As global markets navigate a landscape of easing inflation and strong bank earnings, major U.S. stock indexes have rebounded, driven by value stocks outperforming growth shares. In this environment, dividend stocks can offer investors a combination of income and potential capital appreciation, making them an attractive option for those seeking stability amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.97% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.91% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

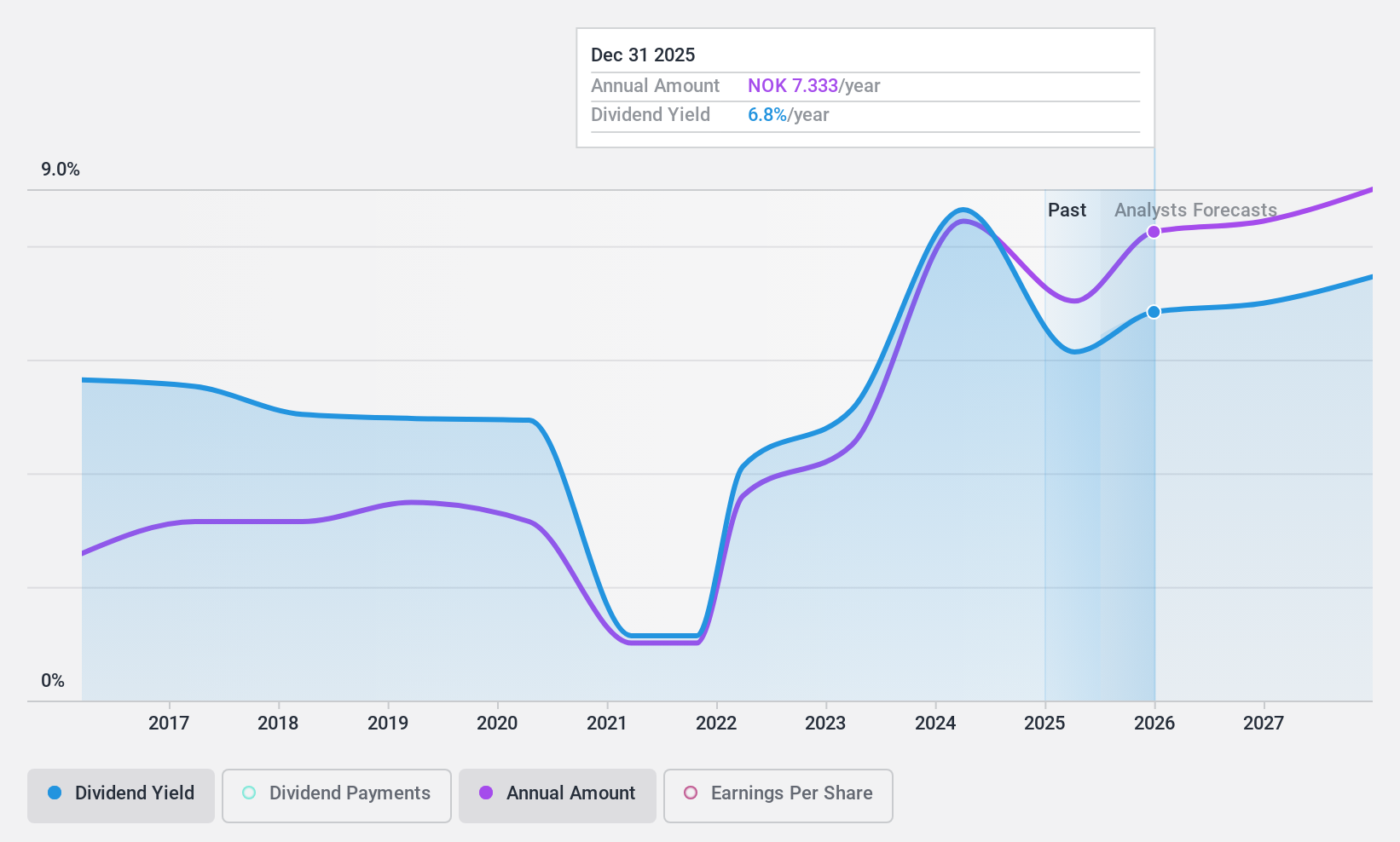

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to retail and corporate clients in Norway and has a market cap of NOK4.73 billion.

Operations: Sparebanken Møre generates revenue from several segments, including Retail at NOK1.06 billion, Corporate at NOK1.00 billion, and Real Estate Brokerage at NOK43 million.

Dividend Yield: 7.7%

Sparebanken Møre offers a compelling dividend yield of 7.81%, ranking in the top 25% in Norway, with dividends covered by earnings at a payout ratio of 66.8%. Despite past volatility and unreliability in dividend payments, they have shown growth over the last decade. The bank's recent NOK 1.05 billion floating rate bond issuance may impact future financial flexibility. Trading below its estimated fair value enhances its attractiveness for value-focused investors.

- Click to explore a detailed breakdown of our findings in Sparebanken Møre's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sparebanken Møre shares in the market.

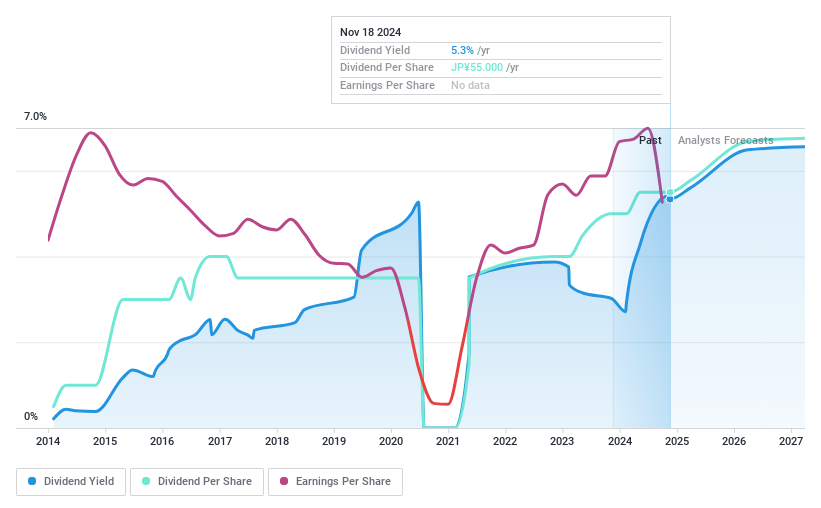

Mazda Motor (TSE:7261)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mazda Motor Corporation manufactures and sells passenger cars and commercial vehicles globally, with a market cap of ¥660.92 billion.

Operations: Mazda Motor Corporation's revenue segments include ¥3.81 billion from Japan, ¥0.82 billion from Europe, ¥3.26 billion from North America, and ¥0.68 billion from other regions.

Dividend Yield: 5.2%

Mazda Motor's dividend yield of 5.25% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 25.7%, ensuring coverage by both earnings and cash flows. Despite past volatility and an unstable track record, dividends have grown over the last decade. Recent guidance revisions indicate lower expected earnings due to decreased sales in Japan, though North American sales remain strong. The ¥15 billion fixed-income offering may affect financial strategies going forward.

- Delve into the full analysis dividend report here for a deeper understanding of Mazda Motor.

- The valuation report we've compiled suggests that Mazda Motor's current price could be quite moderate.

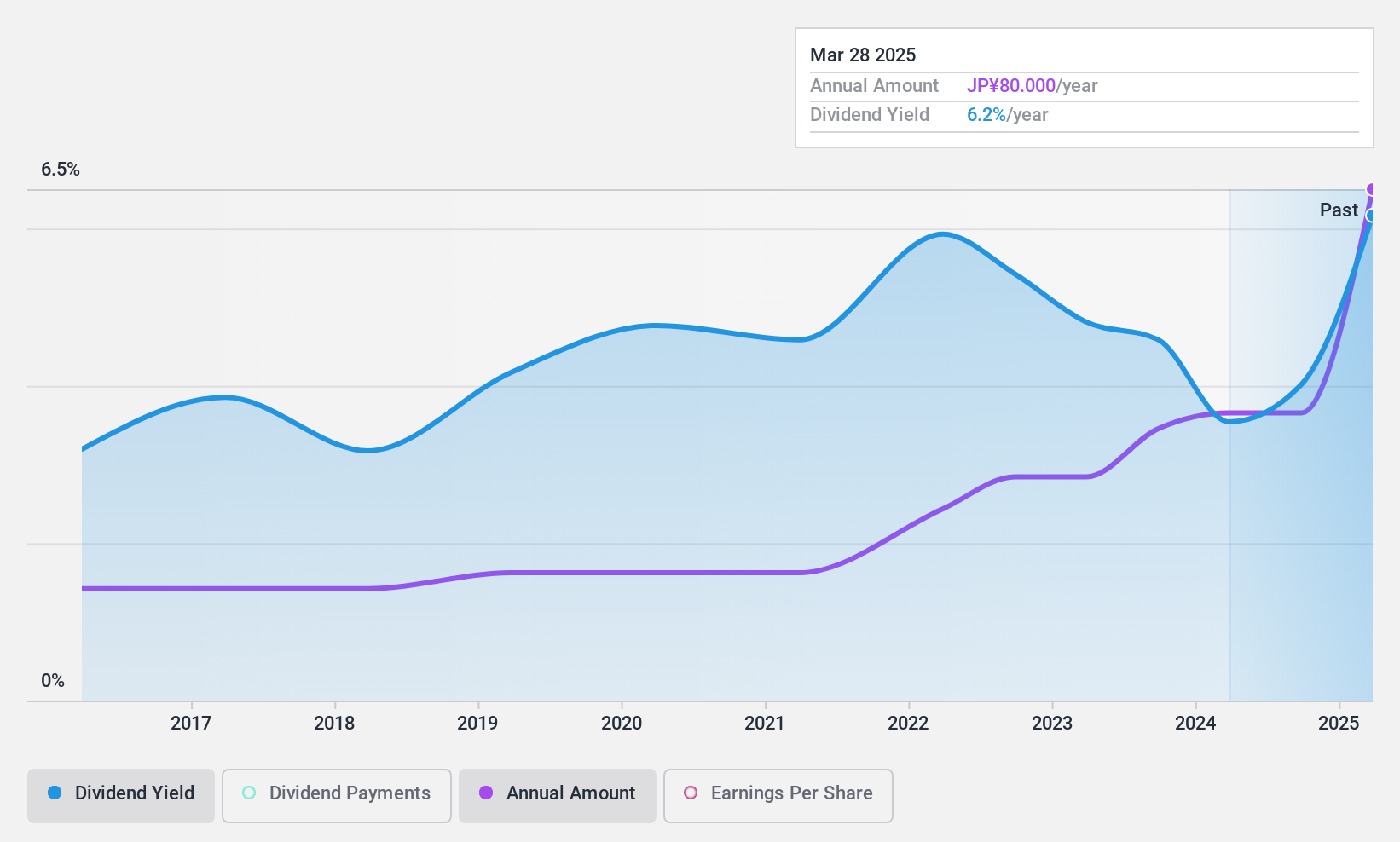

Takashima (TSE:8007)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takashima & Co., Ltd. operates in Japan through its subsidiaries by designing, proposing, processing, and distributing construction and building products, with a market cap of ¥21.66 billion.

Operations: Takashima & Co., Ltd. generates revenue through the sale and distribution of construction and building materials in Japan.

Dividend Yield: 5.1%

Takashima's dividend yield of 5.14% is among the top 25% in Japan, bolstered by a low payout ratio of 24.6%, ensuring dividends are well-covered by earnings and cash flows. However, its dividend history is marked by volatility, with significant annual drops exceeding 20%. Recent announcements include a reduced Q2 dividend and strategic decisions to enhance asset efficiency through policy shareholding reductions. Earnings guidance for fiscal year-end March 2025 projects ¥94 billion in net sales and ¥2 billion operating profit.

- Dive into the specifics of Takashima here with our thorough dividend report.

- Upon reviewing our latest valuation report, Takashima's share price might be too pessimistic.

Summing It All Up

- Embark on your investment journey to our 1978 Top Dividend Stocks selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Undervalued with solid track record and pays a dividend.