Amid ongoing concerns about U.S. trade tariffs and uncertain monetary policies, the European market has faced some challenges, with the pan-European STOXX Europe 600 Index ending slightly lower. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Elicera Therapeutics (OM:ELIC) | 27.8% | 97.2% |

| Vow (OB:VOW) | 13.1% | 120.9% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| CD Projekt (WSE:CDR) | 29.7% | 41.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 114.3% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Ferrari (BIT:RACE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ferrari N.V. designs, engineers, produces, and sells luxury performance sports cars globally and has a market cap of approximately €73.46 billion.

Operations: The company's revenue primarily comes from its luxury performance sports car segment, generating approximately €6.68 billion.

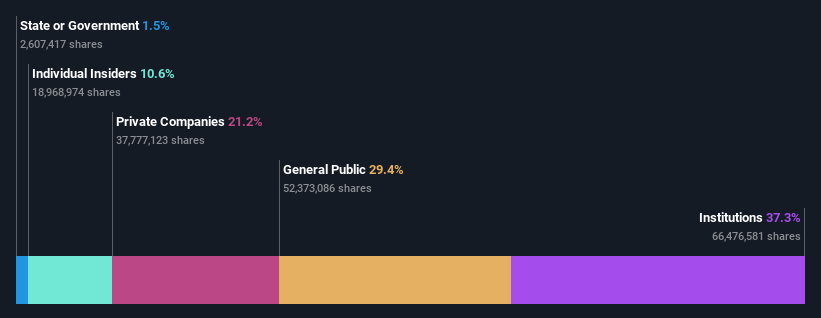

Insider Ownership: 10.6%

Ferrari's earnings are forecast to grow at 9.1% annually, outpacing the Italian market. The company recently completed a $3.15 billion equity offering and has high insider ownership, signaling confidence in its growth prospects despite substantial debt levels. Ferrari's revenue is expected to increase by 7.9% per year, faster than the local market average, supported by strong recent earnings performance and strategic partnerships like the Hot Wheels collaboration with Mattel for expanded product lines.

- Dive into the specifics of Ferrari here with our thorough growth forecast report.

- According our valuation report, there's an indication that Ferrari's share price might be on the expensive side.

Mowi (OB:MOWI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally, with a market cap of NOK104.20 billion.

Operations: Mowi ASA's revenue is primarily derived from its Farming segment at €3.51 billion, Sales & Marketing - Markets at €4.00 billion, Sales and Marketing - Consumer Products at €3.70 billion, and Feed at €1.12 billion.

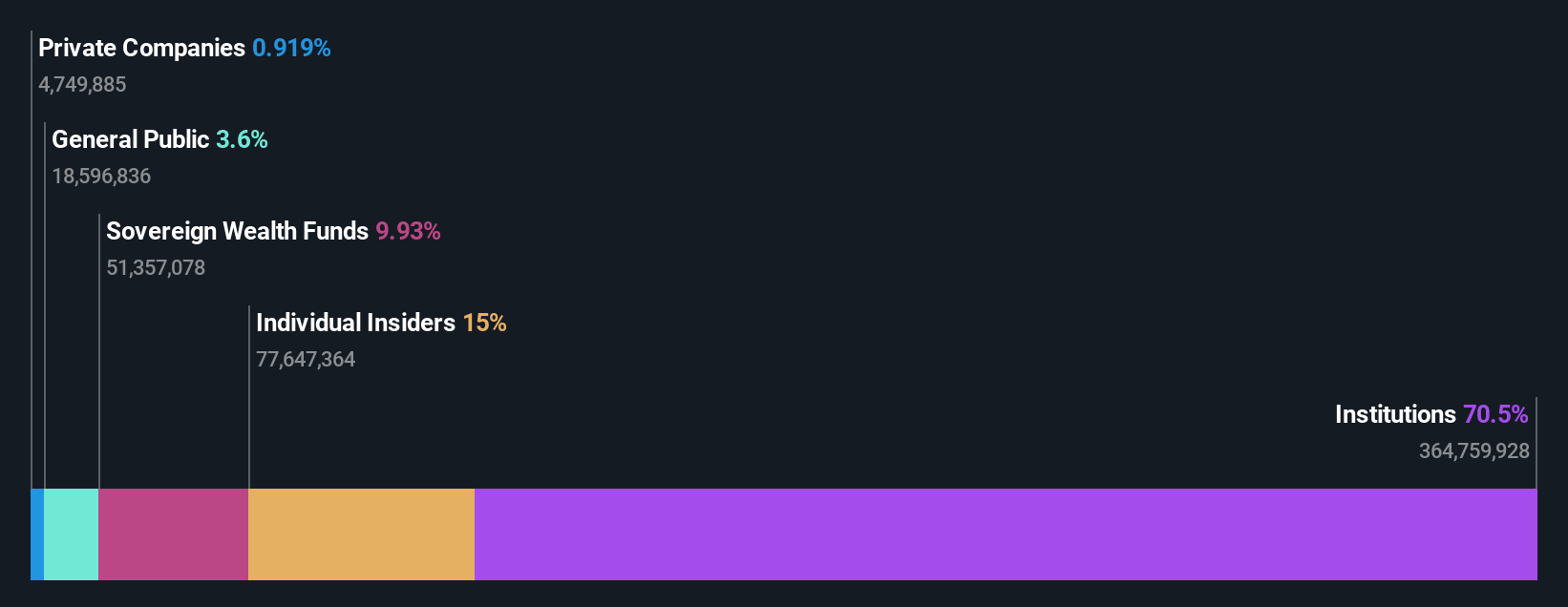

Insider Ownership: 15.4%

Mowi's earnings are forecast to grow significantly at 22.9% annually, surpassing the Norwegian market average. The company is trading below its estimated fair value and has seen more insider buying than selling recently, indicating confidence despite high debt levels. Mowi's strategic review of its Feed division and increased ownership in Nova Sea highlight efforts to streamline operations amid robust financial performance, with recent full-year sales reaching €5.60 billion and net income of €468.5 million.

- Click here to discover the nuances of Mowi with our detailed analytical future growth report.

- Our expertly prepared valuation report Mowi implies its share price may be lower than expected.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: EQT AB (publ) is a global private equity and venture capital firm focusing on private capital and real asset segments, with a market cap of approximately SEK368.69 billion.

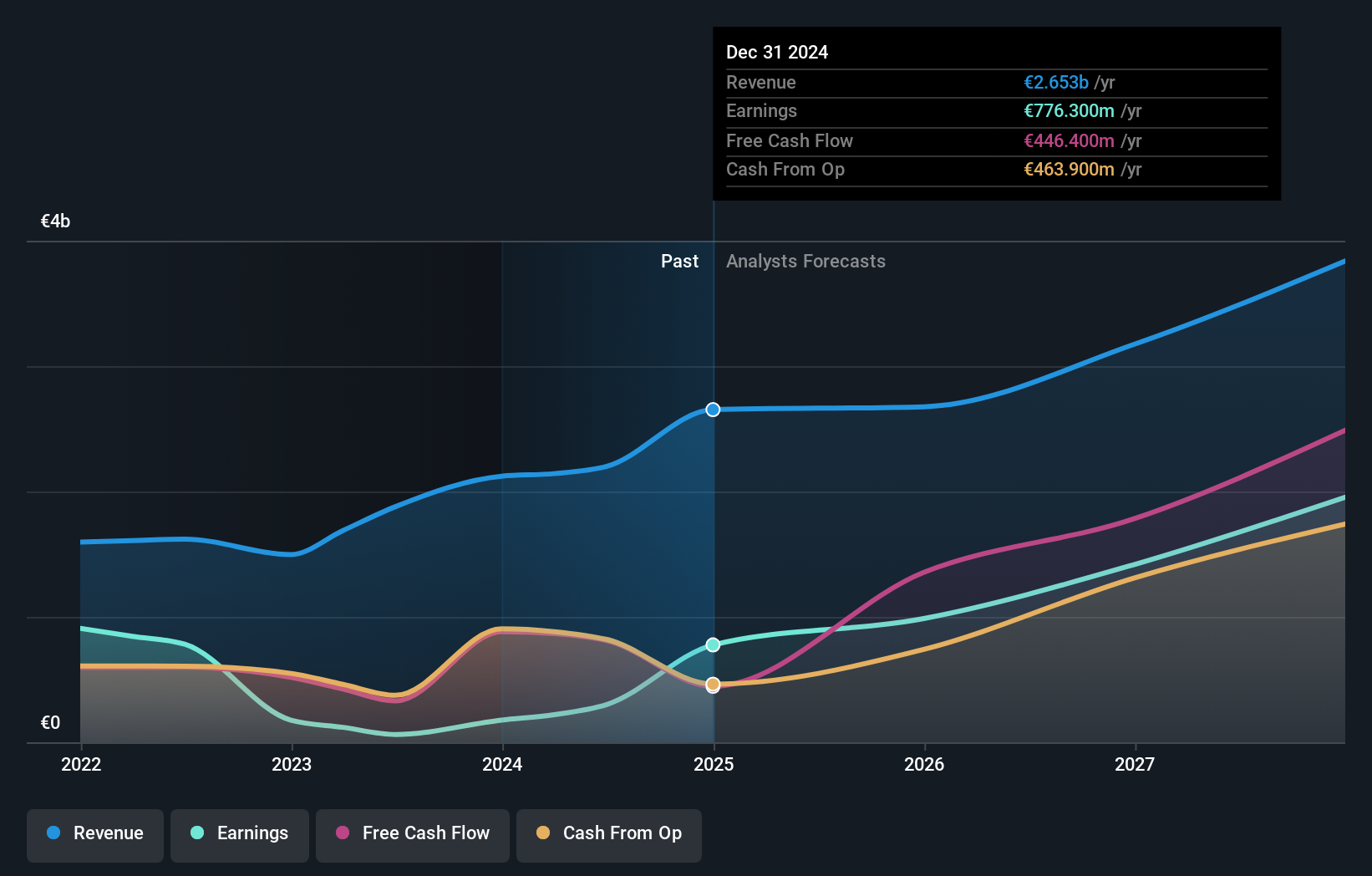

Operations: The company generates revenue from its Central segment (€41.50 million), Real Assets (€951.90 million), and Private Capital (€1.36 billion).

Insider Ownership: 12.3%

EQT is poised for growth with its earnings forecast to rise by 27.8% annually, outpacing the Swedish market. Despite recent insider selling, EQT's substantial investments and strategic initiatives signal confidence in its future trajectory. The company's revenue is expected to grow at 12.6% per year, and it trades below estimated fair value. Recent leadership changes position EQT for continued success as it embarks on a €100 billion fundraising cycle and explores new investment strategies, enhancing its competitive edge in private equity markets.

- Click here and access our complete growth analysis report to understand the dynamics of EQT.

- Our comprehensive valuation report raises the possibility that EQT is priced lower than what may be justified by its financials.

Key Takeaways

- Gain an insight into the universe of 229 Fast Growing European Companies With High Insider Ownership by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives