Is Nordic Aqua Partners (OB:NOAP) In A Good Position To Invest In Growth?

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So should Nordic Aqua Partners (OB:NOAP) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

See our latest analysis for Nordic Aqua Partners

SWOT Analysis for Nordic Aqua Partners

- Currently debt free.

- Shareholders have been diluted in the past year.

- Forecast to reduce losses next year.

- Trading below our estimate of fair value by more than 20%.

- Significant insider buying over the past 3 months.

- Has less than 3 years of cash runway based on current free cash flow.

How Long Is Nordic Aqua Partners' Cash Runway?

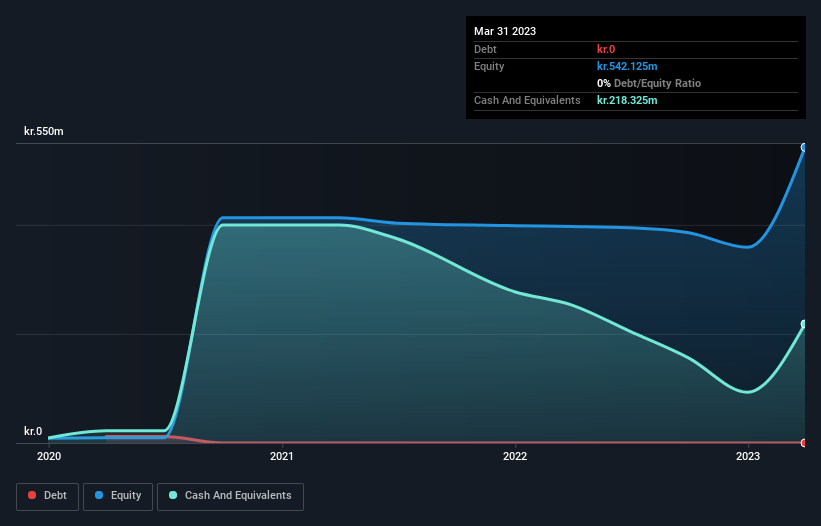

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. In March 2023, Nordic Aqua Partners had kr.218m in cash, and was debt-free. In the last year, its cash burn was kr.224m. So it had a cash runway of approximately 12 months from March 2023. Notably, one analyst forecasts that Nordic Aqua Partners will break even (at a free cash flow level) in about 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. Depicted below, you can see how its cash holdings have changed over time.

How Is Nordic Aqua Partners' Cash Burn Changing Over Time?

Although Nordic Aqua Partners reported revenue of kr.372k last year, it didn't actually have any revenue from operations. That means we consider it a pre-revenue business, and we will focus our growth analysis on cash burn, for now. Over the last year its cash burn actually increased by a very significant 60%. While this spending increase is no doubt intended to drive growth, if the trend continues the company's cash runway will shrink very quickly. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Hard Would It Be For Nordic Aqua Partners To Raise More Cash For Growth?

Since its cash burn is moving in the wrong direction, Nordic Aqua Partners shareholders may wish to think ahead to when the company may need to raise more cash. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of kr.700m, Nordic Aqua Partners' kr.224m in cash burn equates to about 32% of its market value. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

How Risky Is Nordic Aqua Partners' Cash Burn Situation?

Nordic Aqua Partners is not in a great position when it comes to its cash burn situation. Although we can understand if some shareholders find its cash runway acceptable, we can't ignore the fact that we consider its increasing cash burn to be downright troublesome. One real positive is that at least one analyst is forecasting that the company will reach breakeven. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Taking a deeper dive, we've spotted 3 warning signs for Nordic Aqua Partners you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course Nordic Aqua Partners may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Nordic Aqua Partners, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nordic Aqua Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NOAP

Nordic Aqua Partners

Primarily engages in the land-based Atlantic salmon farming in the People’s Republic of China.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives