It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Okeanis Eco Tankers (OB:OET). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Okeanis Eco Tankers with the means to add long-term value to shareholders.

See our latest analysis for Okeanis Eco Tankers

Okeanis Eco Tankers' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Okeanis Eco Tankers managed to grow EPS by 13% per year, over three years. That's a good rate of growth, if it can be sustained.

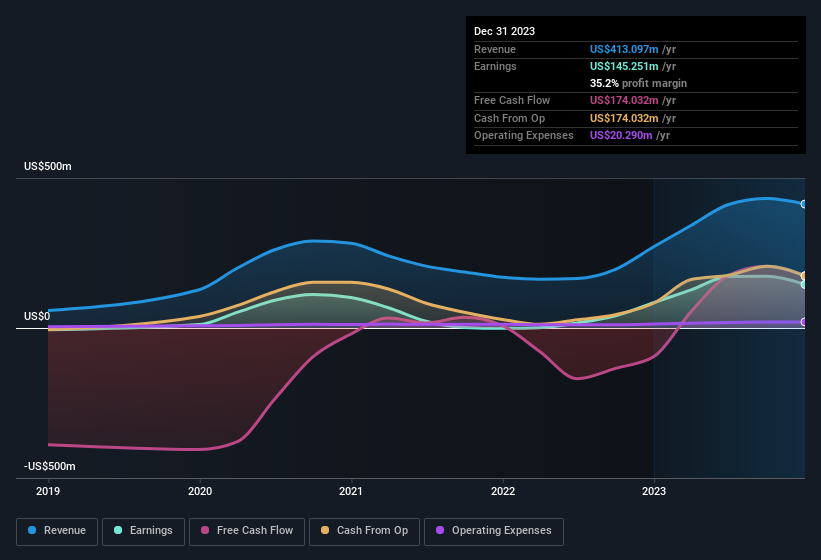

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Okeanis Eco Tankers shareholders can take confidence from the fact that EBIT margins are up from 41% to 49%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Okeanis Eco Tankers.

Are Okeanis Eco Tankers Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Okeanis Eco Tankers shareholders can gain quiet confidence from the fact that insiders shelled out US$8.5m to buy stock, over the last year. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. It is also worth noting that it was Chief Executive Officer Aristidis Alafouzos who made the biggest single purchase, worth kr7.4m, paying kr253 per share.

On top of the insider buying, it's good to see that Okeanis Eco Tankers insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$2.3b. Coming in at 21% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Does Okeanis Eco Tankers Deserve A Spot On Your Watchlist?

One important encouraging feature of Okeanis Eco Tankers is that it is growing profits. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Okeanis Eco Tankers , and understanding them should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Okeanis Eco Tankers isn't the only one. You can see a a curated list of Norwegian companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Okeanis Eco Tankers, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OET

Okeanis Eco Tankers

A shipping company, owns and operates tanker vessels worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives