- Norway

- /

- Semiconductors

- /

- OB:RECSI

REC Silicon (OB:RECSI) delivers shareholders strong 32% CAGR over 3 years, surging 7.8% in the last week alone

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For instance the REC Silicon ASA (OB:RECSI) share price is 128% higher than it was three years ago. Most would be happy with that. And in the last month, the share price has gained 12%.

The past week has proven to be lucrative for REC Silicon investors, so let's see if fundamentals drove the company's three-year performance.

View our latest analysis for REC Silicon

REC Silicon wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

REC Silicon actually saw its revenue drop by 18% per year over three years. So we wouldn't have expected the share price to gain 32% per year, but it has. It's a good reminder that expectations about the future, not the past history, always impact share prices.

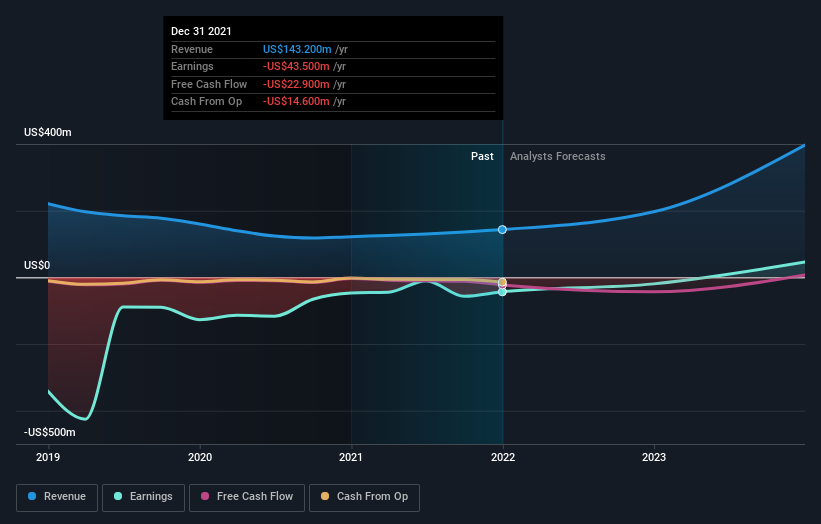

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

REC Silicon shareholders are up 0.5% for the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 9% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for REC Silicon you should be aware of.

Of course REC Silicon may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:RECSI

REC Silicon

Produces and sells silicon materials for the solar and electronics industries worldwide.

Undervalued with high growth potential.