- Norway

- /

- Metals and Mining

- /

- OB:NHY

3 Stocks Estimated To Be Trading At Discounts Of Up To 44.2%

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have weighed on stock indices like the S&P 500 and contributed to a mixed performance across regions. As economic growth remains tepid and central banks cautiously approach monetary policy adjustments, identifying undervalued stocks can be an effective strategy for investors seeking opportunities amid market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.52 | CN¥22.89 | 49.7% |

| WEX (NYSE:WEX) | US$172.60 | US$343.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2706.00 | ¥5411.18 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

| Energy One (ASX:EOL) | A$5.65 | A$11.04 | 48.8% |

| Sinch (OM:SINCH) | SEK31.45 | SEK62.48 | 49.7% |

Let's uncover some gems from our specialized screener.

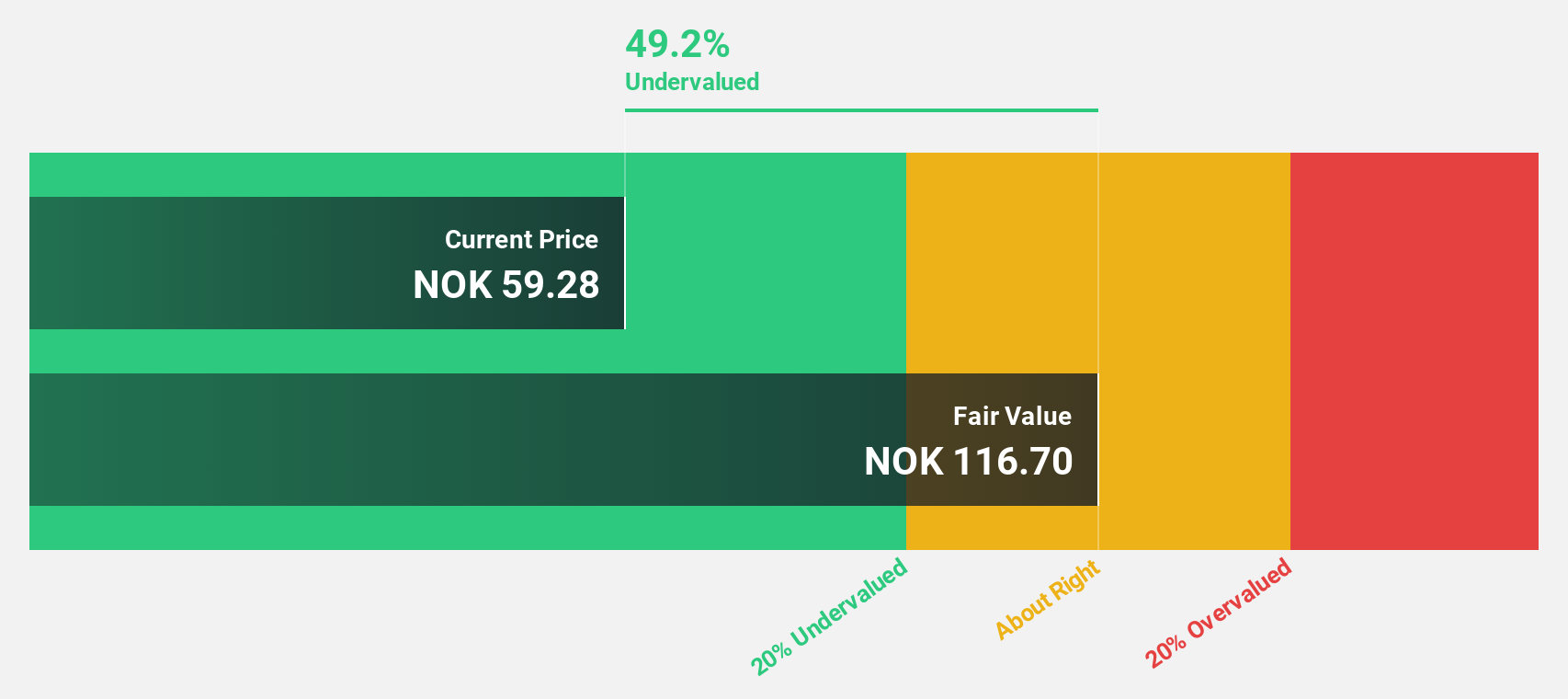

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company engaged in the exploration, development, and production of hydrocarbon resources across Norway, Denmark, the Netherlands, and the United Kingdom with a market cap of NOK14.44 billion.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated $723.10 million.

Estimated Discount To Fair Value: 31.3%

BlueNord is trading 31.3% below its estimated fair value of NOK793.26, indicating potential undervaluation based on cash flows. The company has improved net profit margins to 4% from last year’s lower level and forecasts suggest earnings could grow at 44% annually, outpacing the Norwegian market's average growth rate. However, current debt levels are not well covered by operating cash flow, which may pose a risk if revenue growth projections aren't met.

- The growth report we've compiled suggests that BlueNord's future prospects could be on the up.

- Click here to discover the nuances of BlueNord with our detailed financial health report.

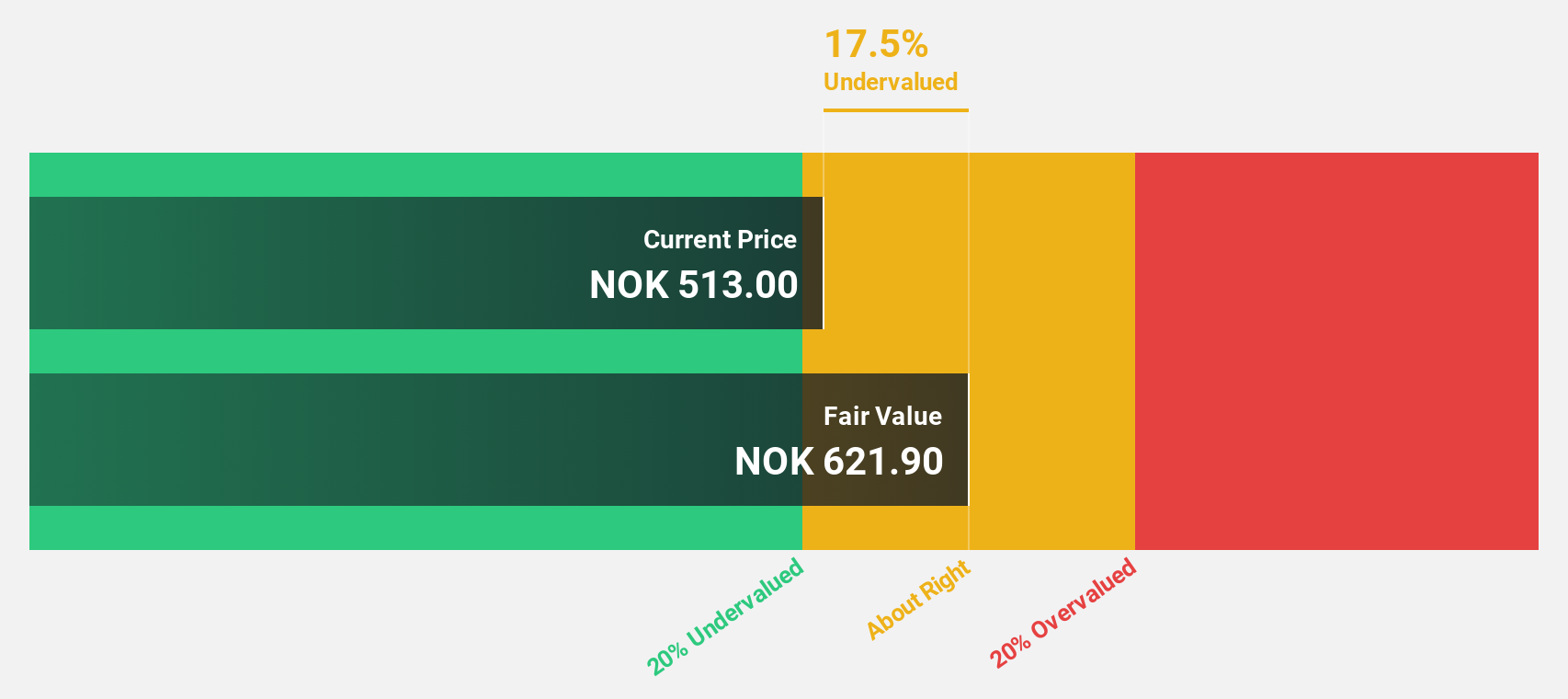

Norsk Hydro (OB:NHY)

Overview: Norsk Hydro ASA is involved in power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities globally, with a market cap of NOK136.68 billion.

Operations: The company's revenue segments include Hydro Energy at NOK10.46 billion, Hydro Extrusions at NOK75.70 billion, Hydro Metal Markets at NOK79.03 billion, Hydro Aluminium Metal at NOK54.21 billion, and Hydro Bauxite & Alumina at NOK46.36 billion.

Estimated Discount To Fair Value: 44.2%

Norsk Hydro is trading significantly below its estimated fair value of NOK123.05, highlighting potential undervaluation based on cash flows. Despite a low net profit margin of 0.7%, recent earnings improvements and a forecasted annual earnings growth rate of 66.7% suggest robust future performance relative to the Norwegian market. However, the dividend yield of 3.64% lacks coverage from current earnings or free cash flows, which could be a concern for income-focused investors.

- Upon reviewing our latest growth report, Norsk Hydro's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Norsk Hydro's balance sheet health report.

