Spotlight On 3 European Penny Stocks With Market Caps Larger Than €20M

Reviewed by Simply Wall St

As European markets experience a pullback from recent highs amid political turmoil and international trade tensions, investors are increasingly looking for opportunities in less traditional areas of the market. Penny stocks, while often considered a relic of past trading days, still offer intriguing prospects for growth by focusing on smaller or newer companies with solid financial foundations. This article highlights several European penny stocks that combine strong balance sheets with potential for significant upside, providing investors with an opportunity to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.92 | €26.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €226.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.52 | DKK114.28M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.54 | €36.81M | ✅ 3 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0776 | €8.2M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 279 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

I.M.D. International Medical Devices (BIT:IMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: I.M.D. International Medical Devices S.p.A. operates in the medical devices industry, focusing on the development and distribution of healthcare products, with a market cap of €25.81 million.

Operations: The company's revenue is primarily derived from its Medical Imaging Systems segment, which generated €36.64 million.

Market Cap: €25.81M

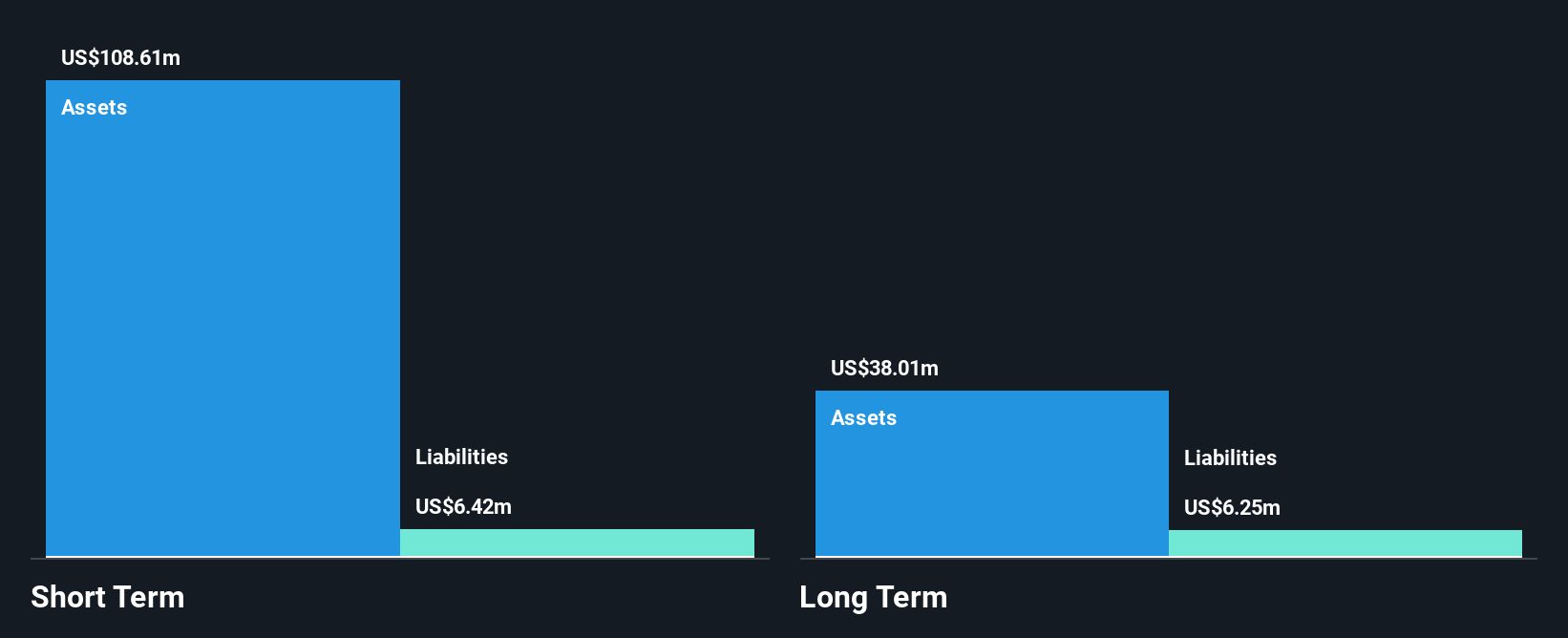

I.M.D. International Medical Devices S.p.A., with a market cap of €25.81 million, has experienced earnings decline over the past five years and reported lower revenue and net income for the first half of 2025 compared to the previous year. Despite stable weekly volatility, its share price remains highly volatile in the short term. The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid liquidity management. While IMD's debt is well covered by operating cash flow, profit margins have decreased from 6.6% to 3.7%, reflecting challenges in maintaining profitability amidst industry pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of I.M.D. International Medical Devices.

- Review our growth performance report to gain insights into I.M.D. International Medical Devices' future.

Nykode Therapeutics (OB:NYKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nykode Therapeutics AS is a clinical-stage biopharmaceutical company focused on discovering and developing novel immunotherapies for cancer and autoimmune diseases, with a market cap of NOK734.73 million.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling $7.89 million.

Market Cap: NOK734.73M

Nykode Therapeutics, with a market cap of NOK734.73 million, reported second-quarter revenue of US$0.198 million, down from US$0.584 million the previous year, highlighting its pre-revenue status in the biotech sector. Despite a positive net income of US$0.859 million for Q2 2025 compared to a significant loss previously, the company remains unprofitable and isn't expected to achieve profitability in the next three years. The management team is experienced with an average tenure of 4.1 years; however, board experience is limited at 0.5 years on average. Nykode's cash runway exceeds one year without debt concerns but faces high share price volatility and declining earnings forecasts over the coming years.

- Click to explore a detailed breakdown of our findings in Nykode Therapeutics' financial health report.

- Assess Nykode Therapeutics' future earnings estimates with our detailed growth reports.

Eniro Group (OM:ENRO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eniro Group AB (publ) is a software-as-a-service company operating in Sweden, Norway, Denmark, and Finland with a market cap of approximately SEK 300.47 million.

Operations: The company generates revenue through two main segments: Dynava, contributing SEK 348 million, and Marketing Partner, contributing SEK 600 million.

Market Cap: SEK300.47M

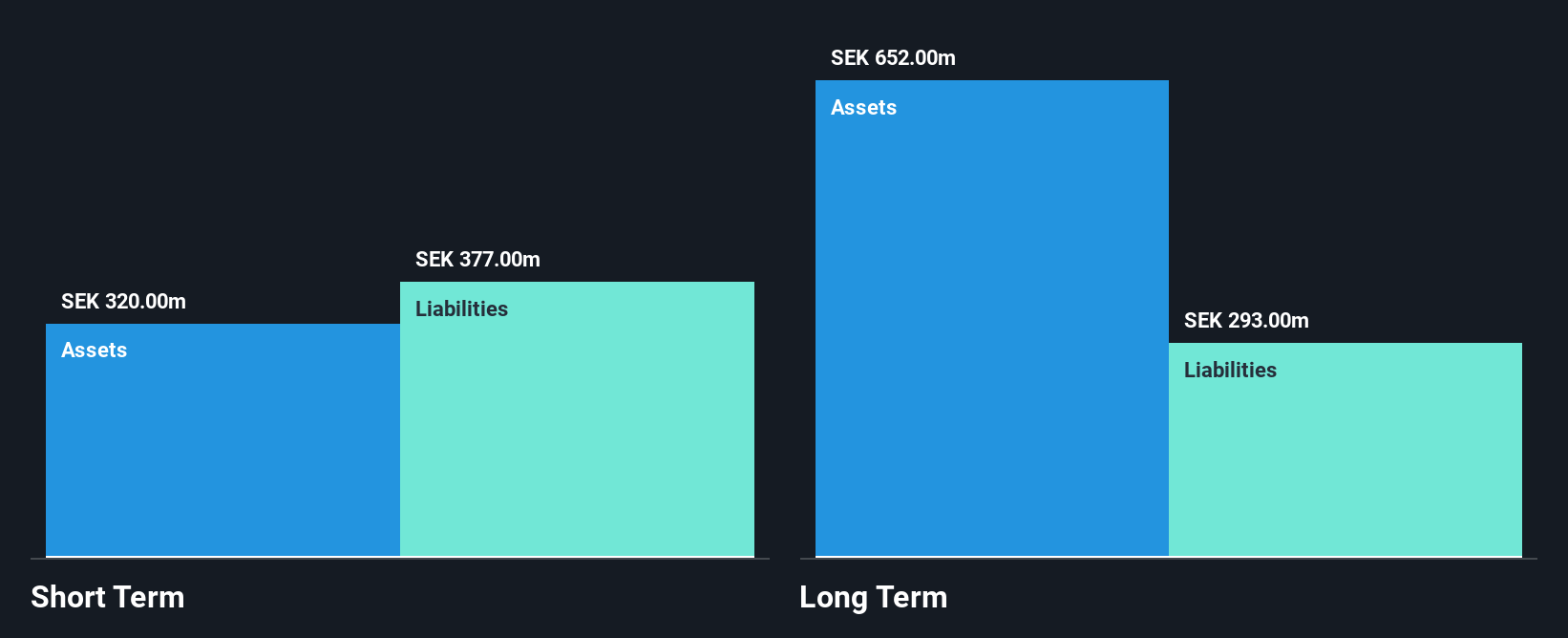

Eniro Group, with a market cap of SEK 300.47 million, shows promising financial stability and growth potential. The company operates without debt, which eliminates concerns about interest payments and enhances its financial flexibility. It has achieved high-quality earnings, with a significant earnings growth of 111.4% over the past year—outpacing both its five-year average and the Media industry decline. Despite some challenges in covering short-term liabilities with assets (SEK320M vs SEK361M), Eniro's return on equity is robust at 24.8%. Recent results indicate steady sales performance and improved net profit margins compared to last year.

- Navigate through the intricacies of Eniro Group with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Eniro Group's track record.

Turning Ideas Into Actions

- Gain an insight into the universe of 279 European Penny Stocks by clicking here.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nykode Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NYKD

Nykode Therapeutics

A clinical-stage biopharmaceutical company, discovers and develops novel immunotherapies for the treatment of cancer and autoimmune diseases.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives