Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, XXL ASA (OB:XXL) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for XXL

How Much Debt Does XXL Carry?

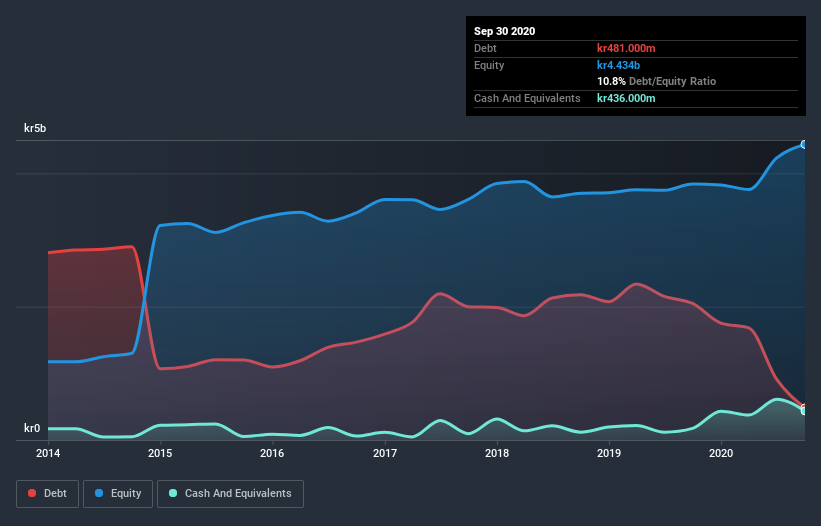

The image below, which you can click on for greater detail, shows that XXL had debt of kr481.0m at the end of September 2020, a reduction from kr2.05b over a year. On the flip side, it has kr436.0m in cash leading to net debt of about kr45.0m.

A Look At XXL's Liabilities

Zooming in on the latest balance sheet data, we can see that XXL had liabilities of kr2.26b due within 12 months and liabilities of kr2.78b due beyond that. On the other hand, it had cash of kr436.0m and kr372.0m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr4.24b.

This deficit is considerable relative to its market capitalization of kr4.76b, so it does suggest shareholders should keep an eye on XXL's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. Carrying virtually no net debt, XXL has a very light debt load indeed. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if XXL can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, XXL reported revenue of kr10b, which is a gain of 10%, although it did not report any earnings before interest and tax. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

Caveat Emptor

Importantly, XXL had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost kr256m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of kr336m into a profit. In the meantime, we consider the stock very risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with XXL (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade XXL, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:XXL

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives