SalMar (OB:SALM) Valuation in Focus After Q3 Results and Harvest Update

Reviewed by Kshitija Bhandaru

SalMar (OB:SALM) has released its third quarter operating results, revealing a harvest volume of 93,200 tonnes. These figures are closely watched by investors because such updates often sway sentiment in the seafood sector.

See our latest analysis for SalMar.

Following SalMar’s latest harvest update, the share price has surged lately with a 38.5% return over the past 90 days. While year-to-date gains are more modest, the one-year total shareholder return of 4.3% suggests recent momentum is now building after a fairly muted stretch.

If SalMar’s recent move has inspired you to look beyond seafood, now is a great moment to expand your perspective and discover fast growing stocks with high insider ownership

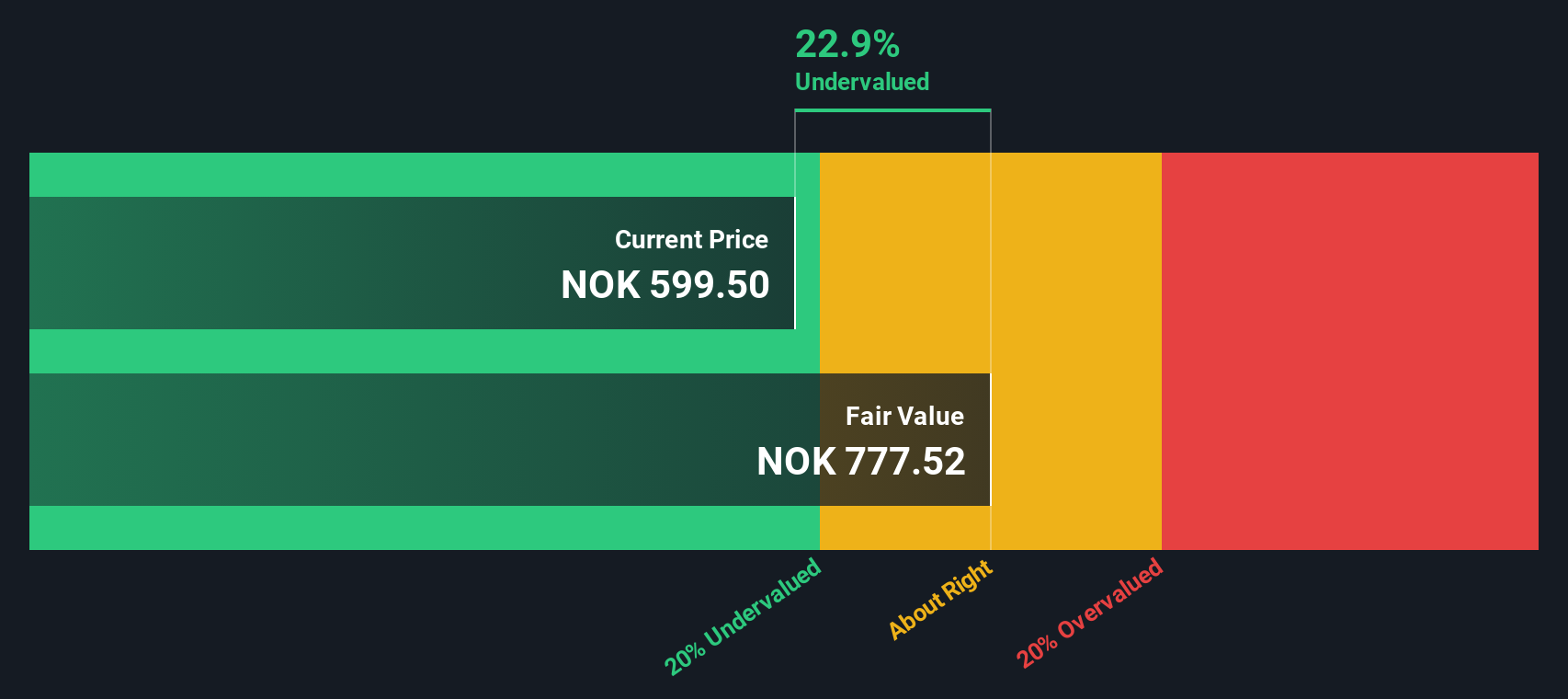

With the stock rallying on recent results, the key question is whether SalMar shares still offer value at current levels, or if the market is already factoring in the company’s growth prospects. Is there still a buying opportunity?

Most Popular Narrative: 3.1% Overvalued

The most popular narrative values SalMar slightly above its last close, hinting at limited upside from current levels. This perspective weighs recent operational progress against what is already priced in by the market.

Ongoing investments in growth projects are seen as catalysts for long-term value creation. These factors support upward revisions in price targets.

Curious what bold moves could drive lasting value in a tough market? The undercurrent here is ambitious future growth and powerful operating leverage baked into the consensus. Some of the most aggressive financial forecasts on the street may be hidden in the details. Can you guess which assumptions fuel that narrative?

Result: Fair Value of $552.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing biological challenges or unpredictable market fluctuations could still disrupt SalMar's trajectory and affect sentiment among investors.

Find out about the key risks to this SalMar narrative.

Another View: DCF Points to Undervaluation

While the consensus view sees SalMar as a bit overvalued based on market assumptions, our DCF model tells a different story. The SWS DCF model estimates SalMar's fair value at NOK788.34, which is well above the current share price. Does this approach capture overlooked long-term value, or is the market pricing in unspoken risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SalMar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SalMar Narrative

If you have a different perspective or see something in the numbers others might have missed, you can easily craft your own view in just a few minutes. Do it your way

A great starting point for your SalMar research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize opportunities where others hesitate. Supercharge your research by finding stocks with untapped growth, future-focused technology, or reliable rewards using the Simply Wall St Screener.

- Tap into the potential of tomorrow's artificial intelligence leaders by scouting these 24 AI penny stocks showing strong momentum and innovation right now.

- Maximize income with reliable cash flow by evaluating these 19 dividend stocks with yields > 3% offering above-average yields and a history of solid payouts.

- Position yourself for the next undervalued gem in the market by reviewing these 898 undervalued stocks based on cash flows and see which stocks the numbers say are priced to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALM

SalMar

An aquaculture company, produces and sells farmed salmon in Asia, North America, Europe, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives