Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies OKEA ASA (OB:OKEA) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for OKEA

How Much Debt Does OKEA Carry?

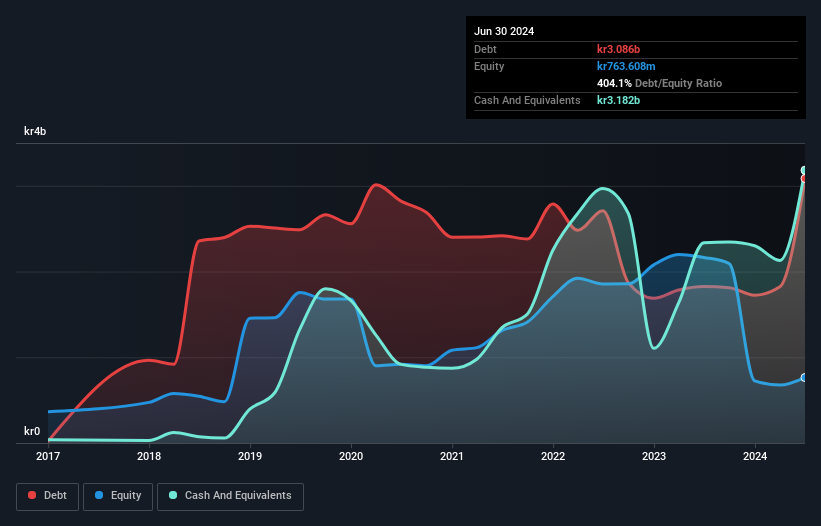

The image below, which you can click on for greater detail, shows that at June 2024 OKEA had debt of kr3.09b, up from kr1.83b in one year. However, it does have kr3.18b in cash offsetting this, leading to net cash of kr96.7m.

A Look At OKEA's Liabilities

The latest balance sheet data shows that OKEA had liabilities of kr5.08b due within a year, and liabilities of kr13.5b falling due after that. On the other hand, it had cash of kr3.18b and kr1.13b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr14.3b.

This deficit casts a shadow over the kr2.28b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, OKEA would likely require a major re-capitalisation if it had to pay its creditors today. OKEA boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

But the bad news is that OKEA has seen its EBIT plunge 11% in the last twelve months. We think hat kind of performance, if repeated frequently, could well lead to difficulties for the stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if OKEA can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While OKEA has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, OKEA produced sturdy free cash flow equating to 71% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

Although OKEA's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of kr96.7m. The cherry on top was that in converted 71% of that EBIT to free cash flow, bringing in kr1.7b. So while OKEA does not have a great balance sheet, it's certainly not too bad. Given our hesitation about the stock, it would be good to know if OKEA insiders have sold any shares recently. You click here to find out if insiders have sold recently.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OKEA

OKEA

An oil and gas company, engages in the development and production of oil and gas in the Norwegian Continental Shelf.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026