For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Storebrand (OB:STB). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Storebrand

Storebrand's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Like a falcon taking flight, Storebrand's EPS soared from kr5.40 to kr7.58, over the last year. That's a commendable gain of 40%.

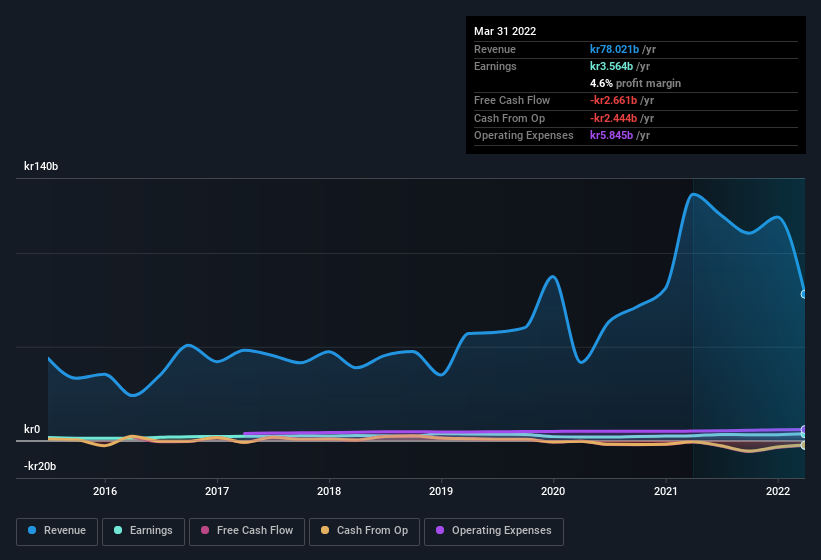

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that, last year, Storebrand's revenue from operations was lower than its revenue, so that could distort my analysis of its margins. While Storebrand may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Storebrand's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Storebrand Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did Storebrand insiders refrain from selling stock during the year, but they also spent kr626k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident.

On top of the insider buying, it's good to see that Storebrand insiders have a valuable investment in the business. Indeed, they have a glittering mountain of wealth invested in it, currently valued at kr1.6b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Does Storebrand Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Storebrand's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So I do think this is one stock worth watching. You still need to take note of risks, for example - Storebrand has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

The good news is that Storebrand is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:STB

Storebrand

Provides insurance products and services in Norway, the United States, Japan, and Sweden.

Undervalued with solid track record.