- Norway

- /

- Metals and Mining

- /

- OB:NHY

These 4 Measures Indicate That Norsk Hydro (OB:NHY) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Norsk Hydro ASA (OB:NHY) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Norsk Hydro

How Much Debt Does Norsk Hydro Carry?

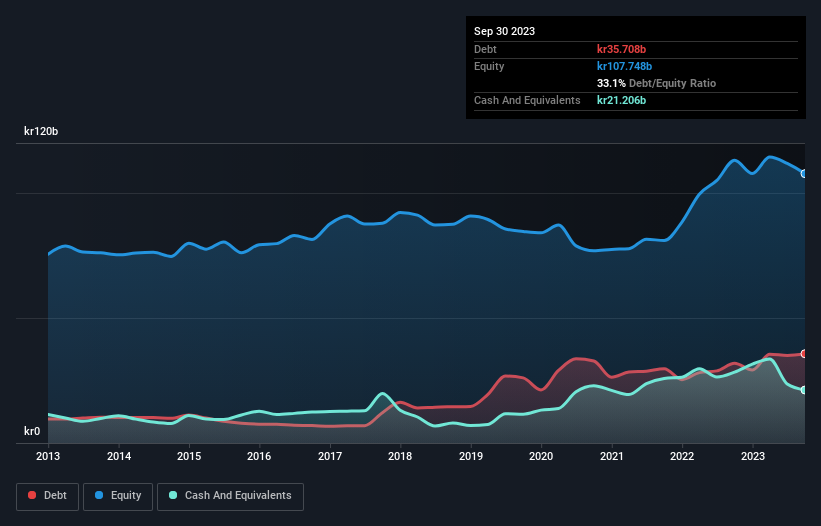

The image below, which you can click on for greater detail, shows that at September 2023 Norsk Hydro had debt of kr35.7b, up from kr31.9b in one year. However, it does have kr21.2b in cash offsetting this, leading to net debt of about kr14.5b.

A Look At Norsk Hydro's Liabilities

According to the last reported balance sheet, Norsk Hydro had liabilities of kr41.7b due within 12 months, and liabilities of kr55.8b due beyond 12 months. Offsetting this, it had kr21.2b in cash and kr26.4b in receivables that were due within 12 months. So its liabilities total kr49.9b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Norsk Hydro has a huge market capitalization of kr133.9b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Norsk Hydro's net debt is only 0.32 times its EBITDA. And its EBIT easily covers its interest expense, being 71.0 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The modesty of its debt load may become crucial for Norsk Hydro if management cannot prevent a repeat of the 36% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Norsk Hydro's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Norsk Hydro's free cash flow amounted to 34% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

While Norsk Hydro's EBIT growth rate has us nervous. To wit both its interest cover and net debt to EBITDA were encouraging signs. Looking at all the angles mentioned above, it does seem to us that Norsk Hydro is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 2 warning signs we've spotted with Norsk Hydro .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Norsk Hydro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NHY

Norsk Hydro

Engages in the power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities worldwide.

Solid track record with excellent balance sheet.