- Philippines

- /

- Office REITs

- /

- PSE:MREIT

3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As global markets experience a wave of optimism driven by hopes for softer tariffs and enthusiasm surrounding artificial intelligence, major indices like the S&P 500 have reached record highs. Amidst this buoyant market environment, investors are keenly searching for opportunities in stocks that may be trading below their estimated value. Identifying such stocks involves analyzing factors like strong fundamentals and potential growth catalysts, which can offer attractive entry points even in a rising market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.14 | 50% |

| GlobalData (AIM:DATA) | £1.785 | £3.57 | 49.9% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.93 | 49.9% |

| PDS (NSEI:PDSL) | ₹492.20 | ₹981.06 | 49.8% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.01 | 49.8% |

| ReadyTech Holdings (ASX:RDY) | A$3.11 | A$6.20 | 49.9% |

| IDP Education (ASX:IEL) | A$13.18 | A$26.27 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5859.00 | ¥11686.17 | 49.9% |

| Cavotec (OM:CCC) | SEK20.00 | SEK39.86 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

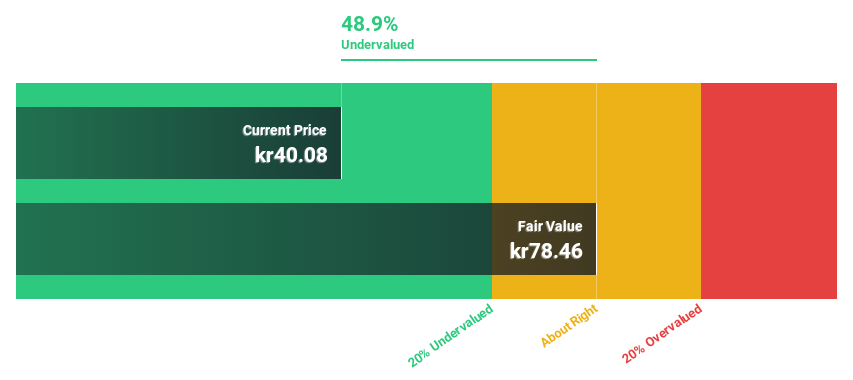

Solstad Offshore (OB:SOFF)

Overview: Solstad Offshore ASA provides offshore service vessels and maritime services to the offshore energy industry, with a market cap of NOK3.77 billion.

Operations: Revenue Segments (in millions of NOK): Platform Supply Vessels: 1,200; Anchor Handling Tug Supply Vessels: 1,500; Subsea Construction Vessels: 2,300.

Estimated Discount To Fair Value: 48.3%

Solstad Offshore is trading at NOK40.56, significantly below its estimated fair value of NOK78.46, making it highly undervalued based on discounted cash flow analysis. Despite expected revenue declines of 8.3% annually over the next three years, profitability is forecast to grow by 34.2% per year and become positive within the same period—an above-market growth rate. Recent contract awards in West Africa, Taiwan, and Australia may bolster future cash flows despite share price volatility.

- Upon reviewing our latest growth report, Solstad Offshore's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Solstad Offshore with our comprehensive financial health report here.

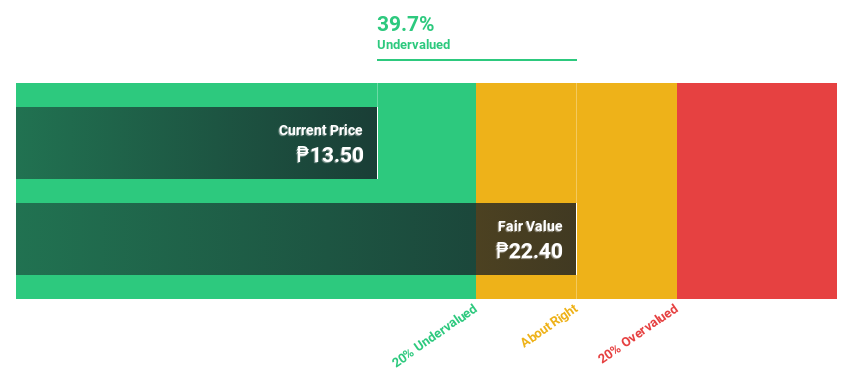

MREIT (PSE:MREIT)

Overview: MREIT, Inc. is a real estate investment trust with operations focused on property investments and a market cap of ₱50.62 billion.

Operations: MREIT, Inc. generates revenue primarily through the lease of its buildings, amounting to ₱3.21 billion.

Estimated Discount To Fair Value: 41.8%

MREIT is trading at ₱13.6, well below its estimated fair value of ₱23.36, suggesting significant undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution and a dividend not fully covered by earnings or free cash flows, its forecasted revenue growth of 22.7% annually and earnings growth of 48% per year outpace the Philippine market averages. Recent executive changes may influence future strategic direction and financial management effectiveness.

- According our earnings growth report, there's an indication that MREIT might be ready to expand.

- Click here to discover the nuances of MREIT with our detailed financial health report.

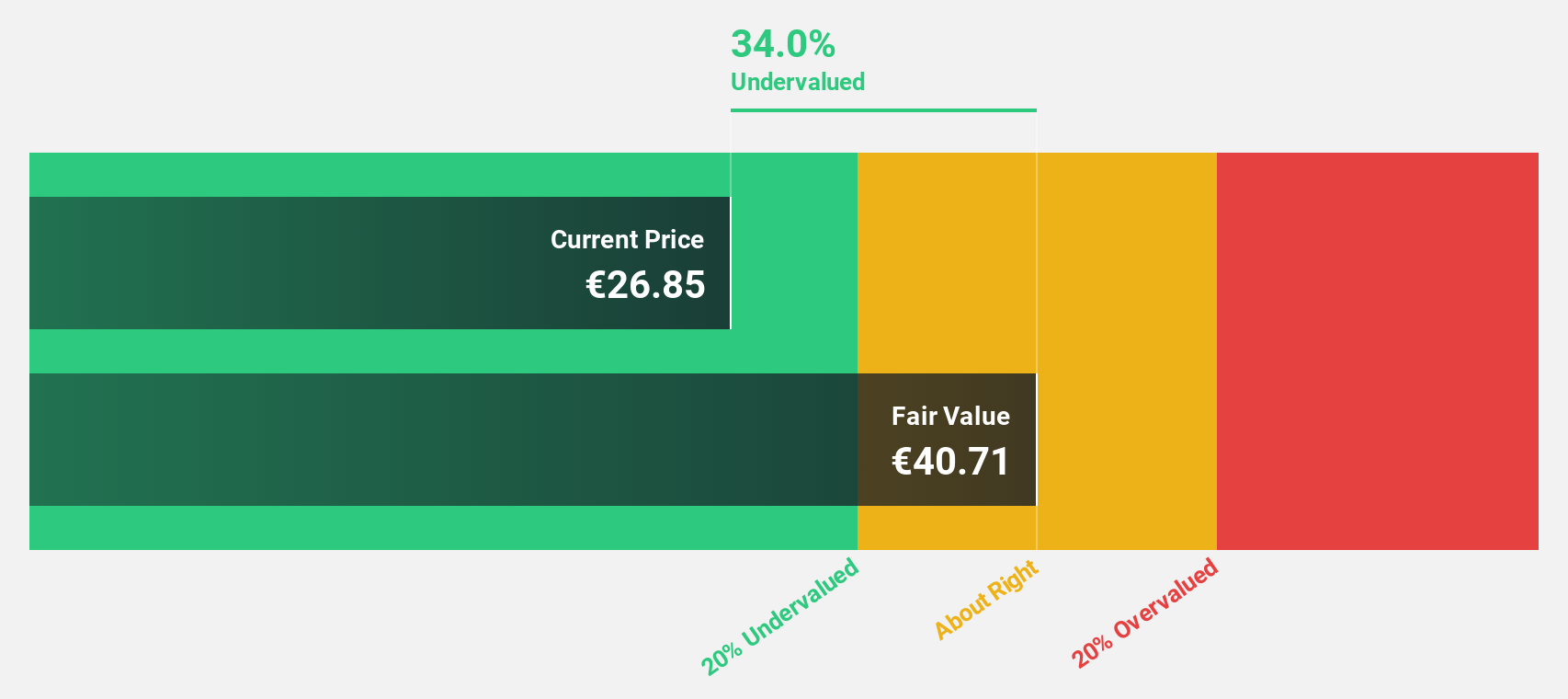

Stratec (XTRA:SBS)

Overview: Stratec SE, with a market cap of €390.21 million, designs and manufactures automation and instrumentation solutions for in-vitro diagnostics and life sciences in Germany, the European Union, and internationally.

Operations: The company's revenue segment includes €250.54 million from automation solutions for highly regulated laboratories.

Estimated Discount To Fair Value: 37.5%

Stratec, trading at €34.6, is significantly undervalued with a fair value estimate of €55.34 based on discounted cash flow analysis. Despite high debt levels and share price volatility, its earnings are projected to grow 25.1% annually, surpassing the German market average of 20.3%. Revenue growth is anticipated at 6.1% per year, slightly above the market rate of 5.6%. Recent conference presentations highlight ongoing strategic engagement and visibility in key industry forums.

- The growth report we've compiled suggests that Stratec's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Stratec stock in this financial health report.

Summing It All Up

- Discover the full array of 898 Undervalued Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:MREIT

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives