Europris ASA (OB:EPR) Investors Are Less Pessimistic Than Expected

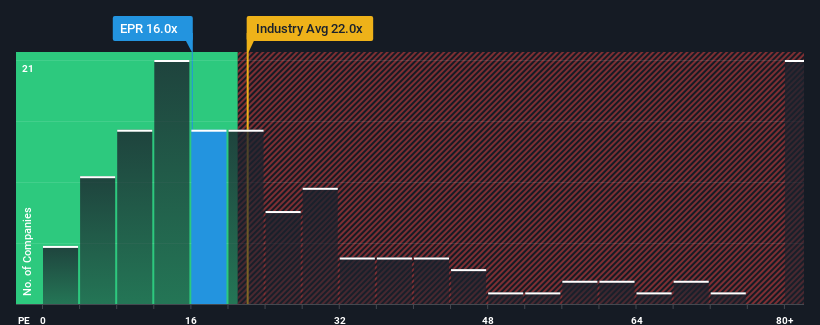

When close to half the companies in Norway have price-to-earnings ratios (or "P/E's") below 12x, you may consider Europris ASA (OB:EPR) as a stock to potentially avoid with its 16x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

While the market has experienced earnings growth lately, Europris' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

See our latest analysis for Europris

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Europris would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 8.5%. The last three years don't look nice either as the company has shrunk EPS by 24% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 12% per annum as estimated by the four analysts watching the company. With the market predicted to deliver 21% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's alarming that Europris' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Europris' P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Europris' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Europris, and understanding should be part of your investment process.

You might be able to find a better investment than Europris. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Europris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:EPR

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives