Elkem (OB:ELK): Assessing Valuation After Strong Revenue and Net Income Growth

Reviewed by Kshitija Bhandaru

Elkem (OB:ELK) has posted strong annual growth numbers, with revenue up 22% and net income increasing by 59%. These results invite a closer look at recent performance and what might be driving investor interest.

See our latest analysis for Elkem.

Elkem’s share price momentum has picked up in recent months, with gains in both the past quarter and year to date as investors respond to its impressive growth. Over the past year, the total shareholder return sits just above break-even, reflecting some caution but also the company’s potential as renewed growth sparks fresh interest.

If you’re curious about what else might drive your portfolio forward, now’s a great opportunity to discover fast growing stocks with high insider ownership

With the stock gaining momentum but trading near analyst price targets, the question remains: is this renewed optimism a buying opportunity for Elkem, or has the market already priced in its future growth?

Most Popular Narrative: 2.9% Undervalued

Elkem's most widely followed narrative sets a fair value just above the last close price, implying analysts see a modest upside over current levels. This sets the stage for a deep dive into what assumptions are driving that target.

The diverse geographical presence helps offset negative impacts from global trade tensions. This suggests that Elkem could maintain or increase revenue by leveraging its regional business model. Initiatives to supply the green transition, such as R&D in carbon capture, storage, and using biogenic materials, could enhance long-term revenue and net margins by meeting rising demand for sustainable products.

What if Elkem’s projected strength doesn’t just come from conventional demand, but is driven by bold expectations for fast-growing green markets and profit margins that defy sector norms? The full story unveils the surprising quantitative leaps behind this upbeat price target. Find out exactly how the narrative believes Elkem could outpace the market.

Result: Fair Value of $27.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, global trade tensions and weak demand in key markets such as China and the EU could still undercut Elkem’s growth outlook and margins.

Find out about the key risks to this Elkem narrative.

Another View: Multiples Paint a Different Picture

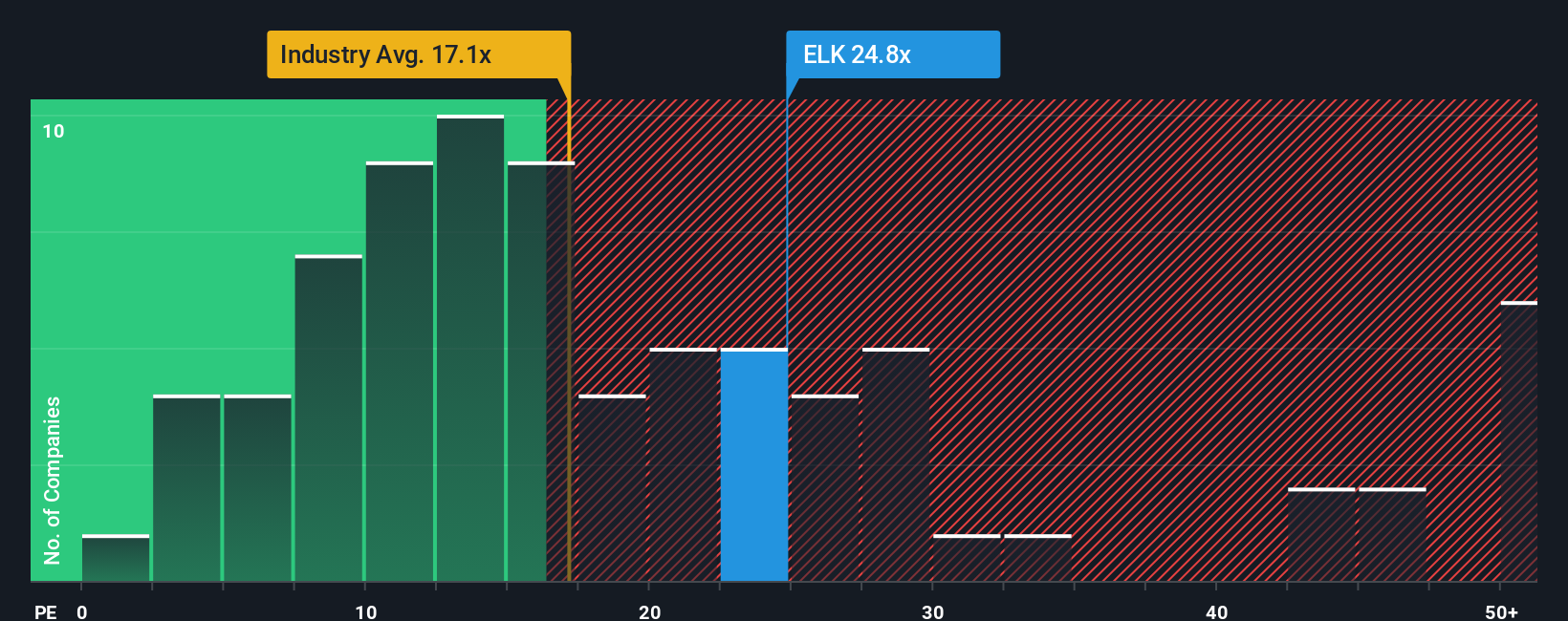

Looking at Elkem’s price-to-earnings ratio, the stock appears expensive at 24.5x compared to the European Chemicals industry average of 17.6x. However, against its peer average of 26.9x and a fair ratio of 44.2x, the valuation seems less extreme. Does this suggest near-term risk, or could it signal untapped value if the market shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elkem Narrative

If you’d rather examine the numbers first-hand or believe a different story better fits Elkem’s future, it takes just a few minutes to put together your own perspective, so why not Do it your way?

A great starting point for your Elkem research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next winning investment slip away. Supercharge your search with these unique opportunities on Simply Wall St and spot tomorrow’s standouts before the crowd.

- Grow your income by tapping into these 19 dividend stocks with yields > 3%, which offers high yields and solid fundamentals for lasting value.

- Ride the surge in digital finance with these 78 cryptocurrency and blockchain stocks, as blockchain innovations reshape entire industries.

- Seize tomorrow’s breakthroughs by checking out these 24 AI penny stocks, fueling artificial intelligence transformation across sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elkem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ELK

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives