In the wake of a "red sweep" in the U.S. elections, global markets have been buoyant, with major indices like the S&P 500 and Nasdaq Composite reaching record highs amid expectations of accelerated economic growth and favorable tax policies. As investors navigate these optimistic yet uncertain times, companies with high insider ownership often attract attention due to their alignment of interests between management and shareholders, potentially offering unique opportunities for growth amidst evolving market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

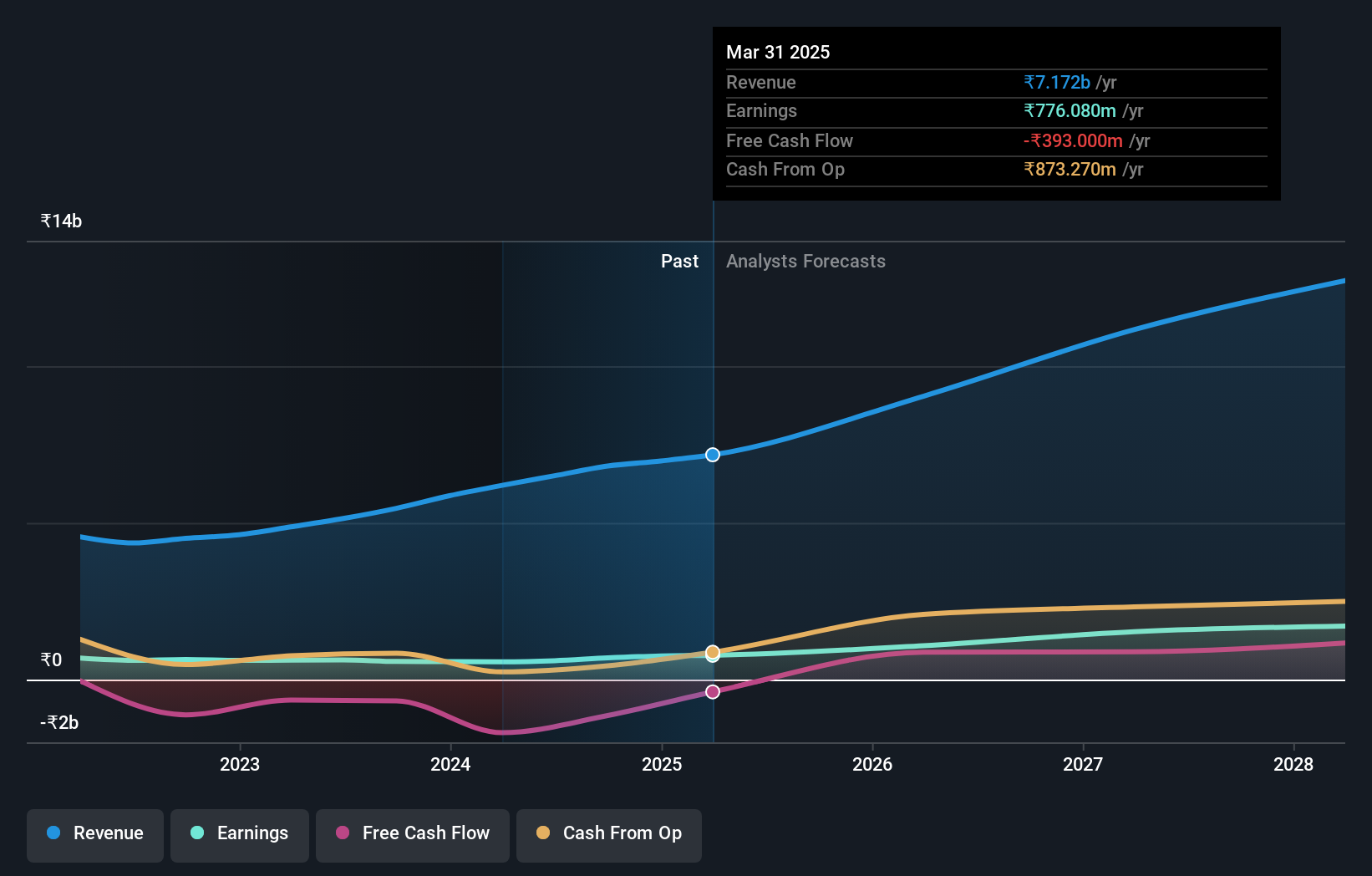

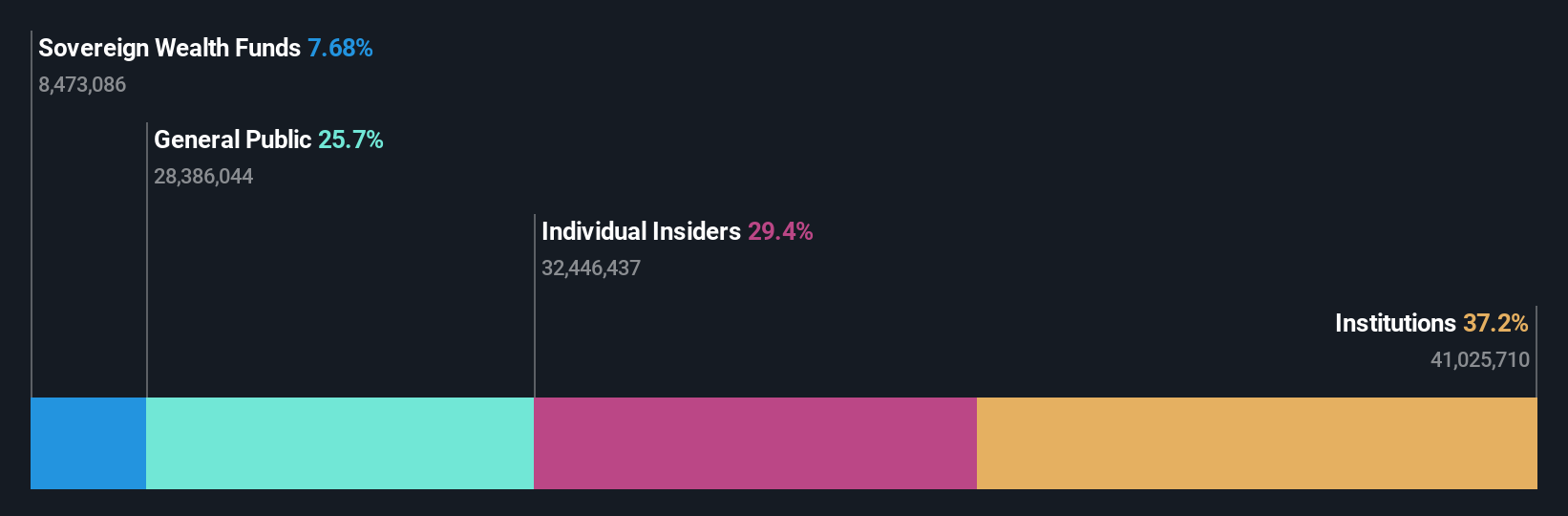

Krsnaa Diagnostics (NSEI:KRSNAA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Krsnaa Diagnostics Limited offers diagnostic services in India and has a market cap of ₹30.34 billion.

Operations: The company generates revenue of ₹6.81 billion from its Radiology and Pathology Services segment in India.

Insider Ownership: 27.7%

Earnings Growth Forecast: 37.4% p.a.

Krsnaa Diagnostics demonstrates strong growth potential with forecasted revenue and earnings expected to outpace the Indian market significantly. Recent earnings reports show a robust increase in net income, reflecting effective business strategies. The company has secured key public-private partnership contracts, enhancing its service reach. Despite trading below estimated fair value and offering good relative value compared to peers, shareholders experienced dilution last year. Insider ownership remains high, supporting confidence in long-term growth prospects.

- Click to explore a detailed breakdown of our findings in Krsnaa Diagnostics' earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Krsnaa Diagnostics shares in the market.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK 15.32 billion.

Operations: The company's revenue segments are comprised of NOK 8.28 billion from Norway, NOK 12.44 billion from Sweden, NOK 7.37 billion from Denmark, NOK 3.62 billion from Finland, and NOK 1.76 billion from the Baltics, with Group Shared Services contributing an additional NOK 9.20 billion.

Insider Ownership: 29.0%

Earnings Growth Forecast: 21.5% p.a.

