- Norway

- /

- Oil and Gas

- /

- OB:OET

With EPS Growth And More, Okeanis Eco Tankers (OB:OET) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Okeanis Eco Tankers (OB:OET), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Okeanis Eco Tankers

How Fast Is Okeanis Eco Tankers Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Okeanis Eco Tankers has grown EPS by 23% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

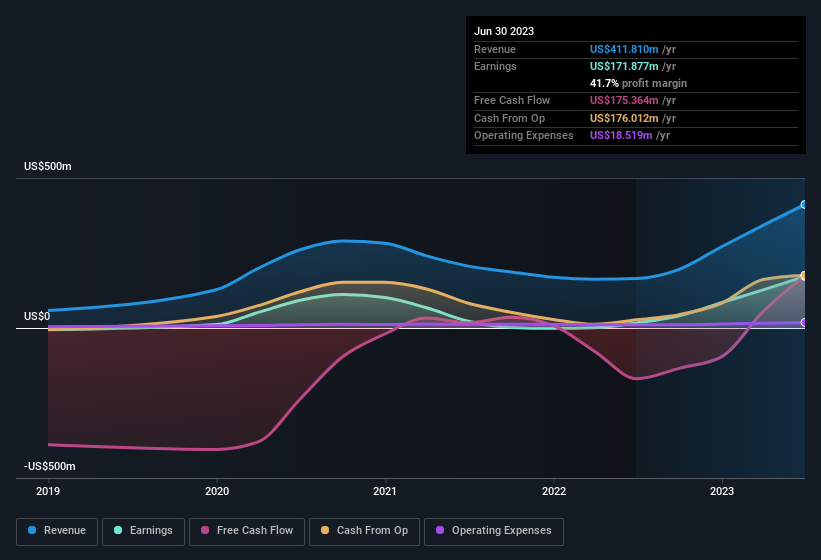

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Okeanis Eco Tankers is growing revenues, and EBIT margins improved by 35.6 percentage points to 53%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Okeanis Eco Tankers' future profits.

Are Okeanis Eco Tankers Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Okeanis Eco Tankers will be more than happy to see insiders committing themselves to the company, spending US$5.3m on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. It is also worth noting that it was Chief Executive Officer Aristidis Alafouzos who made the biggest single purchase, worth kr5.2m, paying kr234 per share.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Okeanis Eco Tankers will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 55%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. And their holding is extremely valuable at the current share price, totalling US$4.3b. That means they have plenty of their own capital riding on the performance of the business!

Does Okeanis Eco Tankers Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Okeanis Eco Tankers' strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. Before you take the next step you should know about the 3 warning signs for Okeanis Eco Tankers (1 doesn't sit too well with us!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Okeanis Eco Tankers isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OET

Okeanis Eco Tankers

A shipping company, owns and operates tanker vessels worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives