- Taiwan

- /

- Real Estate

- /

- TWSE:2542

3 Stocks That May Be Trading At A Discount Of Up To 41.4%

Reviewed by Simply Wall St

In the current global market environment, uncertainty surrounding the incoming Trump administration's policies has contributed to volatility, with U.S. stocks experiencing a partial reversal of recent gains and sector returns showing significant variation. As investors navigate these fluctuations and consider potential policy impacts on corporate earnings, identifying stocks that may be undervalued can offer opportunities for those seeking value investments. A good stock in this context is one that not only shows potential for growth but also trades below its intrinsic value, presenting a possible discount in light of prevailing economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$279.00 | NT$554.65 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| Solum (KOSE:A248070) | ₩17280.00 | ₩34265.45 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥16.20 | CN¥32.31 | 49.9% |

| XD (SEHK:2400) | HK$22.40 | HK$44.60 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44600.00 | ₩88907.79 | 49.8% |

| iFLYTEKLTD (SZSE:002230) | CN¥53.07 | CN¥105.85 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

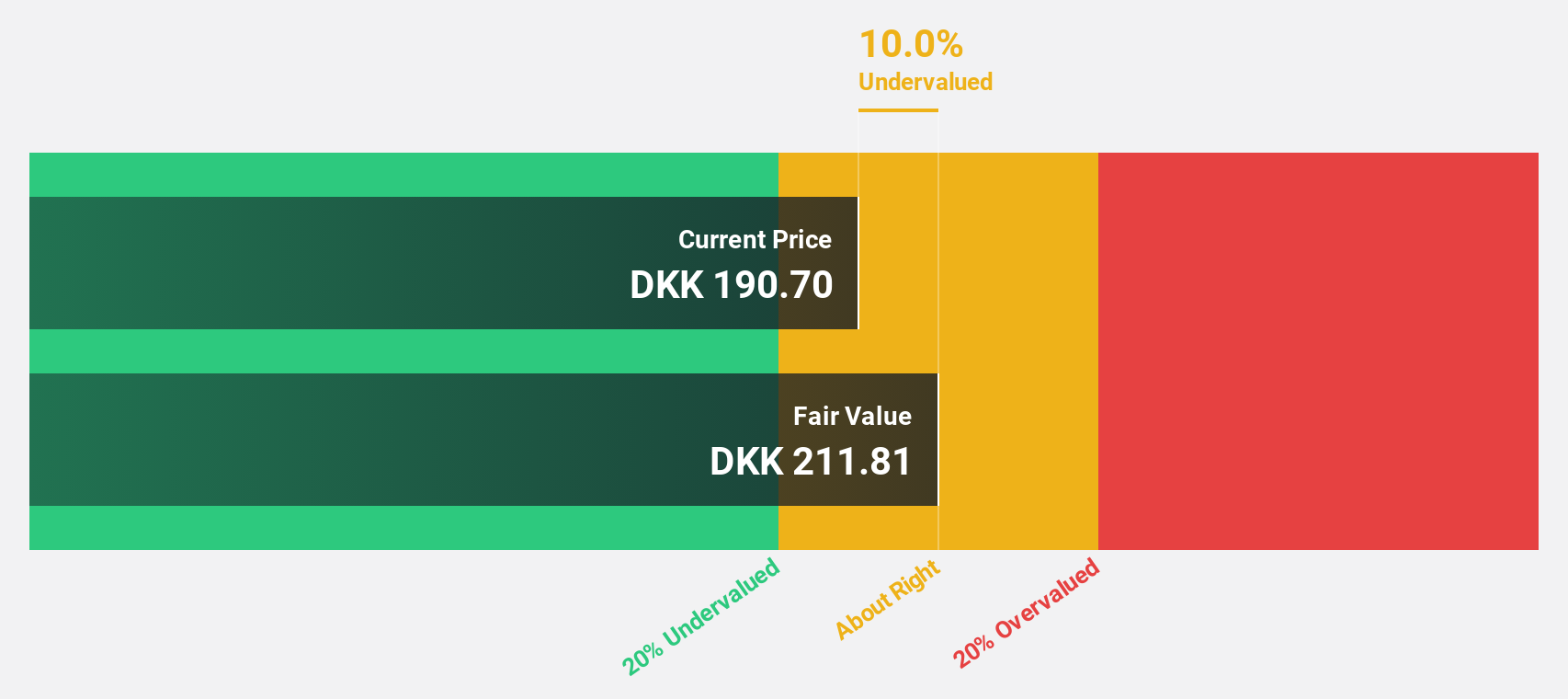

ALK-Abelló (CPSE:ALK B)

Overview: ALK-Abelló A/S is an allergy solutions company operating in Europe, North America, and internationally, with a market cap of DKK34.95 billion.

Operations: The company's revenue is primarily derived from its allergy treatment segment, which generated DKK5.38 billion.

Estimated Discount To Fair Value: 14.7%

ALK-Abelló's recent earnings report shows strong financial performance, with Q3 sales rising to DKK 1.31 billion and net income increasing to DKK 212 million. The company is trading at a price below its estimated fair value of DKK 185.23, suggesting it may be undervalued based on cash flows. Additionally, ALK-Abelló's strategic initiatives and product innovations in allergy testing devices could support further revenue growth exceeding the Danish market average over the next few years.

- The analysis detailed in our ALK-Abelló growth report hints at robust future financial performance.

- Click here to discover the nuances of ALK-Abelló with our detailed financial health report.

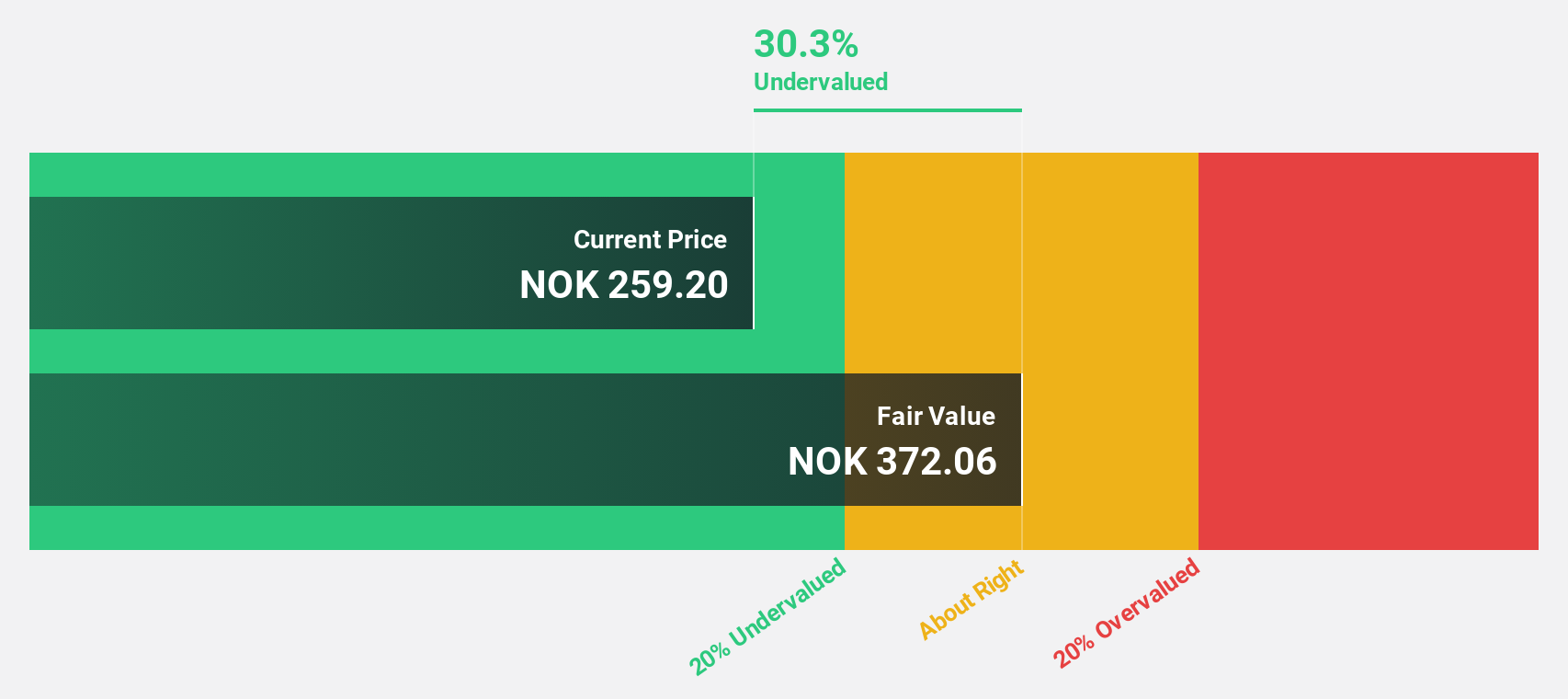

Gjensidige Forsikring (OB:GJF)

Overview: Gjensidige Forsikring ASA provides general insurance and pension products across Norway, Sweden, Denmark, Latvia, Lithuania, and Estonia with a market capitalization of NOK98.14 billion.

Operations: The company's revenue segments include Pension (NOK1.10 billion), General Insurance Sweden (NOK1.97 billion), General Insurance Private (NOK14.80 billion), and General Insurance Commercial (NOK20.44 billion).

Estimated Discount To Fair Value: 41.4%

Gjensidige Forsikring's current trading price of NOK 196.3 is significantly below its estimated fair value of NOK 334.74, highlighting potential undervaluation based on cash flows. Although the dividend yield of 4.46% isn't fully covered by free cash flows, earnings are projected to grow at a robust rate of 13.3% annually, outpacing the Norwegian market average. Recent earnings reports show improved net income and EPS figures, reinforcing positive financial momentum despite slower revenue growth forecasts.

- Our comprehensive growth report raises the possibility that Gjensidige Forsikring is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Gjensidige Forsikring.

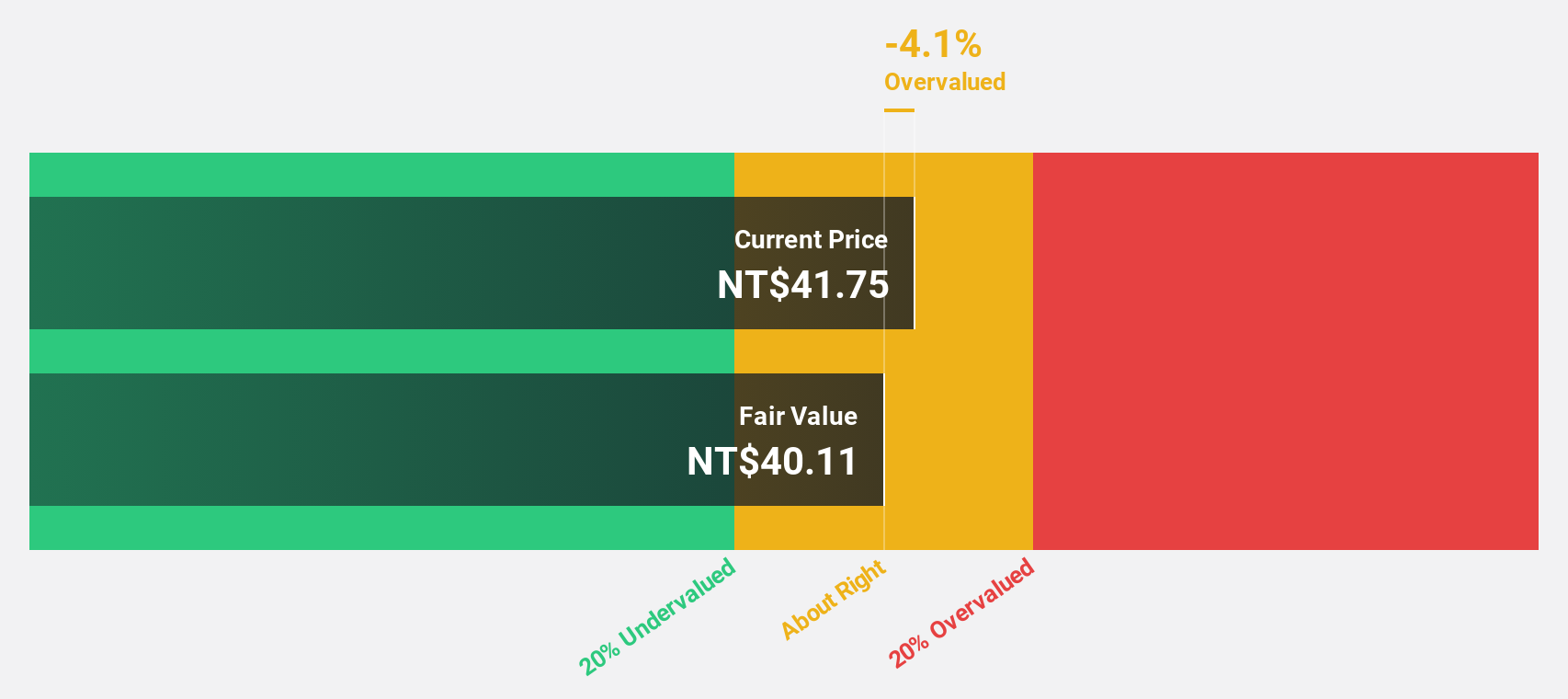

Highwealth Construction (TWSE:2542)

Overview: Highwealth Construction Corp. operates in Taiwan, focusing on the development, construction, leasing, and sale of residential and commercial buildings, with a market cap of NT$88.12 billion.

Operations: The company's revenue is primarily derived from its activities in the development, construction, leasing, and sale of residential and commercial properties in Taiwan.

Estimated Discount To Fair Value: 15.3%

Highwealth Construction's current trading price of NT$43.3 is below its estimated fair value of NT$51.13, suggesting undervaluation based on cash flows. Despite a decline in sales, net income has risen significantly year-over-year, with earnings per share doubling. Forecasts indicate substantial annual profit growth of 131.9%, outpacing the Taiwanese market average, although operating cash flow does not adequately cover debt obligations, which may pose financial challenges moving forward.

- According our earnings growth report, there's an indication that Highwealth Construction might be ready to expand.

- Navigate through the intricacies of Highwealth Construction with our comprehensive financial health report here.

Taking Advantage

- Investigate our full lineup of 935 Undervalued Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Highwealth Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2542

Highwealth Construction

Engages in the development, construction, leasing, and sale of residential and commercial buildings in Taiwan.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives