- Norway

- /

- Energy Services

- /

- OB:TGS

How Investors May Respond To TGS (OB:TGS) Expanding Ultra-Long Offset Seismic Campaign in Gulf of America

Reviewed by Sasha Jovanovic

- On September 29, 2025, TGS announced the launch of its second multi-client Ultra-Long Offset Ocean Bottom Node data acquisition campaign in the Gulf of America, expanding coverage by more than 5,400 square kilometers in the competitive Paleogene West play using advanced Gemini and ZXPLRe node technologies.

- This new survey, which was not included in previously disclosed bookings and is backed by industry funding, aims to enhance subsurface imaging and support exploration and development amid heightened activity in high-potential energy regions.

- We'll explore how TGS's expansion of advanced seismic campaigns in the Gulf of America affects its investment narrative and outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

TGS Investment Narrative Recap

To be a TGS shareholder, you need to believe that rising global energy demand and ongoing investment in frontier exploration will drive greater demand for the company’s advanced seismic data, and that adoption of cutting-edge acquisition technologies will support future revenue growth despite oil price volatility and a challenging macro environment. The launch of TGS’s second Ultra-Long Offset Ocean Bottom Node campaign in the Gulf of America reinforces its exposure to exploration catalysts, but does not meaningfully change the biggest current risk: earnings sensitivity to oil prices and the lumpy nature of large client deals.

Among TGS’s recent project announcements, the PAMA Phase II 3D survey in Brazil stands out for its scale and relevance to the growth catalyst of expanding data sets in underexplored basins. Similar to the campaign in the Gulf of America, the Brazil expansion targets areas that may attract supermajors seeking new reserves, strengthening TGS's position as global exploration activity rebounds. This focus on dataset coverage offers additional catalysts but leaves TGS exposed to outsized impacts from delayed renewals or project deferrals.

However, investors should be aware that concentrated client exposure and unpredictable contract timing mean that...

Read the full narrative on TGS (it's free!)

TGS' narrative projects $1.5 billion revenue and $226.2 million earnings by 2028. This requires a 5.7% yearly revenue decline and an earnings increase of $201.2 million from the current earnings of $25.0 million.

Uncover how TGS' forecasts yield a NOK120.10 fair value, a 55% upside to its current price.

Exploring Other Perspectives

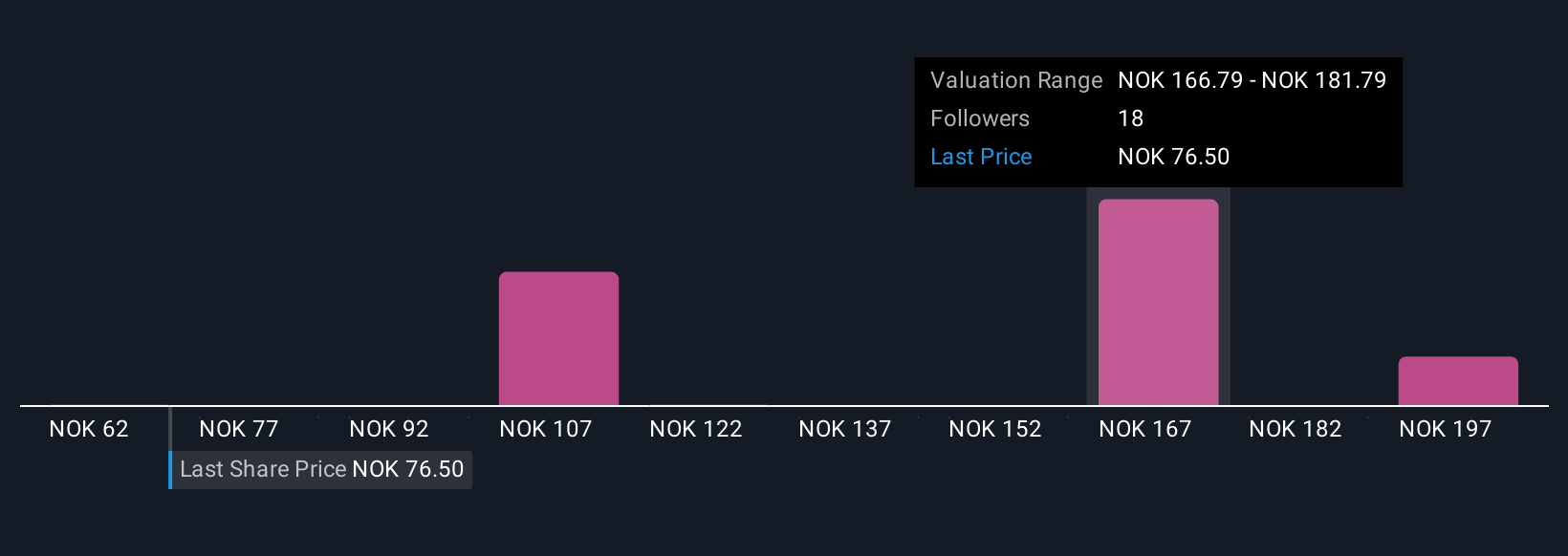

With 6 fair value estimates from the Simply Wall St Community spanning US$61.77 to US$211.12, investor opinions on TGS’s worth are wide ranging. Amid such differing views, remember: the company's high reliance on major clients means revenue can swing sharply with just a few delayed or lost deals.

Explore 6 other fair value estimates on TGS - why the stock might be worth 20% less than the current price!

Build Your Own TGS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TGS research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TGS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TGS' overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TGS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TGS

TGS

Provides geoscience data services to the oil and gas industry in Norway and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives