- Norway

- /

- Energy Services

- /

- OB:SBX

One SeaBird Exploration Plc (OB:SBX) Analyst Just Slashed Their Estimates By A Notable 15%

Market forces rained on the parade of SeaBird Exploration Plc (OB:SBX) shareholders today, when the covering analyst downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon. Shares are up 9.4% to kr10.94 in the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

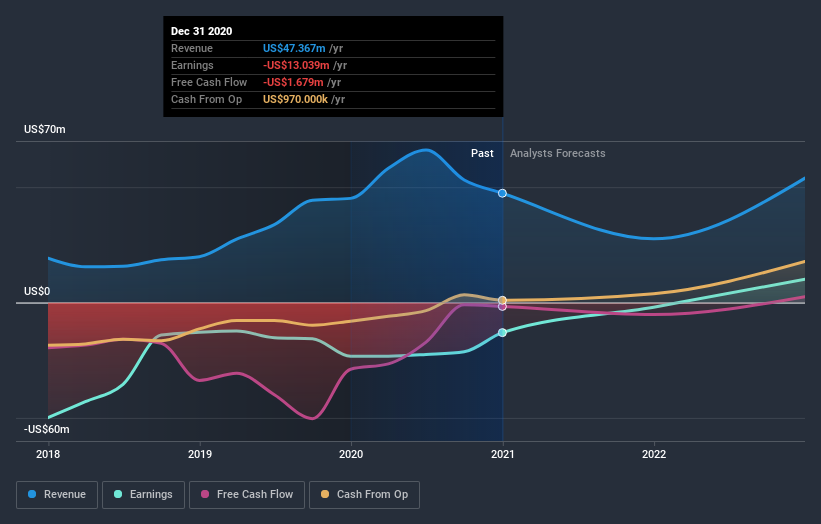

Following the latest downgrade, the current consensus, from the solitary analyst covering SeaBird Exploration, is for revenues of US$28m in 2021, which would reflect a disturbing 42% reduction in SeaBird Exploration's sales over the past 12 months. Losses are predicted to fall substantially, shrinking 85% to US$0.07. Before this latest update, the analyst had been forecasting revenues of US$33m and earnings per share (EPS) of US$0.04 in 2021. So we can see that the consensus has become notably more bearish on SeaBird Exploration's outlook with these numbers, making a measurable cut to this year's revenue estimates. Furthermore, they expect the business to be loss-making this year, compared to their previous forecasts of a profit.

View our latest analysis for SeaBird Exploration

The consensus price target lifted 14% to US$1.75, clearly signalling that the weaker revenue and EPS outlook are not expected to weigh on the stock over the longer term.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the SeaBird Exploration's past performance and to peers in the same industry. One more thing stood out to us about these estimates, and it's the idea that SeaBird Exploration'sdecline is expected to accelerate, with revenues forecast to fall 42% next year, topping off a historical decline of 17% a year over the past five years. Compare this against analyst estimates for companies in the wider industry, which suggest that revenues (in aggregate) are expected to grow 2.6% next year. So while a broad number of companies are forecast to grow, unfortunately SeaBird Exploration is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most important thing to take away is that the analyst is expecting SeaBird Exploration to become unprofitable this year. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that SeaBird Exploration's revenues are expected to grow slower than the wider market. The rising price target is a puzzle, but still - with a serious cut to this year's outlook, we wouldn't be surprised if investors were a bit wary of SeaBird Exploration.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have analyst estimates for SeaBird Exploration going out as far as 2022, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade SeaBird Exploration, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:SBX

SeaBird Exploration

Provides marine seismic data for the oil and gas industry in Europe, Africa, the Middle East, North and South America, and the Asia Pacific.

High growth potential with excellent balance sheet.