Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Reach Subsea (OB:REACH). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Reach Subsea

Reach Subsea's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Reach Subsea's EPS went from kr0.028 to kr0.59 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

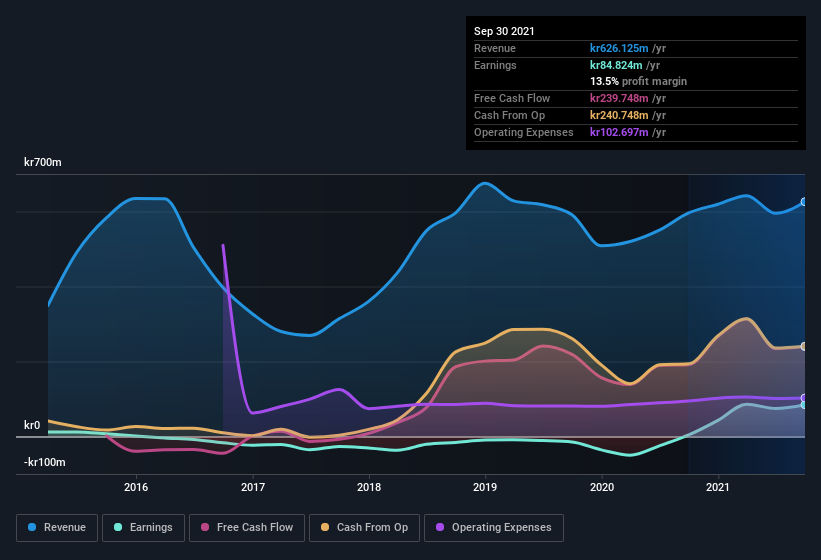

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Reach Subsea shareholders can take confidence from the fact that EBIT margins are up from 2.7% to 11%, and revenue is growing. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Reach Subsea is no giant, with a market capitalization of kr486m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Reach Subsea Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Reach Subsea top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Director, Anders Onarheim, paid kr1.5m to buy shares at an average price of kr2.94.

I do like that insiders have been buying shares in Reach Subsea, but there is more evidence of shareholder friendly management. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations under kr1.8b, like Reach Subsea, the median CEO pay is around kr2.9m.

The Reach Subsea CEO received kr1.7m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Reach Subsea Deserve A Spot On Your Watchlist?

Reach Subsea's earnings per share have taken off like a rocket aimed right at the moon. The company can also boast of insider buying, and reasonable remuneration for the CEO. It could be that Reach Subsea is at an inflection point, given the EPS growth. For those chasing fast growth, then, I'd suggest to stock merits monitoring. Still, you should learn about the 3 warning signs we've spotted with Reach Subsea (including 1 which shouldn't be ignored) .

The good news is that Reach Subsea is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Reach Subsea, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:REACH

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives