With EPS Growth And More, Gjensidige Forsikring (OB:GJF) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Gjensidige Forsikring (OB:GJF), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Gjensidige Forsikring

How Quickly Is Gjensidige Forsikring Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, Gjensidige Forsikring's EPS has grown 26% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

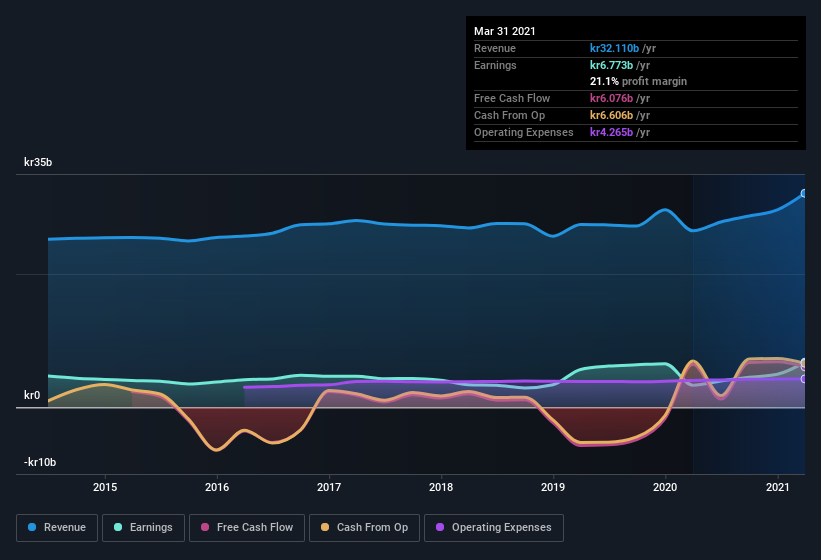

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Gjensidige Forsikring's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Gjensidige Forsikring shareholders can take confidence from the fact that EBIT margins are up from 17% to 27%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Gjensidige Forsikring.

Are Gjensidige Forsikring Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent kr23m buying Gjensidige Forsikring shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. Zooming in, we can see that the biggest insider purchase was by Chief Executive Officer Helge Baastad for kr5.9m worth of shares, at about kr90.00 per share.

It's reassuring that Gjensidige Forsikring insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Gjensidige Forsikring, with market caps over kr66b, is about kr13m.

The Gjensidige Forsikring CEO received kr10m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Gjensidige Forsikring Worth Keeping An Eye On?

You can't deny that Gjensidige Forsikring has grown its earnings per share at a very impressive rate. That's attractive. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. On balance the message seems to be that this stock is worth looking at, at least for a while. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Gjensidige Forsikring (1 makes us a bit uncomfortable) you should be aware of.

As a growth investor I do like to see insider buying. But Gjensidige Forsikring isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Gjensidige Forsikring, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:GJF

Gjensidige Forsikring

Provides general insurance and pension products in Norway, Sweden, Denmark, Finland, Latvia, Lithuania, and Estonia.

Reasonable growth potential with proven track record and pays a dividend.