Insider confidence is evident with recent share purchases by executives between August and September 2024. The company's future prospects appear promising as they continue to engage with key industry players.

- Navigate through the intricacies of Oxford Instruments with our comprehensive valuation report here.

Explore historical data to track Oxford Instruments' performance over time in our Past section.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sabre operates as a technology solutions provider for the global travel and tourism industry, with a market cap of $1.18 billion.

Operations: Sabre's revenue primarily comes from Travel Solutions, contributing $2.70 billion, and Hospitality Solutions, adding $315.74 million. The company's gross profit margin has seen fluctuations over the years but recently stood at 59.47%. Operating expenses are significant, with research and development being a notable component.

PE: -3.2x

Sabre, a technology solutions provider for the travel industry, has recently seen insider confidence with share purchases over the past year. The company's strategic agreements with airlines like Riyadh Air and Arajet highlight its innovative approach in airline retailing and distribution. Despite facing challenges such as shareholder dilution, Sabre's partnerships leverage AI to enhance customer experiences. With Eric L. Kelly joining the board in January 2025, his extensive tech expertise could drive future growth opportunities.

- Click here and access our complete valuation analysis report to understand the dynamics of Sabre.

Examine Sabre's past performance report to understand how it has performed in the past.

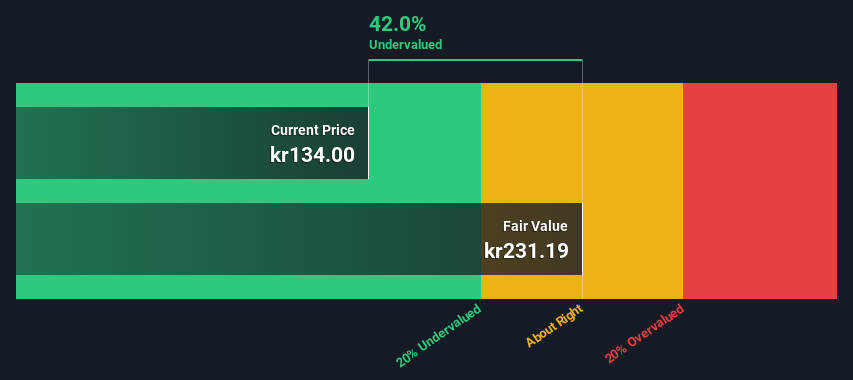

Atea (OB:ATEA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Atea is a leading provider of IT infrastructure and related services in the Nordic and Baltic regions, with a market capitalization of approximately NOK 19.20 billion.

Operations: Atea derives its revenue primarily from product sales, with a significant portion of costs attributed to the cost of goods sold (COGS). Over recent periods, the company has experienced variations in gross profit margin, reaching up to 31.04%. Operating expenses include depreciation and amortization as well as general and administrative costs.

PE: 21.4x

Atea, a company with a strong presence in the IT infrastructure sector, recently reported third-quarter sales of NOK 7.98 billion, up from NOK 7.74 billion the previous year. Their net income rose to NOK 192 million from NOK 182 million. Despite its reliance on external borrowing for funding, Atea's earnings are projected to grow at nearly 20% annually. Notably, insider confidence is evident as they increased their shareholding earlier this year, suggesting optimism about future performance and growth potential within their niche market segment.

- Delve into the full analysis valuation report here for a deeper understanding of Atea.

Evaluate Atea's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Delve into our full catalog of 191 Undervalued Small Caps With Insider Buying here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives