- Canada

- /

- Metals and Mining

- /

- TSX:BTO

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets grapple with tariff uncertainties and mixed economic signals, investors are keenly observing how these factors influence stock valuations. With the S&P 500 Index experiencing slight declines amidst earnings surprises and manufacturing gains, identifying stocks that may be trading below their estimated value becomes particularly compelling. In such a market environment, a good stock is one that demonstrates resilience and potential for growth despite broader economic challenges, making it an attractive consideration for those seeking opportunities in undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIP (TSE:2379) | ¥2275.00 | ¥4529.30 | 49.8% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | US$29.57 | US$58.94 | 49.8% |

| Biotage (OM:BIOT) | SEK138.70 | SEK273.61 | 49.3% |

| People & Technology (KOSDAQ:A137400) | ₩41400.00 | ₩81928.41 | 49.5% |

| Solum (KOSE:A248070) | ₩17570.00 | ₩34836.48 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.19 | CN¥29.99 | 49.3% |

| Canatu Oyj (HLSE:CANATU) | €12.50 | €24.79 | 49.6% |

| RENK Group (DB:R3NK) | €24.94 | €49.37 | 49.5% |

| Marcus & Millichap (NYSE:MMI) | US$37.27 | US$73.76 | 49.5% |

| Kyndryl Holdings (NYSE:KD) | US$41.54 | US$82.14 | 49.4% |

Let's uncover some gems from our specialized screener.

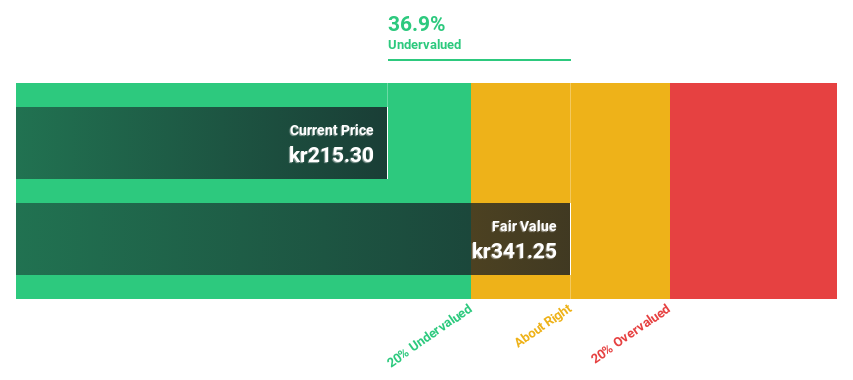

Mowi (OB:MOWI)

Overview: Mowi ASA is a seafood company that farms, produces, and supplies Atlantic salmon products globally with a market capitalization of NOK113.51 billion.

Operations: The company's revenue segments include Farming (€4.12 billion), Sales and Marketing (€7.25 billion), Consumer Products (€1.98 billion), and Feed (€1.17 billion).

Estimated Discount To Fair Value: 36.2%

Mowi is trading at NOK219.5, significantly below its estimated fair value of NOK344.25, indicating potential undervaluation based on cash flows. Despite a high debt level, earnings are projected to grow 22.86% annually over the next three years, outpacing the Norwegian market's growth rate and supporting its valuation appeal. Recent earnings show improved net income and sales year-over-year, while the company increased its stake in Nova Sea to 95%, potentially enhancing future revenue streams.

- Insights from our recent growth report point to a promising forecast for Mowi's business outlook.

- Click to explore a detailed breakdown of our findings in Mowi's balance sheet health report.

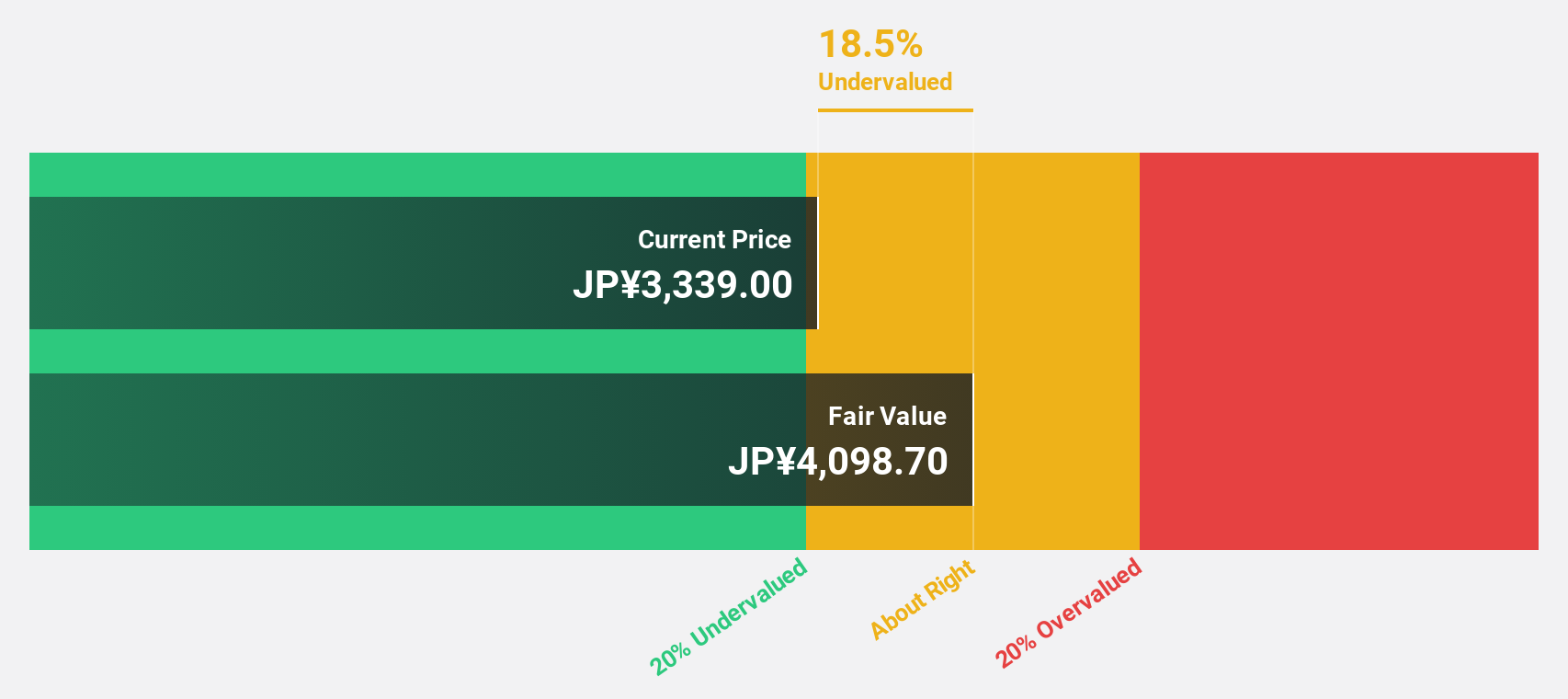

Kokusai Electric (TSE:6525)

Overview: Kokusai Electric Corporation develops, manufactures, sells, repairs, and maintains semiconductor manufacturing equipment globally with a market cap of ¥6.34 billion.

Operations: The company generates revenue of ¥223.84 million from its Semiconductor Manufacturing Equipment Business segment.

Estimated Discount To Fair Value: 43.4%

Kokusai Electric's stock, trading at ¥2735, is significantly below its estimated fair value of ¥4831.31, highlighting potential undervaluation based on cash flows. The company's earnings grew by 26.5% last year and are projected to increase by 16.6% annually, surpassing the Japanese market's growth rate. Despite recent share price volatility and slower revenue growth forecasts compared to high-growth benchmarks, Kokusai Electric remains financially appealing with robust profit expectations and strong return on equity forecasts.

- Our growth report here indicates Kokusai Electric may be poised for an improving outlook.

- Navigate through the intricacies of Kokusai Electric with our comprehensive financial health report here.

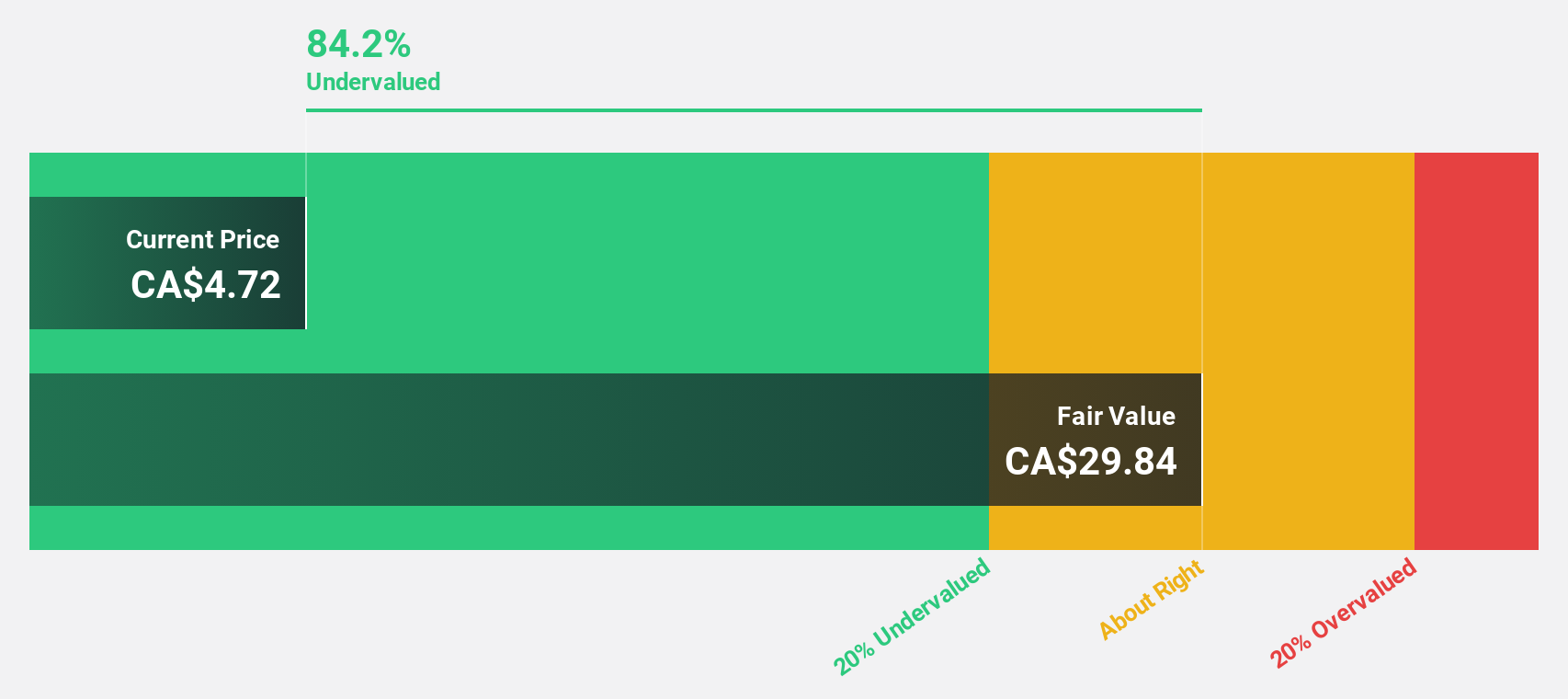

B2Gold (TSX:BTO)

Overview: B2Gold Corp. is a gold producer company with a market capitalization of approximately CA$4.82 billion.

Operations: The company's revenue segments include $977.41 million from the Fekola Mine, $435.23 million from the Masbate Mine, and $501.58 million from the Otjikoto Mine.

Estimated Discount To Fair Value: 40.3%

B2Gold, trading at CA$3.67, is significantly undervalued compared to its estimated fair value of CA$6.15, presenting a strong case for potential value based on cash flows. The company anticipates revenue growth of 15.6% annually, outpacing the Canadian market average. Despite a recent dividend cut to CA$0.02 per share due to strategic investments in growth projects like the Goose Mine and Antelope deposit, B2Gold maintains robust production forecasts and financial flexibility with substantial cash flow support from its operations.

- The analysis detailed in our B2Gold growth report hints at robust future financial performance.

- Click here to discover the nuances of B2Gold with our detailed financial health report.

Summing It All Up

- Get an in-depth perspective on all 906 Undervalued Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if B2Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTO

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives