Assessing Bakkafrost (OB:BAKKA) Valuation After Latest Harvest Volumes and Share Price Rebound

Reviewed by Kshitija Bhandaru

P/F Bakkafrost (OB:BAKKA) has announced its third-quarter production figures, revealing harvest volumes of 25,400 tons in the Faroe Islands and 5,300 tons in Scotland. These results are likely on investors’ minds this week.

See our latest analysis for P/F Bakkafrost.

The recent disclosure of strong harvest volumes, particularly from the Faroe Islands, seems to have provided a brief lift in sentiment. However, investor caution is lingering. After a sharp drop earlier in the year, P/F Bakkafrost’s share price has rebounded 18% over the past 90 days, though the one-year total shareholder return remains down 27%.

If today’s update has you reassessing your strategy, now might be an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with the stock rebounding off its lows and still down for the year, investors must weigh whether Bakkafrost is trading below its intrinsic value or if the market is already anticipating stronger growth ahead.

Most Popular Narrative: 2.6% Undervalued

With the narrative estimating fair value at NOK 479.58 versus the last close of NOK 467.20, attention is shifting to the growth forecasts anchoring this mild undervaluation.

The company's investments to produce larger and more robust smolt in both the Faroe Islands and Scotland, along with state-of-the-art wellboat and processing capabilities, are driving operational efficiencies and reduced biological risk, setting up for improved margins and more stable future earnings.

Want to see what’s fueling this narrative’s math? The valuation is built on projections of new efficiency, impressive margin expansion, and a future earnings leap. Find out what assumptions lie underneath this forecast and how they stack up against sector norms. The full story could surprise you.

Result: Fair Value of $479.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational challenges in Scotland and ongoing fluctuations in global salmon prices could still threaten Bakkafrost’s recovery story in the months ahead.

Find out about the key risks to this P/F Bakkafrost narrative.

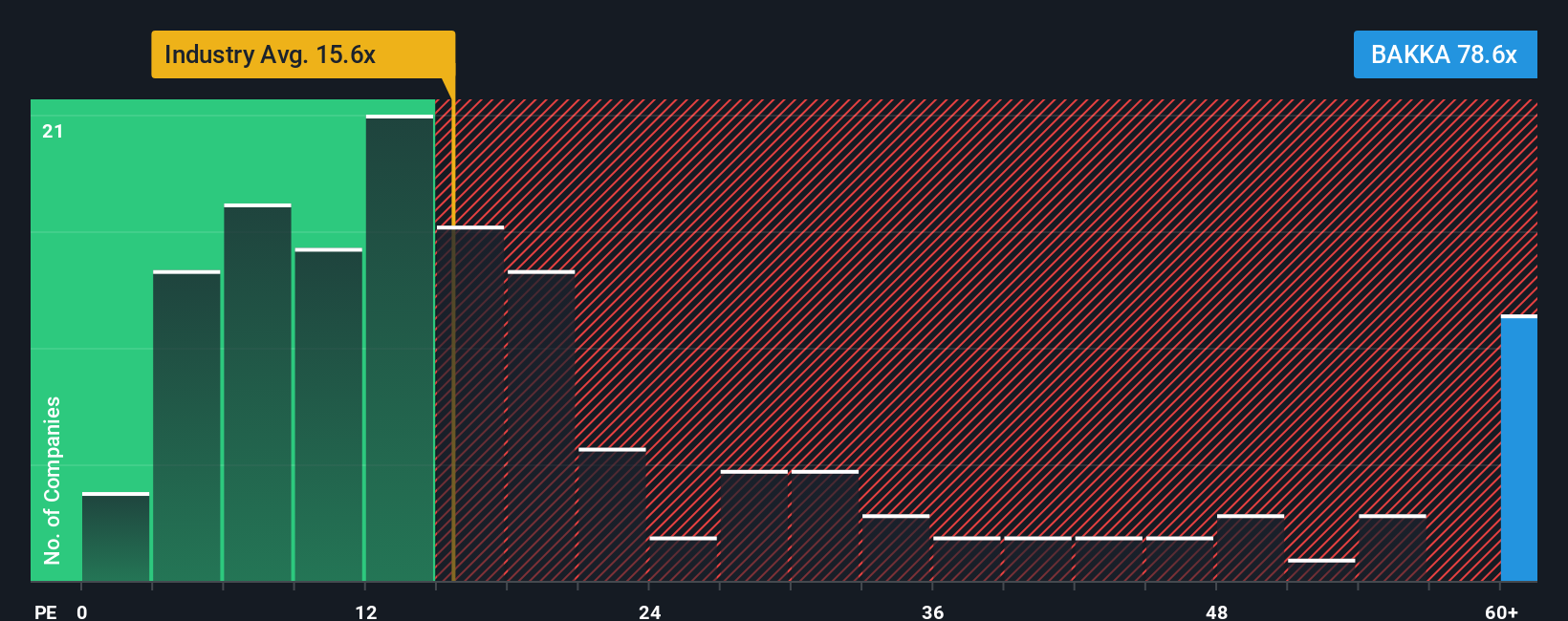

Another View: Peer and Industry Comparisons Signal Caution

Turning to price-to-earnings, Bakkafrost trades at 76.6x, which is much higher than its sector peers at 31.1x and the European Food industry at 15.8x. Even compared to its fair ratio of 67.7x, the stock looks expensive. This could signal valuation risks if future growth falls short. Could optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own P/F Bakkafrost Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own perspective in just a few minutes, and Do it your way.

A great starting point for your P/F Bakkafrost research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for a single opportunity. Expand your options now and put your capital to work where the most promising growth stories are taking shape.

- Jump on unique, undervalued opportunities by evaluating companies featured in these 878 undervalued stocks based on cash flows and see which ones may be flying under the market’s radar.

- Capitalize on powerful innovation by checking out these 25 AI penny stocks that are harnessing artificial intelligence to disrupt traditional industries.

- Boost your portfolio’s income stream by tapping into these 18 dividend stocks with yields > 3% offering compelling yields above 3% and a history of reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives