- Norway

- /

- Real Estate

- /

- OB:ENTRA

Will New Board Elections at Entra (OB:ENTRA) Signal a Shift in Its Governance Strategy?

Reviewed by Sasha Jovanovic

- Entra ASA recently held an extraordinary general meeting where all agenda items were approved, including the election of Henrik Kall and Charlotte Levin as new board and nomination committee members until the next AGM in 2026.

- This governance refresh introduces new leadership perspectives at a pivotal time for the company, with potential implications for its strategic direction and oversight.

- We’ll explore how the approval of new board members at Entra ASA may shape its investment narrative and future governance outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Entra Investment Narrative Recap

Investors who believe in Entra's ability to maintain high occupancy in its core Oslo and Bergen office markets, despite structural shifts in workplace demand, may see long-term value. The recent board and nomination committee appointments introduce new oversight but do not materially impact the immediate catalyst of lease retention or the ongoing risk of rising vacancies and changing tenant needs.

Among recent company updates, the renewal of a five-year lease with Sykehusapotekene HF is particularly relevant, underscoring Entra's focus on tenant stability and income visibility as it navigates broader shifts in office space demand. These kinds of agreements are crucial given the persistent risks tied to vacancy rates and evolving tenant preferences.

However, investors should also consider that persistent or growing vacancies, particularly if hybrid work accelerates, still present a significant risk to Entra's earnings and future growth...

Read the full narrative on Entra (it's free!)

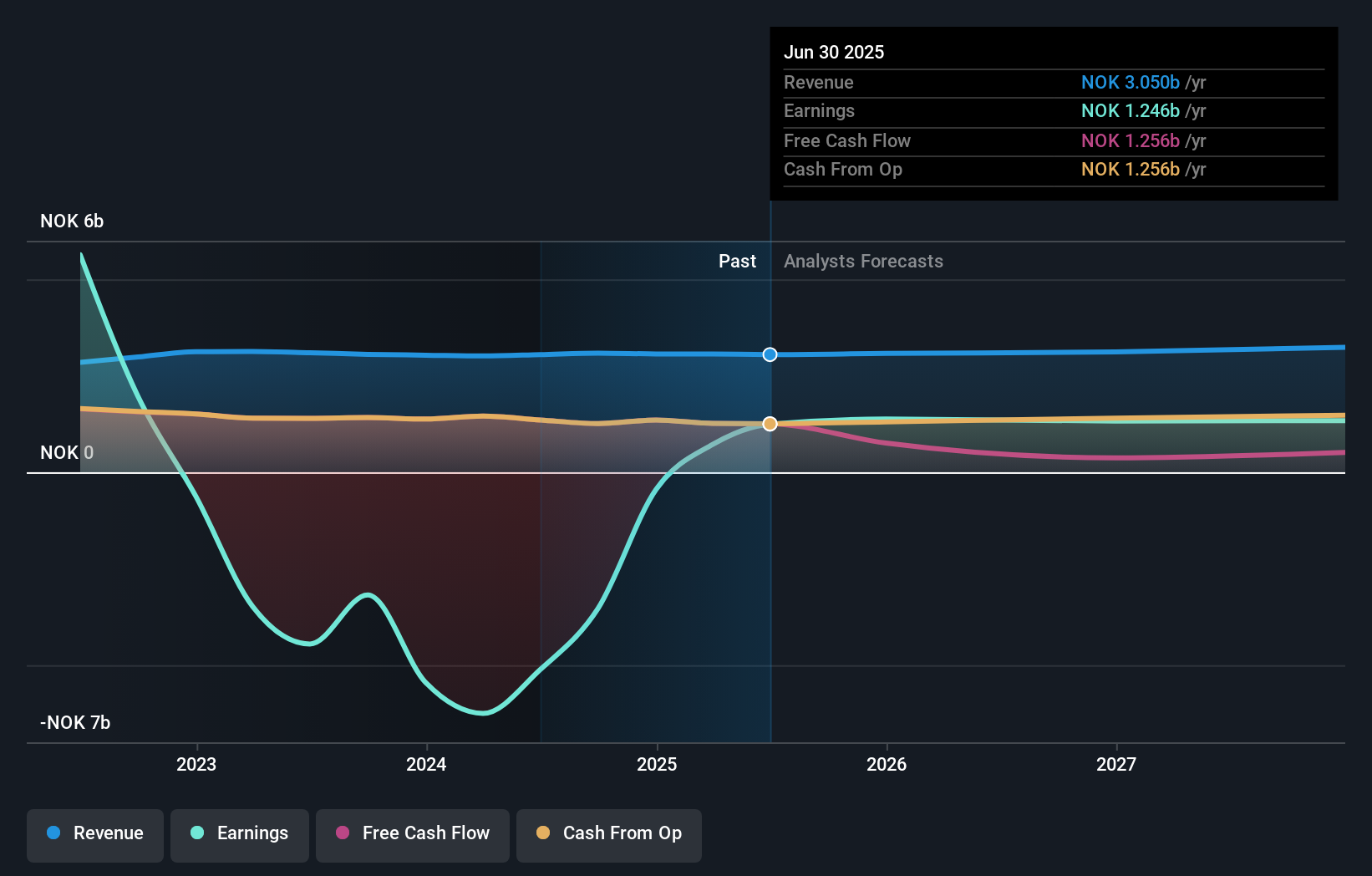

Entra's narrative projects NOK 3.3 billion revenue and NOK 1.4 billion earnings by 2028. This requires 2.2% yearly revenue growth and a NOK 0.2 billion earnings increase from NOK 1.2 billion today.

Uncover how Entra's forecasts yield a NOK125.20 fair value, a 6% upside to its current price.

Exploring Other Perspectives

The sole fair value estimate from the Simply Wall St Community stands at NOK125.20, reflecting one individual perspective. Contrasting views on vacancy risks highlight why it’s worth comparing multiple outlooks on Entra’s prospects.

Explore another fair value estimate on Entra - why the stock might be worth as much as 6% more than the current price!

Build Your Own Entra Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Entra research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Entra research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Entra's overall financial health at a glance.

No Opportunity In Entra?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ENTRA

Entra

Develops real estate properties in Oslo, Bergen, Drammen, Sandvika, and Stavanger.

Very low risk with poor track record.

Similar Companies

Market Insights

Community Narratives