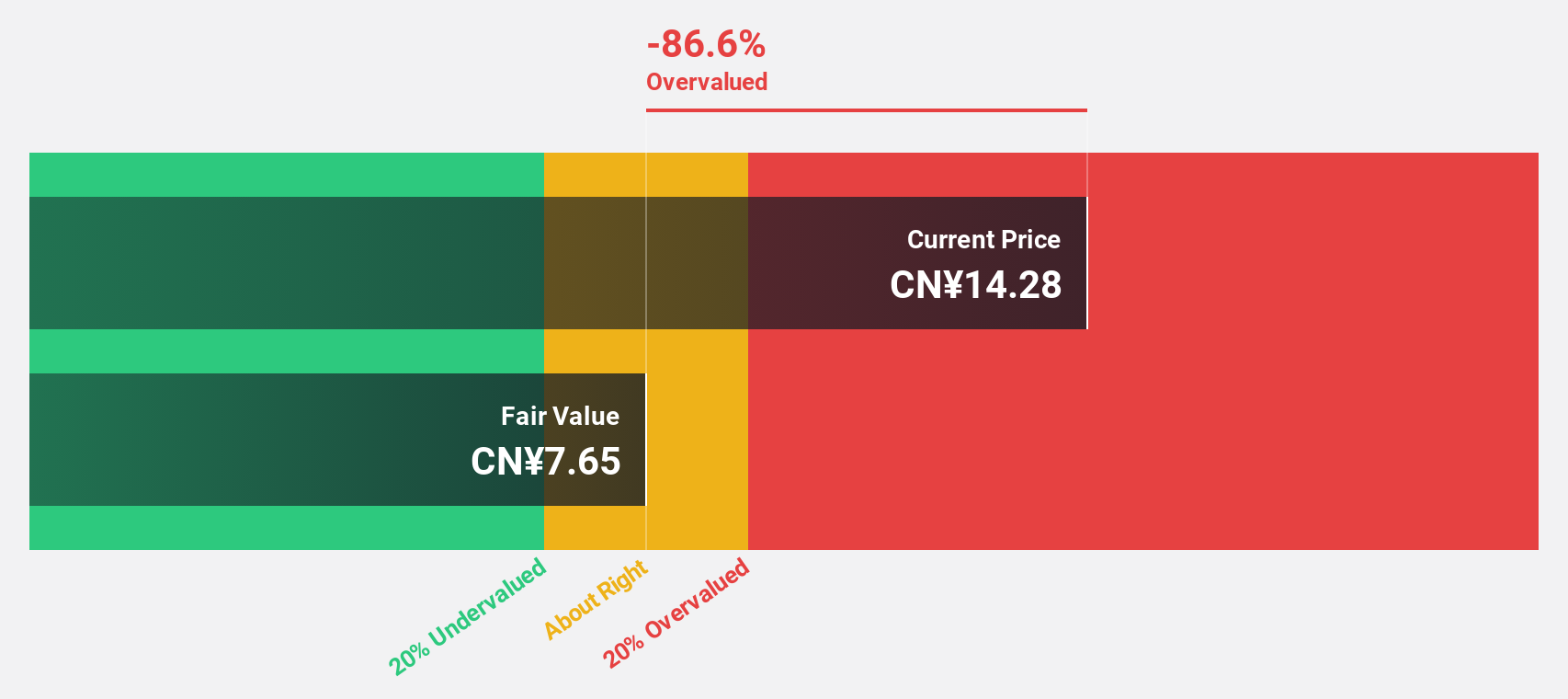

KPC PharmaceuticalsInc (SHSE:600422)

Overview: KPC Pharmaceuticals, Inc. is a pharmaceutical company involved in the research, development, production, marketing, and wholesale distribution of botanical drugs both in China and internationally, with a market cap of CN¥11.35 billion.

Operations: KPC Pharmaceuticals, Inc. generates revenue through its activities in research, development, production, marketing, and commercial wholesale of botanical drugs within China and on an international scale.

Estimated Discount To Fair Value: 40%

KPC Pharmaceuticals is trading over 20% below its estimated fair value of CNY 25.33, indicating potential undervaluation based on cash flows. Despite a decline in sales to CNY 5,457.45 million for the nine months ending September 2024, net income slightly increased to CNY 387.4 million. Forecasted earnings growth of over 28% annually outpaces the Chinese market average, though revenue growth lags behind industry expectations at 14.2%.

- Insights from our recent growth report point to a promising forecast for KPC PharmaceuticalsInc's business outlook.

- Get an in-depth perspective on KPC PharmaceuticalsInc's balance sheet by reading our health report here.

Key Takeaways

- Explore the 958 names from our Undervalued Stocks Based On Cash Flows screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norsk Hydro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NHY

Norsk Hydro

Engages in the power production, bauxite extraction, alumina refining, aluminium smelting, and recycling activities worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives