- Norway

- /

- Hospitality

- /

- OB:SATS

Investors Appear Satisfied With Sats ASA's (OB:SATS) Prospects As Shares Rocket 26%

Sats ASA (OB:SATS) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 85% in the last year.

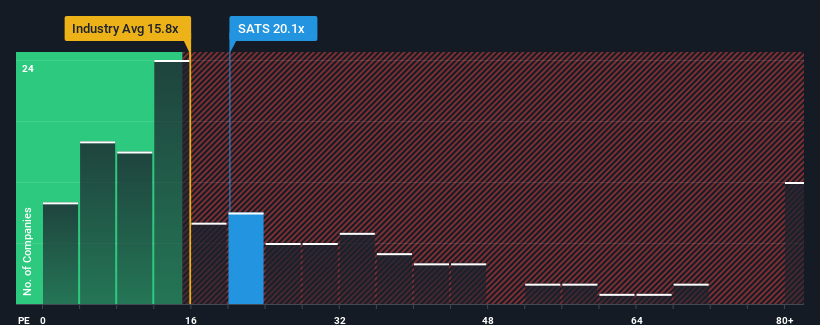

Following the firm bounce in price, given close to half the companies in Norway have price-to-earnings ratios (or "P/E's") below 11x, you may consider Sats as a stock to avoid entirely with its 20.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been advantageous for Sats as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Sats

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Sats' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 45% last year. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 23% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 16% per year, which is noticeably less attractive.

In light of this, it's understandable that Sats' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Sats' P/E

Shares in Sats have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sats maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Sats that you should be aware of.

Of course, you might also be able to find a better stock than Sats. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SATS

Sats

Provides fitness and training services in Norway, Sweden, Denmark, and Finland.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives