Why Investors Shouldn't Be Surprised By Lerøy Seafood Group ASA's (OB:LSG) Low P/S

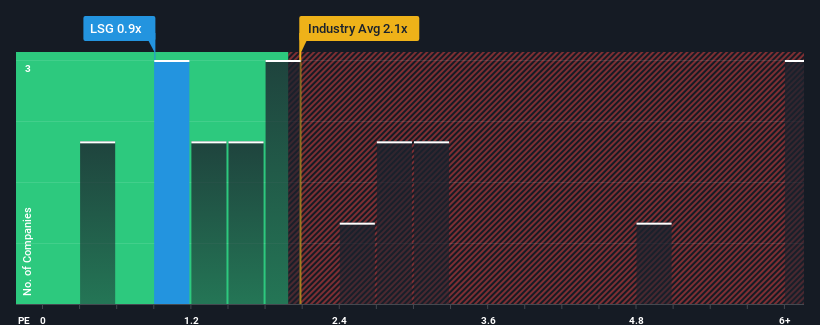

Lerøy Seafood Group ASA's (OB:LSG) price-to-sales (or "P/S") ratio of 0.9x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Food industry in Norway have P/S ratios greater than 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Lerøy Seafood Group

What Does Lerøy Seafood Group's Recent Performance Look Like?

Recent revenue growth for Lerøy Seafood Group has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. Those who are bullish on Lerøy Seafood Group will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Lerøy Seafood Group.Is There Any Revenue Growth Forecasted For Lerøy Seafood Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lerøy Seafood Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's top line. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.4% per year over the next three years. That's shaping up to be materially lower than the 14% per year growth forecast for the broader industry.

In light of this, it's understandable that Lerøy Seafood Group's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Lerøy Seafood Group's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lerøy Seafood Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 2 warning signs for Lerøy Seafood Group that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:LSG

Lerøy Seafood Group

Produces, processes, markets, sells, and distributes seafood products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives