- Norway

- /

- Real Estate

- /

- OB:ENTRA

Entra (OB:ENTRA): Assessing Valuation Following Board and Governance Changes

Reviewed by Kshitija Bhandaru

Entra (OB:ENTRA) has announced the approval of new board and nomination committee members following an extraordinary general meeting. These leadership changes signal a potential shift in the company's governance approach and have captured investor attention this week.

See our latest analysis for Entra.

After spending much of the year under pressure, Entra’s share price has shown modest improvement recently, closing at NOK 117.4 and delivering a 1.4% year-to-date rise. However, the 1-year total shareholder return remains firmly negative at -13.9%, reflecting lingering investor caution despite new board appointments and fresh lease and financing announcements. While the past three years show a robust total return of 26.3%, investors are looking for signs that momentum is rebuilding amid leadership changes and a more challenging landscape for property stocks.

If you’re interested in broadening your search, now is the perfect time to discover fast growing stocks with high insider ownership.

This recent flurry of boardroom moves and operational updates raises an important question for investors: Is Entra currently trading at an attractive discount, or has the market already factored in the potential for future growth?

Most Popular Narrative: 6.2% Undervalued

With Entra last closing at NOK 117.4, the narrative’s fair value of NOK 125.2 points to upside potential that investors are weighing carefully. This perspective brings together expected growth in earnings, margins, and Oslo office demand as future catalysts that could shift the stock’s trajectory.

Strong demand for prime office locations in Oslo and other major Norwegian cities, combined with limited new supply in the near term, is likely to support higher occupancy and above-inflation rental growth in Entra's portfolio. This would positively impact future revenue and earnings. Continued central government and technology sector employment in Norway provides Entra with a stable, creditworthy tenant base, reducing vacancy risk and supporting sustained rental income visibility for long-term revenue growth.

Want to unravel the numbers shaping this bullish stance? The narrative expects major margin improvements and a strong tenant mix, but there is one surprising financial lever that justifies that ambitious valuation. Dive in to discover the confidence behind these growth projections and what makes this stock’s future so hotly debated.

Result: Fair Value of $125.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent vacancies and potential shifts in remote work trends could pressure Entra’s revenue outlook. These factors pose real challenges to the optimistic valuation.

Find out about the key risks to this Entra narrative.

Another View: Multiples Raise Red Flags

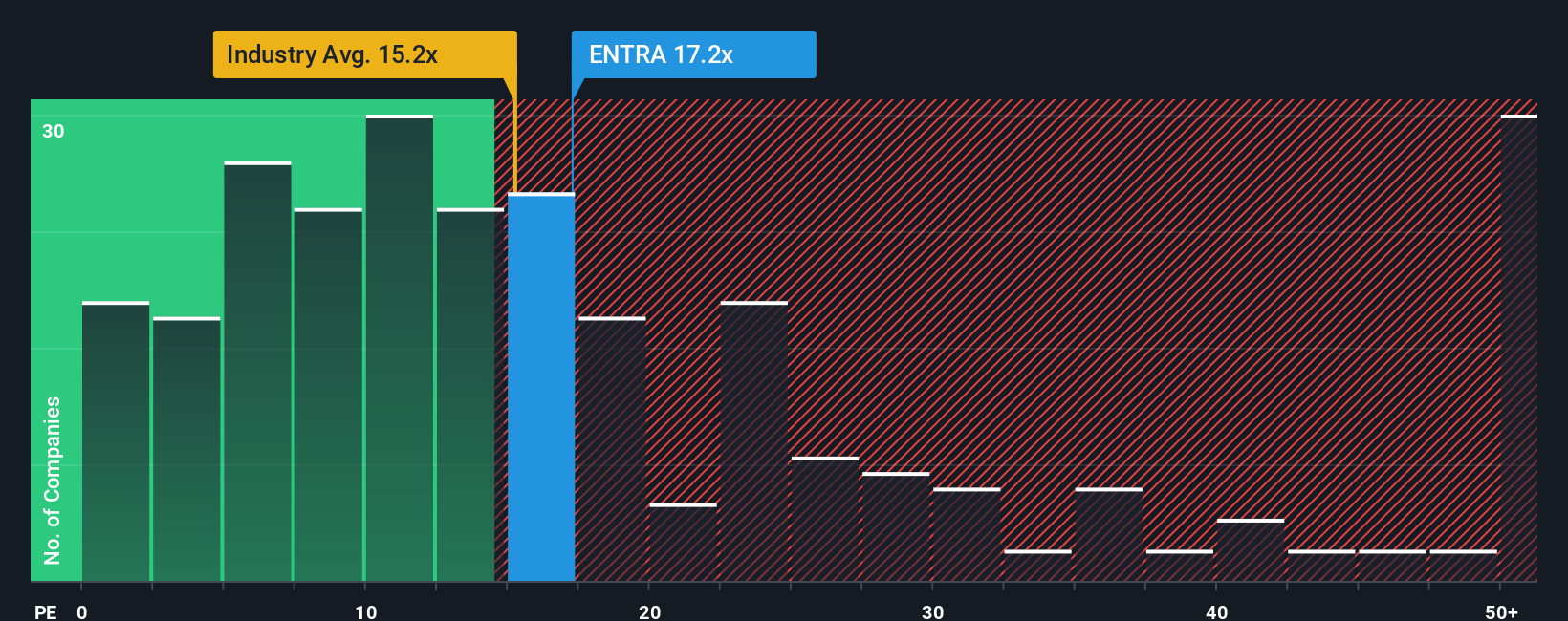

While the analyst consensus points to upside, our comparison using the price-to-earnings ratio tells a different story. Entra trades at 17.2 times earnings, which is higher than both the industry average (15.4x) and its peer group (17.1x). The market’s fair ratio for this stock is also just 15.4x. This gap suggests investors may be paying a premium, raising the possibility of valuation risk if market sentiment shifts. Could this be a warning sign that upside is limited?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entra Narrative

If you want to test your own assumptions about Entra or prefer digging into the numbers yourself, you can easily shape your own view in just a few minutes. Do it your way.

A great starting point for your Entra research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead by checking out some of the market’s best opportunities right now. Smart investors keep their edge by searching widely and acting early, not waiting on headlines to move.

- Unlock growth potential and boost your watchlist with these 899 undervalued stocks based on cash flows that currently trade below their real worth, offering real room for upside.

- Capture exciting returns from rapid advancements in healthcare tech by leveraging these 33 healthcare AI stocks driving medical innovation with artificial intelligence breakthroughs.

- Spot powerful trends reshaping global finance by getting ahead with these 79 cryptocurrency and blockchain stocks capitalizing on blockchain and cryptocurrency momentum before the crowd notices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ENTRA

Entra

Develops real estate properties in Oslo, Bergen, Drammen, Sandvika, and Stavanger.

Very low risk with poor track record.

Similar Companies

Market Insights

Community Narratives