Atea ASA shows promising growth potential, with forecasted revenue and earnings expected to outpace the Norwegian market. The company recently secured a significant four-year agreement with Tiera Oy, potentially doubling previous contract values. Despite trading below estimated fair value, Atea's dividend sustainability is questionable due to insufficient earnings coverage. The recent share buyback program reflects a commitment to enhancing shareholder value, while high insider ownership underscores confidence in its future growth trajectory.

- Take a closer look at Atea's potential here in our earnings growth report.

- Our expertly prepared valuation report Atea implies its share price may be lower than expected.

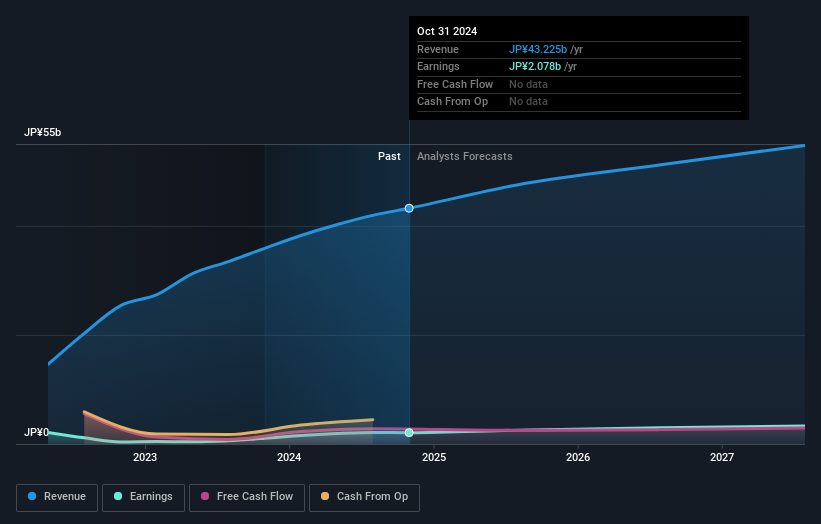

Eternal Hospitality GroupLtd (TSE:3193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Eternal Hospitality Group Co., Ltd. operates restaurants in Japan and has a market cap of ¥40.46 billion.

Operations: Eternal Hospitality Group Co., Ltd. generates revenue from its restaurant operations in Japan.

Insider Ownership: 35.6%

Earnings Growth Forecast: 14.2% p.a.

Eternal Hospitality Group Ltd. is trading at a significant discount to its estimated fair value, offering potential upside. Despite high share price volatility, the company forecasts earnings growth of 14.17% annually, outpacing the broader JP market's 9.1%. Revenue is expected to grow at 8.7% per year, exceeding market averages but not significantly high. Recent dividend increases and stable insider ownership indicate confidence in long-term growth prospects despite no substantial insider trading activity recently.

- Click here to discover the nuances of Eternal Hospitality GroupLtd with our detailed analytical future growth report.

- Our valuation report here indicates Eternal Hospitality GroupLtd may be undervalued.

Taking Advantage

- Click through to start exploring the rest of the 1526 Fast Growing Companies With High Insider Ownership now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Atea, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential with excellent balance sheet and pays a dividend.