Storebrand (OB:STB) Margin Surge to 9.8% Reinforces Bullish Narratives on Profit Quality and Value

Reviewed by Simply Wall St

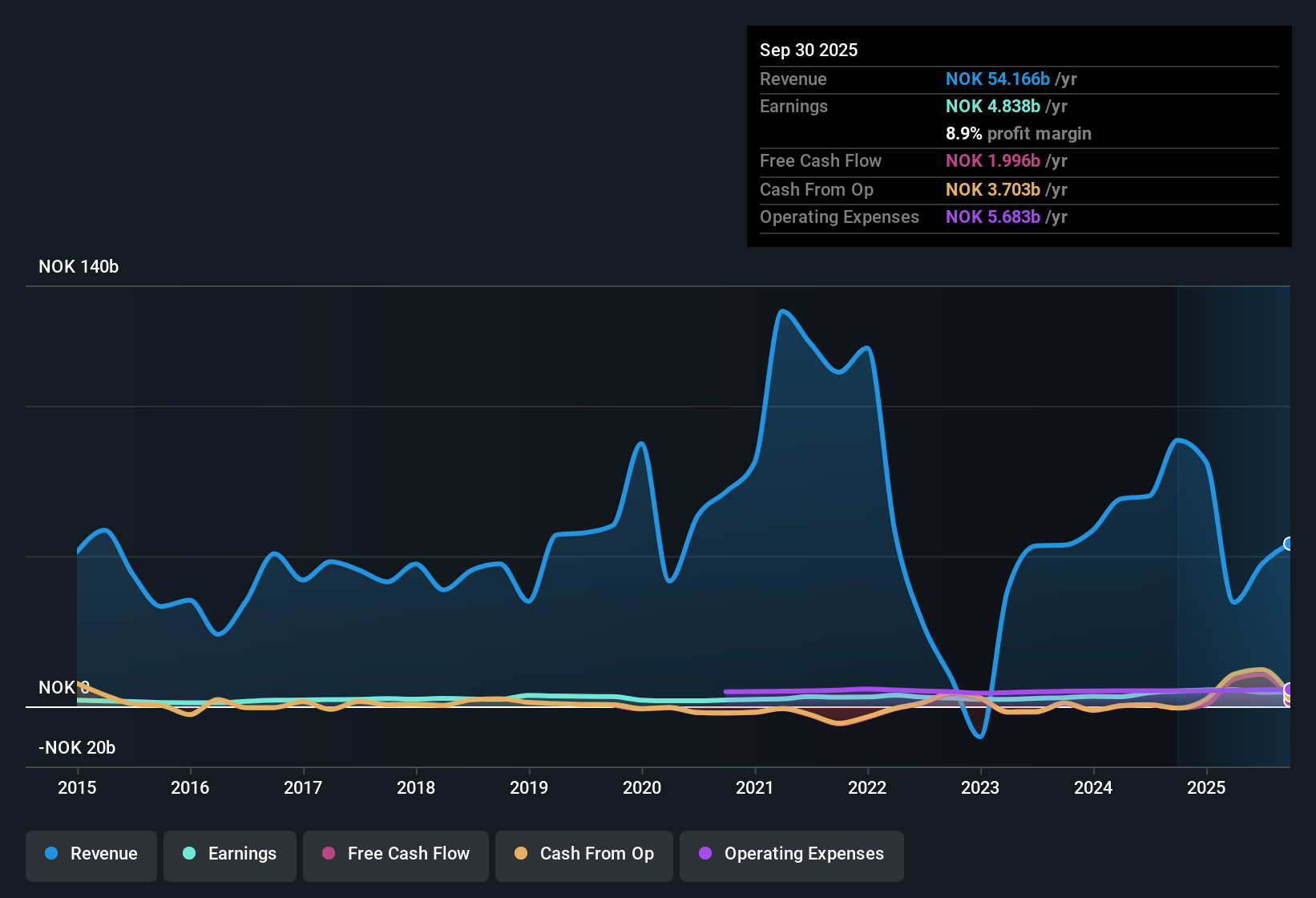

Storebrand (OB:STB) reported net profit margins of 9.8%, up from 6.5% last year, and posted a 1.5% uptick in earnings growth for the year. The company’s strong revenue outlook, with a projected 7.9% annual growth pace that easily outpaces the wider Norwegian market’s 2.6%, and its high-quality earnings, put the focus on ongoing growth momentum. Investors are watching whether Storebrand’s relative undervaluation on a price-to-earnings basis and profit expansion can outweigh concerns about the company’s less robust financial position and only moderate earnings growth forecasts.

See our full analysis for Storebrand.Next, we will break down how these earnings results compare to the most widely followed narratives about Storebrand, to see which expectations are met and where new questions might be raised.

See what the community is saying about Storebrand

Profit Margin Jumps to 9.8% as Market Share Expands

- Storebrand’s net profit margin stood at 9.8% this period, a notable rise from 6.5% last year. Analysts forecast profit margins to increase even further to 42.8% over the next 3 years.

- According to the analysts' consensus view, the company’s strategic strength in Nordic pensions and asset management heavily supports the margin gains.

- Consensus narrative notes that Storebrand’s push into digital and sustainability initiatives helps secure efficiency gains, contributing to higher profitability over time.

- What is surprising is that despite modest headline earnings growth, margin improvement is seen as a durable advantage. This reinforces analysts’ expectations for asset management-driven profitability.

Consensus narrative invites a closer look at how margin expansion and profit quality fit with analysts' long-term expectations for Storebrand’s growth and market positioning. 📊 Read the full Storebrand Consensus Narrative.

Forecasted 4.5% Annual Earnings Growth Faces Revenue Dip

- Earnings are forecast to climb at 4.5% per year going forward. However, analysts expect revenue to decrease by 48.1% annually over the next three years, which signals a dramatic projected shift even as earnings margins rise.

- Analysts' consensus view points to tensions in the growth story.

- Consensus sees Storebrand leveraging structural growth in pensions and successful deals like the Danish Infrastructure acquisition to deliver on profit targets, even as overall revenue is set to fall sharply.

- This disconnect between margin strength and top-line outlook challenges the idea of unbroken growth, making careful monitoring of business mix and efficiency crucial to the bullish scenario.

Trading Below DCF Fair Value but at Premium to Industry

- Storebrand trades at a price-to-earnings ratio of 14.6x, below its DCF fair value of 225.73 but above the broader European insurance industry average of 12.4x. This highlights a valuation gap versus peers.

- Analysts' consensus view believes that, while Storebrand appears favorably priced against its estimated intrinsic value, the current share price of 158.5 is only modestly below the analyst target of 156.25, suggesting that upside may be limited unless earnings momentum accelerates.

- Consensus highlights that the market generally agrees Storebrand is fairly priced, given the small difference between share price and target. However, there is an expectation that future management fee growth could be a potential catalyst for valuation re-rating.

- Bears might note that this premium to the industry average, paired with only moderate growth forecasts, leaves little room for disappointment on execution or market conditions.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Storebrand on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the results? Share your perspective and craft your own narrative in just a few minutes with us. Do it your way

A great starting point for your Storebrand research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Storebrand’s shrinking revenue outlook and only moderate earnings growth raise concerns about whether its recent momentum can deliver sustainable, balanced performance.

If you’re seeking companies that show steady gains year after year, check out stable growth stocks screener (2095 results) to find those with more consistent growth and less volatility risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:STB

Storebrand

Provides insurance products and services in Norway, Sweden, the United Kingdom, Finland, Denmark, Germany, Luxemburg, and Ireland.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives