What P/F Bakkafrost (OB:BAKKA)'s Q3 Harvest Volumes Reveal About Its Operational Recovery in Scotland

Reviewed by Sasha Jovanovic

- P/F Bakkafrost recently announced its third quarter 2025 production results, reporting harvest volumes of 25,400 tons in the Faroe Islands and 5,300 tons in Scotland.

- This update provides fresh insight into the operational health of the company's core regions, with particular attention on performance in Scotland following previously reported challenges.

- We'll explore how these latest harvest volumes may influence Bakkafrost's investment narrative, especially regarding expectations for operational recovery in Scotland.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

P/F Bakkafrost Investment Narrative Recap

To be a shareholder in P/F Bakkafrost, you have to believe that the company's investments in larger smolt, operational efficiencies, and stronger branding will ultimately drive a reliable recovery in earnings and margins, especially if Scotland rebounds from recent setbacks. The latest Q3 production figures show a steady harvest in the Faroe Islands and ongoing challenges in Scotland, but the numbers alone do not yet signal a decisive turning point on either the company’s primary recovery catalyst or its core risks.

Among the company’s recent announcements, its August revision raising 2026 production guidance is especially relevant. This increase suggests confidence in future output growth, but with Q3 Scottish harvest still subdued, questions remain over how quickly operations there can regain momentum and underpin these higher targets.

Yet even as optimism builds around a volume recovery, investors should be aware that…

Read the full narrative on P/F Bakkafrost (it's free!)

P/F Bakkafrost's outlook forecasts DKK10.7 billion in revenue and DKK2.1 billion in earnings by 2028. Achieving this requires 17.9% annual revenue growth and an increase in earnings of approximately DKK1.87 billion from the current level of DKK228.2 million.

Uncover how P/F Bakkafrost's forecasts yield a NOK479.58 fair value, in line with its current price.

Exploring Other Perspectives

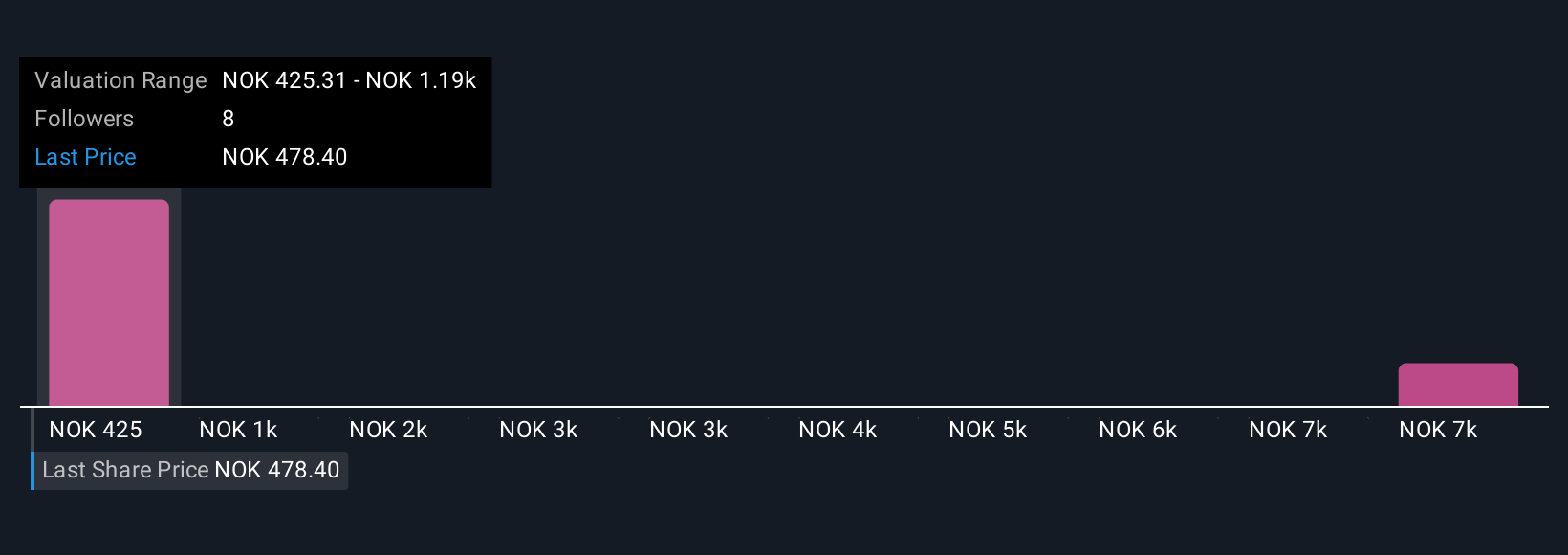

Seven distinct fair value estimates from the Simply Wall St Community put Bakkafrost’s worth anywhere between DKK 425.31 and DKK 7,980.93 per share. Given ongoing operational risk in Scotland and tight balance sheet conditions, investor opinions vary sharply, consider reviewing these different perspectives to broaden your view.

Explore 7 other fair value estimates on P/F Bakkafrost - why the stock might be worth 11% less than the current price!

Build Your Own P/F Bakkafrost Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your P/F Bakkafrost research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free P/F Bakkafrost research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate P/F Bakkafrost's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives