- Norway

- /

- Energy Services

- /

- OB:TGS

The Bull Case For TGS (OB:TGS) Could Change Following Major Gulf of America Seismic Survey Expansion

Reviewed by Sasha Jovanovic

- TGS recently announced the launch of the Amendment West-1 multi-client Ultra-Long Offset Ocean Bottom Node survey in the Gulf of America, expanding its Paleogene West play seismic coverage with advanced imaging technologies and targeting over 5,400 square kilometers in the East Breaks area.

- A distinct feature of this campaign is its use of industry-supported funding and next-generation data solutions aimed at meeting growing operator demand in a region expected to see strong competition in future lease rounds.

- We'll now examine how this expanded multi-client subsurface data initiative might influence TGS's broader investment case and earnings outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

TGS Investment Narrative Recap

To invest in TGS, you need confidence in a rebound for global energy exploration and high-value seismic data, especially in the Gulf of Mexico and other frontier regions. The Amendment West-1 survey strengthens TGS's position in an area closely watched for upcoming lease rounds, but in the near-term, it does not materially offset concerns related to customer concentration and lumpy large-ticket deal timing, which remain the biggest earnings risks.

Among recent announcements, the launch of PAMA Phase II in Brazil's Equatorial Margin is the most relevant, as it highlights TGS's parallel expansion into other growth basins and the company’s continued push to diversify its dataset and client base. This supports the medium-term catalyst of deeper participation in high-potential exploration markets, though it does not resolve immediate earnings lumpiness tied to deal flow concentration.

However, investors should also be aware that if a top customer were to delay or reduce commitments, annual revenue could quickly...

Read the full narrative on TGS (it's free!)

TGS is projected to have $1.5 billion in revenue and $226.2 million in earnings by 2028. This outlook assumes a 5.7% annual revenue decline and a $201.2 million increase in earnings from the current $25.0 million.

Uncover how TGS' forecasts yield a NOK120.10 fair value, a 63% upside to its current price.

Exploring Other Perspectives

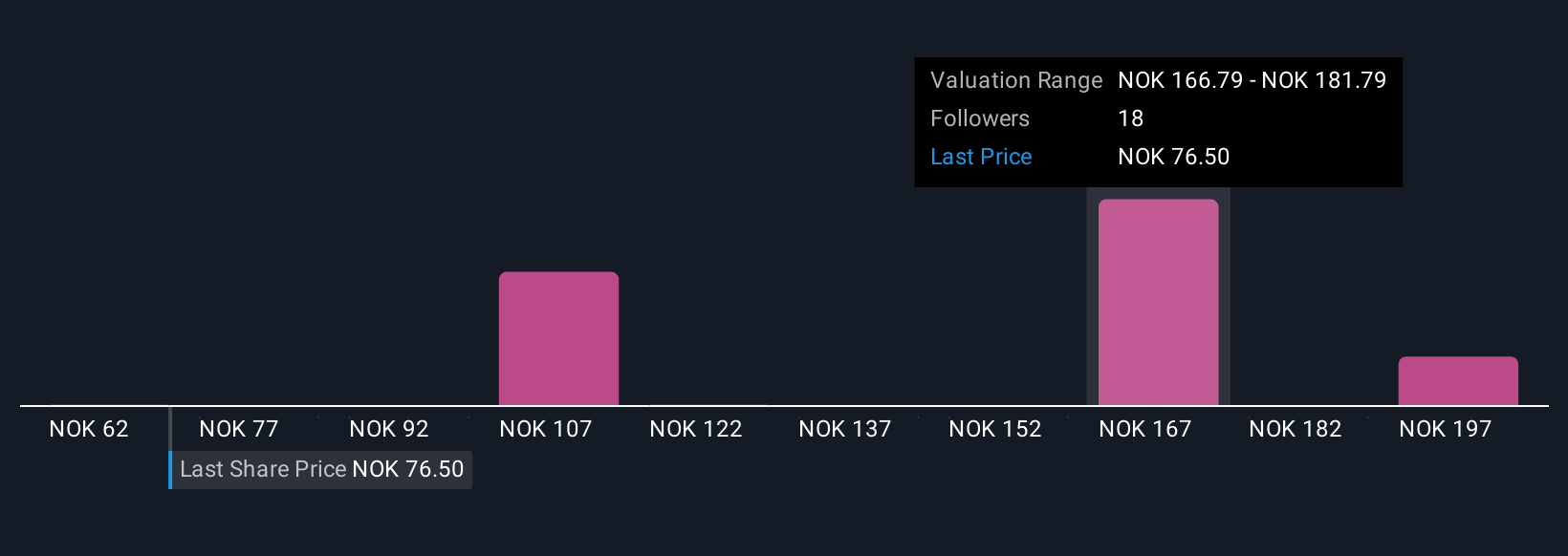

Six fair value estimates from the Simply Wall St Community range from NOK61.77 to NOK219.14. While some analyses highlight asset-heavy project risk, others foresee data expansion boosting future earnings, showing how widely perspectives can diverge.

Explore 6 other fair value estimates on TGS - why the stock might be worth 16% less than the current price!

Build Your Own TGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TGS research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TGS' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives