- Norway

- /

- Healthtech

- /

- OB:CONTX

ContextVision (OB:CONTX) Shareholders Have Enjoyed A Whopping 664% Share Price Gain

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. For example, the ContextVision AB (publ) (OB:CONTX) share price is up a whopping 664% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. In contrast, the stock has fallen 9.9% in the last 30 days.

It really delights us to see such great share price performance for investors.

See our latest analysis for ContextVision

While ContextVision made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years ContextVision saw its revenue grow at 7.3% per year. That's a pretty good long term growth rate. Arguably it's more than reflected in the very strong share price gain of 50% a year over a half a decade. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

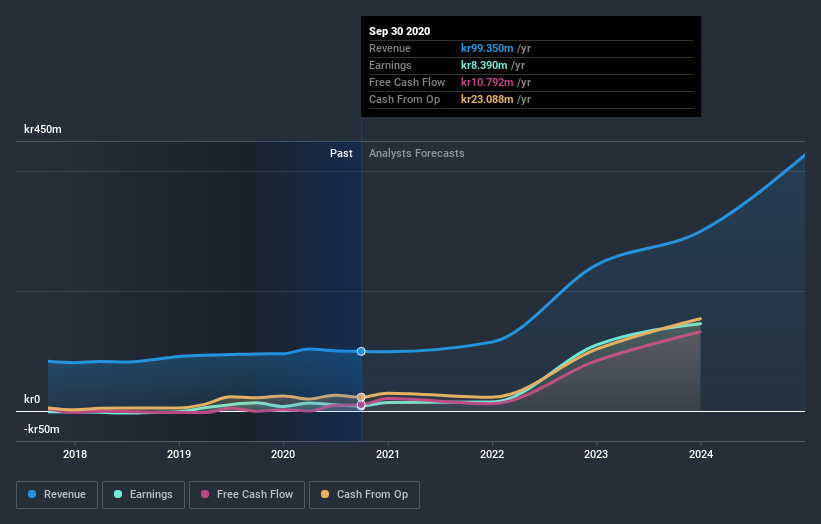

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for ContextVision in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that ContextVision has rewarded shareholders with a total shareholder return of 106% in the last twelve months. That's better than the annualised return of 50% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for ContextVision you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

If you’re looking to trade ContextVision, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:CONTX

ContextVision

A medical technology software company, provides image analysis and imaging for medical systems in Asia, Europe, and America.

Flawless balance sheet and good value.

Market Insights

Community Narratives