- Norway

- /

- Semiconductors

- /

- OB:RECSI

Why Investors Shouldn't Be Surprised By REC Silicon ASA's (OB:RECSI) P/S

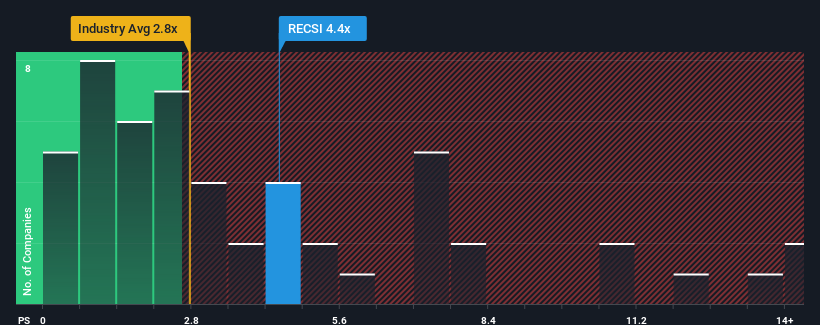

When close to half the companies in the Semiconductor industry in Norway have price-to-sales ratios (or "P/S") below 2.8x, you may consider REC Silicon ASA (OB:RECSI) as a stock to potentially avoid with its 4.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for REC Silicon

What Does REC Silicon's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, REC Silicon's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think REC Silicon's future stacks up against the industry? In that case, our free report is a great place to start.How Is REC Silicon's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as REC Silicon's is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.9%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 61% per year over the next three years. That's shaping up to be materially higher than the 14% per year growth forecast for the broader industry.

With this information, we can see why REC Silicon is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look into REC Silicon shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 1 warning sign for REC Silicon that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:RECSI

REC Silicon

Produces and sells silicon materials for the solar and electronics industries in Norway and internationally.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives