- Norway

- /

- Semiconductors

- /

- OB:NOD

Nordic Semiconductor (OB:NOD): Valuation Insights Following Breakthrough 5G IoT-Satellite Connectivity Demo

Reviewed by Kshitija Bhandaru

Nordic Semiconductor (OB:NOD) joined Sateliot and Gatehouse Satcom in a breakthrough event, successfully sending 5G IoT data from an off-the-shelf device to a Low Earth Orbit satellite. This accomplishment opens the door to seamless global IoT connectivity without requiring hardware changes.

See our latest analysis for Nordic Semiconductor.

It has been an exciting year for Nordic Semiconductor, with this satellite 5G breakthrough adding momentum to impressive stock performance. The company’s share price has climbed nearly 60% year-to-date, and the 1-year total shareholder return now stands above 70%. These are clear signals that investors are paying attention to both long-term potential and fresh innovation.

If global connectivity developments spark your interest, it might just be the right moment to see what else is out there and discover See the full list for free.

With momentum building and shares soaring, the key question now is whether Nordic Semiconductor remains undervalued amid strong growth or if the market has already factored in the company’s innovation and future prospects.

Most Popular Narrative: 12.9% Overvalued

Nordic Semiconductor’s latest close sits above the narrative fair value estimate, suggesting investors may be pricing in more upside than the fundamentals presently justify. This sets the stage for debate as to whether market expectations for future growth are too optimistic.

Optimism about the company's exposure to green technology and sustainability trends could be inflating valuation. However, tightening regulatory requirements and European climate policies may increase compliance costs and CapEx, potentially leading to downward pressure on net margins and earnings over time.

Curious how bullish assumptions about margin expansion and future growth could justify a much higher multiple in five years? Find out which forecasts underpin this bold valuation outlook and what would have to go right for the market to prove analysts wrong. The biggest drivers behind this number might surprise you.

Result: Fair Value of $145.74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if recent product innovations and expanded customer demand persist, Nordic Semiconductor’s strong growth could easily defy the prevailing cautious outlook.

Find out about the key risks to this Nordic Semiconductor narrative.

Another View: Market Multiples Tell a Different Story

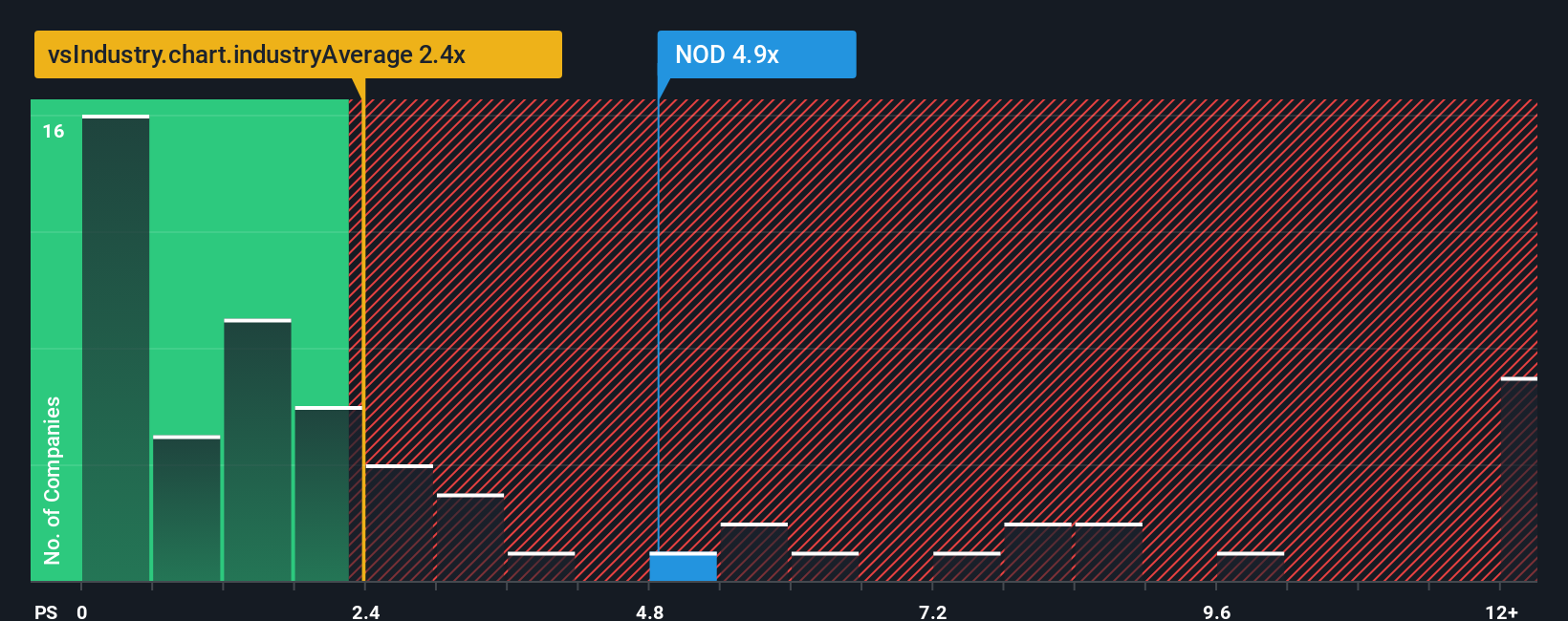

Looking at market multiples, Nordic Semiconductor currently trades at a price-to-sales ratio of 5.1x. This is higher than both the European semiconductor industry average of 2.3x and its own estimated fair ratio of 1.5x. Such a wide gap signals the market is placing a significant premium on the company, which brings higher valuation risk if growth expectations are not met. Will these elevated expectations hold, or is there a correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordic Semiconductor Narrative

For those who want to see the bigger picture firsthand, it’s easy to dive into the data and craft your own perspective in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nordic Semiconductor.

Looking for More Investment Ideas?

Take action today so you do not miss your next big opportunity. Turn insights into smarter decisions by tapping into new sectors, fresh trends, and high-potential companies.

- Uncover hidden value by checking out these 892 undervalued stocks based on cash flows and see which stocks offer compelling upside based on strong cash flow fundamentals.

- Capitalize on tomorrow’s breakthroughs by browsing these 33 healthcare AI stocks, which features companies blending advanced healthcare with artificial intelligence for the next wave of growth.

- Boost your portfolio’s income with these 19 dividend stocks with yields > 3%, highlighting companies paying sizeable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives