- Norway

- /

- Oil and Gas

- /

- OB:OKEA

Is OKEA ASA's (OB:OKEA) Latest Stock Performance A Reflection Of Its Financial Health?

OKEA (OB:OKEA) has had a great run on the share market with its stock up by a significant 12% over the last week. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. In this article, we decided to focus on OKEA's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for OKEA

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for OKEA is:

31% = kr652m ÷ kr2.1b (Based on the trailing twelve months to September 2023).

The 'return' is the yearly profit. So, this means that for every NOK1 of its shareholder's investments, the company generates a profit of NOK0.31.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of OKEA's Earnings Growth And 31% ROE

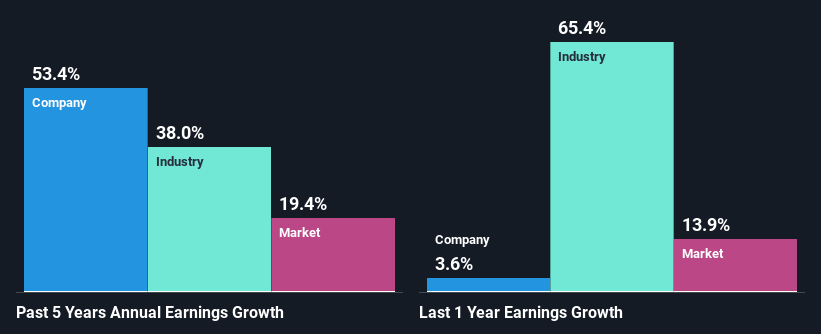

First thing first, we like that OKEA has an impressive ROE. Secondly, even when compared to the industry average of 22% the company's ROE is quite impressive. So, the substantial 53% net income growth seen by OKEA over the past five years isn't overly surprising.

Next, on comparing with the industry net income growth, we found that OKEA's growth is quite high when compared to the industry average growth of 38% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for OKEA? You can find out in our latest intrinsic value infographic research report.

Is OKEA Making Efficient Use Of Its Profits?

OKEA's significant three-year median payout ratio of 57% (where it is retaining only 43% of its income) suggests that the company has been able to achieve a high growth in earnings despite returning most of its income to shareholders.

While OKEA has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 55% of its profits over the next three years. However, OKEA's future ROE is expected to decline to 18% despite there being not much change anticipated in the company's payout ratio.

Conclusion

In total, we are pretty happy with OKEA's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OKEA

OKEA

An oil and gas company, engages in the development and production of oil and gas in the Norwegian Continental Shelf.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026