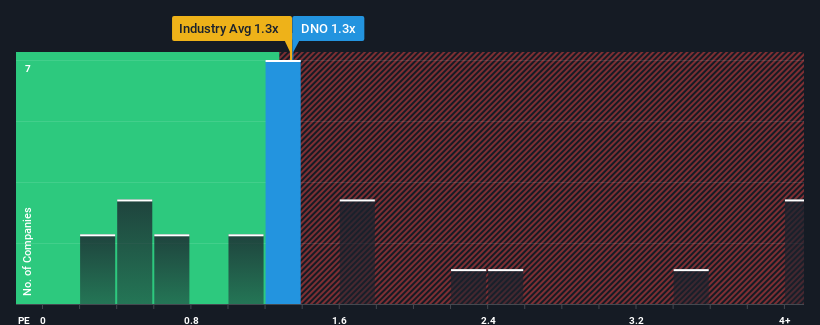

With a median price-to-sales (or "P/S") ratio of close to 1.3x in the Oil and Gas industry in Norway, you could be forgiven for feeling indifferent about DNO ASA's (OB:DNO) P/S ratio, which comes in at about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for DNO

How Has DNO Performed Recently?

Recent times haven't been great for DNO as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DNO will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

DNO's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 8.6% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 7.6% per year. With the rest of the industry predicted to shrink by 1.2% per annum, that would be a fantastic result.

With this in mind, we find it intriguing that DNO's P/S trades in-line with its industry peers. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What Does DNO's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of DNO's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware DNO is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of DNO's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives