The Market Doesn't Like What It Sees From Lerøy Seafood Group ASA's (OB:LSG) Revenues Yet

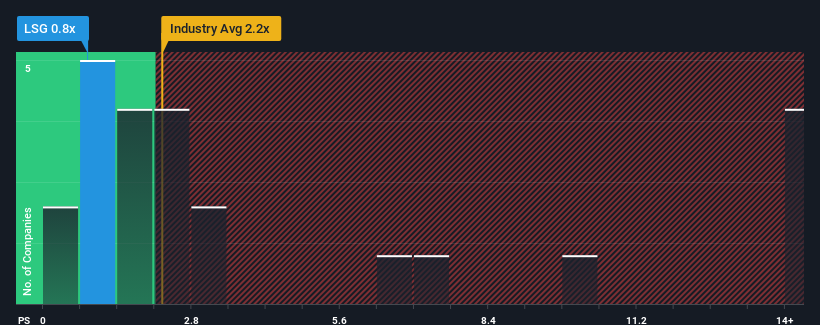

With a price-to-sales (or "P/S") ratio of 0.8x Lerøy Seafood Group ASA (OB:LSG) may be sending bullish signals at the moment, given that almost half of all the Food companies in Norway have P/S ratios greater than 2.2x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Lerøy Seafood Group

How Lerøy Seafood Group Has Been Performing

With revenue growth that's inferior to most other companies of late, Lerøy Seafood Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Lerøy Seafood Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Lerøy Seafood Group's to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's revenues. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.1% per annum during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 150% each year, which is noticeably more attractive.

With this information, we can see why Lerøy Seafood Group is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Lerøy Seafood Group's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Lerøy Seafood Group maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Lerøy Seafood Group that you should be aware of.

If these risks are making you reconsider your opinion on Lerøy Seafood Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:LSG

Lerøy Seafood Group

Produces, processes, markets, sells, and distributes seafood products.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives