- Germany

- /

- Capital Markets

- /

- XTRA:MLP

Uncovering 3 Undiscovered European Gems with Promising Potential

Reviewed by Simply Wall St

The European market has recently seen mixed returns across major indices, with the pan-European STOXX Europe 600 Index remaining relatively flat and individual country indices showing varied performance. As inflation in the eurozone reaches the ECB's target and labor markets remain steady, investors are increasingly on the lookout for opportunities that can thrive in these stable yet cautious economic conditions. In this environment, identifying stocks with strong fundamentals and potential for growth is crucial for those seeking to uncover hidden gems within Europe's diverse market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Medistim (OB:MEDI)

Simply Wall St Value Rating: ★★★★★★

Overview: Medistim ASA is a company that develops, produces, services, leases, and distributes medical devices for cardiac and vascular surgery across the United States, Asia, Europe, and internationally with a market cap of NOK4.04 billion.

Operations: Medistim generates revenue primarily through the sale of its own products, accounting for NOK511.31 million, and third-party product sales contributing NOK99.05 million.

Medistim, a nimble player in the medical device sector, has been making waves with its debt-free status and robust earnings growth of 19.8% over the past year, outpacing the industry average of 12.5%. Recent financials highlight a net income jump to NOK 43 million from NOK 24 million year-on-year, while sales climbed to NOK 181.55 million from NOK 133.79 million. Despite potential margin pressures from R&D investments and market expansions in China and Canada, Medistim's solid cash flow and high-quality earnings provide a sturdy foundation for navigating these challenges and pursuing future growth opportunities.

Dynavox Group (OM:DYVOX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dynavox Group AB (publ) focuses on developing and selling assistive technology products for individuals with impaired communication skills, with a market cap of SEK12.27 billion.

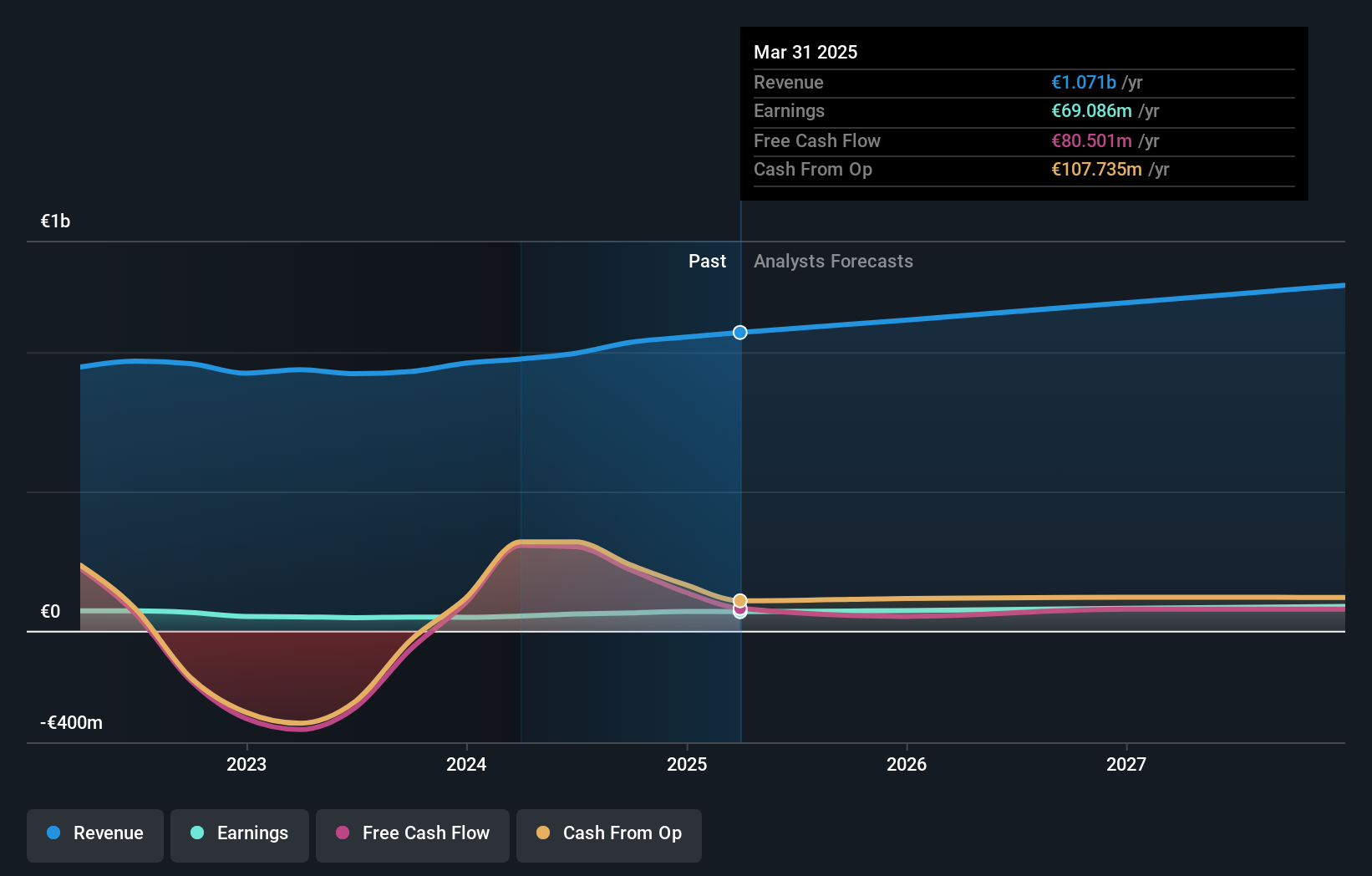

Operations: Dynavox Group generates revenue primarily from its computer hardware segment, totaling SEK2.13 billion.

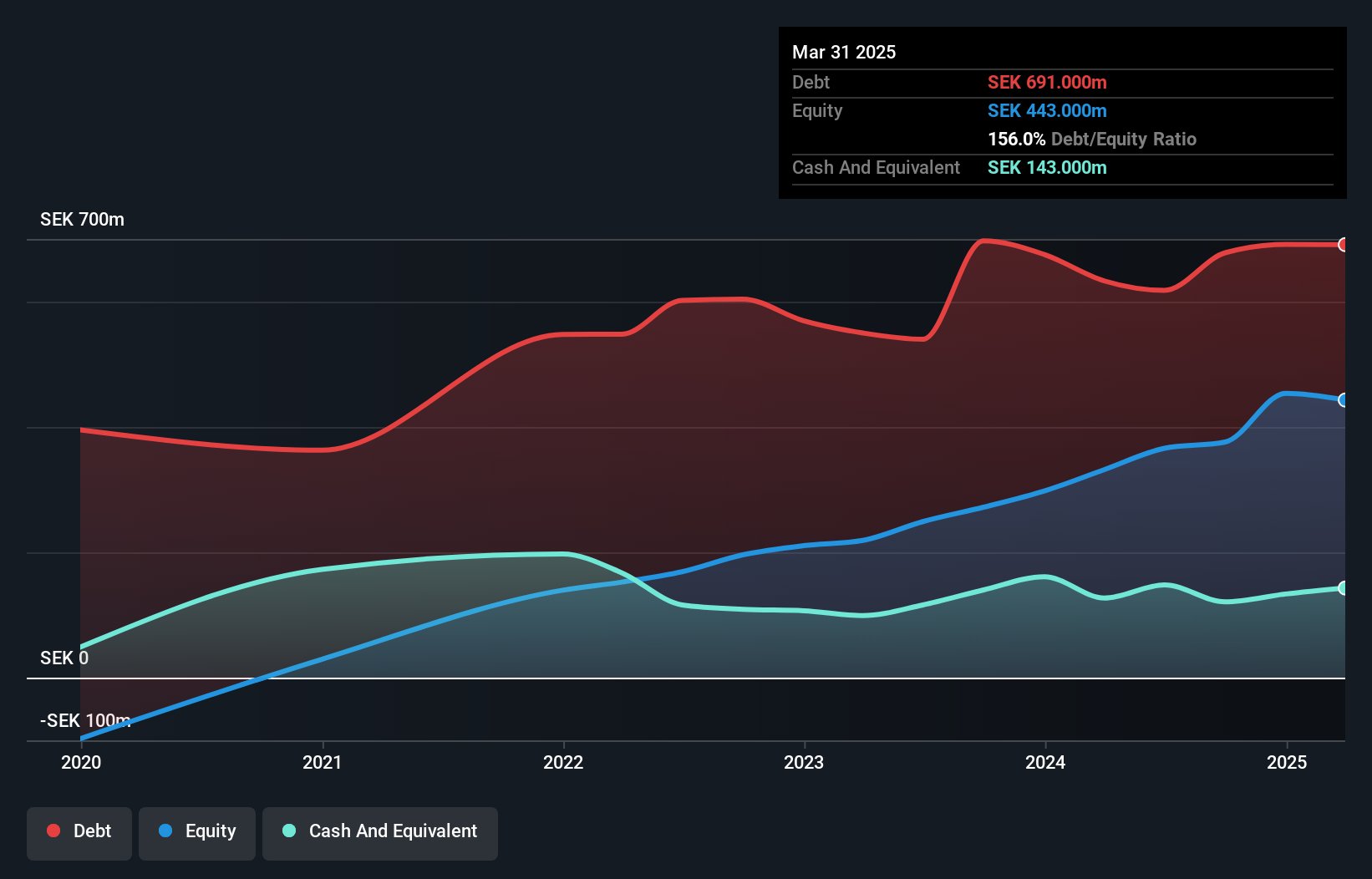

Dynavox Group is making waves with strategic acquisitions, including its recent purchase of Cenomy in France, aiming to bolster its market presence and revenue streams. The company plans to add 150 new sales and marketing staff, which could drive future growth despite rising operational costs. With a net debt to equity ratio of 123.7%, financial leverage remains high, yet earnings grew by an impressive 46.9% last year—outpacing the tech industry average of 26.2%. Trading at SEK 85 per share, Dynavox's valuation aligns closely with analyst targets; however, significant insider selling suggests caution for potential investors.

MLP (XTRA:MLP)

Simply Wall St Value Rating: ★★★★★★

Overview: MLP SE, with a market cap of approximately €935.13 million, operates in Germany offering financial services to private, corporate, and institutional clients through its various subsidiaries.

Operations: MLP SE's primary revenue streams include Financial Consulting (€450.39 million), FERI (€265.89 million), and Banking (€226.45 million). The company also generates income from DOMCURA (€133.72 million) and Deutschland.Immobilien (€49.61 million).

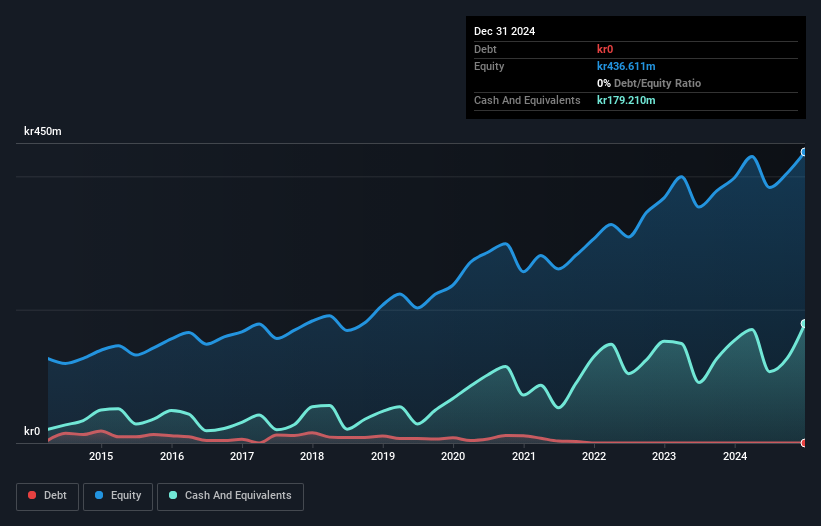

MLP, a nimble player in the European market, has been leveraging digitalization and AI to boost efficiency and client service. The company is trading at 28.5% below its estimated fair value and boasts a debt-free balance sheet, which provides flexibility for growth initiatives. Over the past year, MLP's earnings surged by 30.8%, outpacing the industry average of 19.4%. However, challenges like high acquisition costs and restructuring expenses could impact organic growth potential. Despite these hurdles, analysts have set a price target of €11.25 per share with expectations for profit margins to rise from 6.6% to 7.1%.

Where To Now?

- Delve into our full catalog of 325 European Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MLP

MLP

Provides financial services to private, corporate, and institutional clients in Germany.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026