- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Aker BP (OB:AKRBP): Exploring Share Valuation After Recent 8% Gain

Reviewed by Kshitija Bhandaru

Aker BP (OB:AKRBP) shares have edged up over the past month, gaining about 8%. Given these moves, many investors are turning a careful eye to the company’s fundamentals and recent financial performance.

See our latest analysis for Aker BP.

Momentum seems to be building for Aker BP, with its recent 8% share price return over the past 30 days reflecting growing investor confidence after a period of steadier performance. Looking at the bigger picture, its 1-year total shareholder return comes in at a healthy 20%, underscoring both recovery and long-term strength.

If you’re curious to see what else is catching investors’ attention in related sectors, this is a perfect moment to broaden your horizons with fast growing stocks with high insider ownership

But with shares now trading close to analyst targets, investors may be wondering whether Aker BP remains undervalued or if the market has already priced in its future growth prospects. Is there still a buying opportunity left?

Most Popular Narrative: 3% Overvalued

With Aker BP's last close price hovering just above the narrative's fair value estimate, the gap between market optimism and analyst expectations is razor-thin. Every assumption matters in this context. Investors seeking clarity on potential upside may want to examine what is really underpinning this consensus.

The Yggdrasil project is designed to be technologically advanced and low-emission, powered by renewable electricity from shore, ensuring efficient and cost-effective operations that will likely improve net margins by reducing operational costs and environmental compliance expenses. Aker BP’s commitment to digitalization, including developments like Agile Asset Management and the ACE toolkit, aims to optimize operations and enhance efficiency, potentially leading to improved net margins and higher earnings through reduced downtime and streamlined processes.

Curious what bold forecasts justify nearly parity between share price and target? The real story may come down to a battle between ambitious earnings growth assumptions and elevated profit multiples. Want to spot the one variable that could flip this narrative on its head? Read on for the quantitative secrets behind the price target.

Result: Fair Value of $256.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in emissions costs or unexpected production challenges could quickly undermine these optimistic assumptions. Investors should remain vigilant for surprises.

Find out about the key risks to this Aker BP narrative.

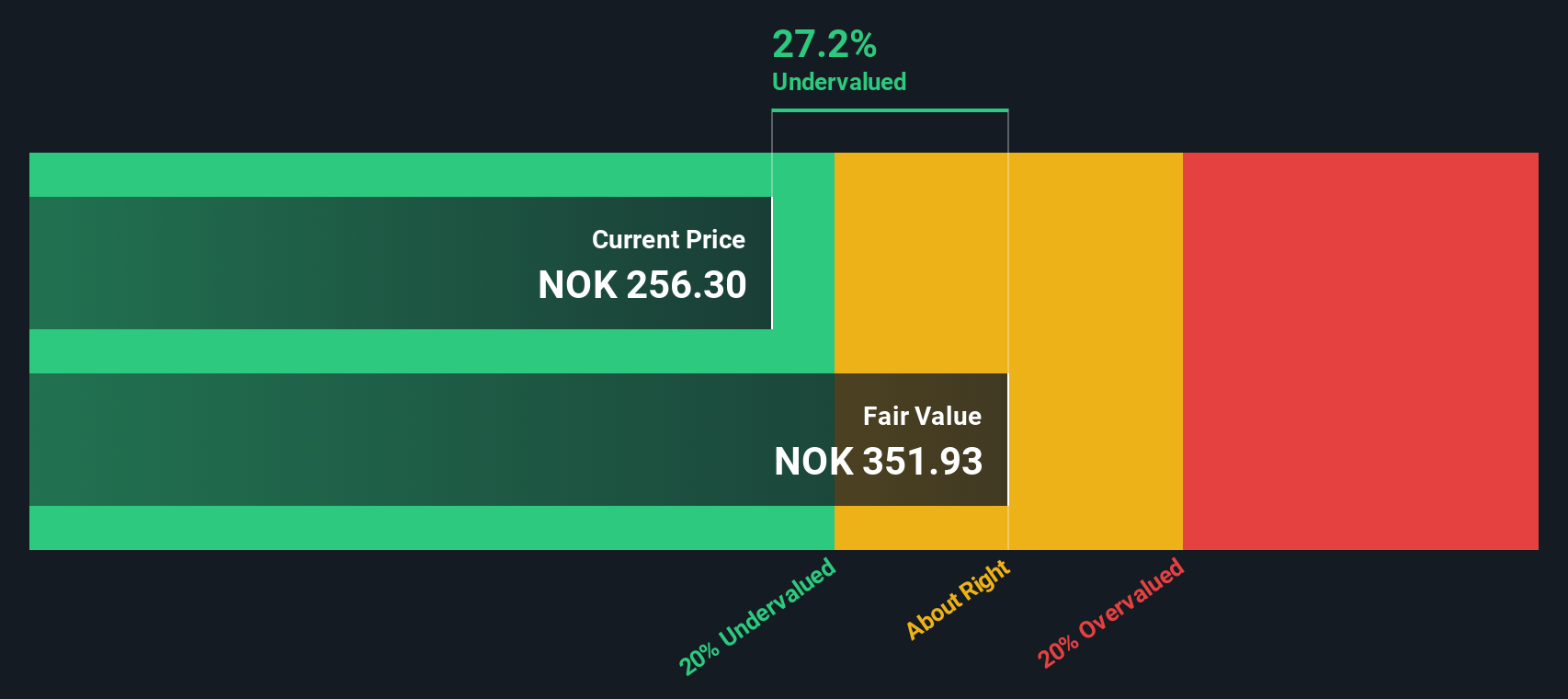

Another View: Discounted Cash Flow Signals Opportunity

While analyst price targets suggest Aker BP is fairly valued or even slightly overvalued based on earnings projections, our SWS DCF model offers a contrasting perspective. The DCF result points to shares trading around 25% below fair value, which could indicate meaningful upside if cash flow forecasts prove accurate. Are analyst assumptions too conservative, or does the market see risks that the DCF might not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aker BP for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aker BP Narrative

If these conclusions don’t fit your perspective, or if you’d rather dig into the numbers on your own terms, you can build your own view of Aker BP’s value in just a few minutes. Do it your way

A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big winner slip through the cracks. Expand your portfolio possibilities by checking out these standout stock opportunities chosen for different strategies and trends:

- Capture the excitement of artificial intelligence breakthroughs when you analyze these 25 AI penny stocks, which are transforming entire industries right now.

- Boost your portfolio with reliable income by selecting from these 19 dividend stocks with yields > 3%, which have yields greater than 3% and solid financials.

- Ride the momentum of digital disruption by tracking these 78 cryptocurrency and blockchain stocks, where innovation meets blockchain and future technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives