Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Black Sea Property AS (OB:BSP) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Black Sea Property

What Is Black Sea Property's Net Debt?

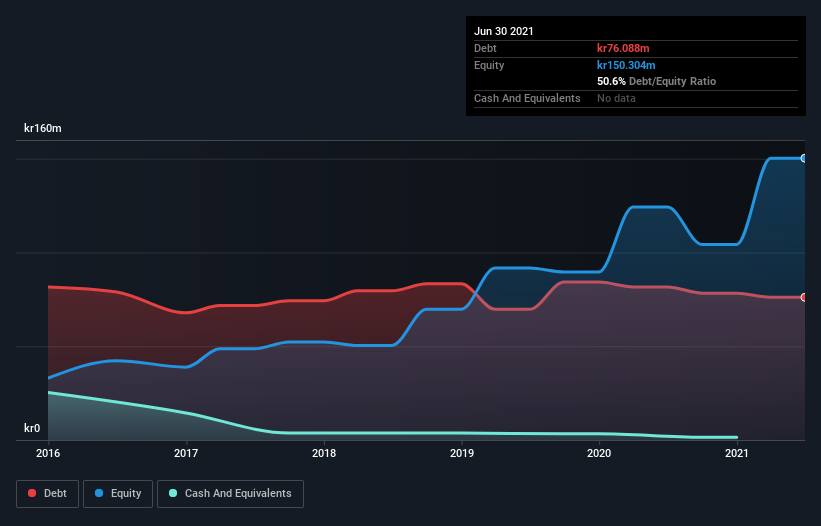

As you can see below, Black Sea Property had kr76.1m of debt at June 2021, down from kr81.6m a year prior. Net debt is about the same, since the it doesn't have much cash.

A Look At Black Sea Property's Liabilities

According to the last reported balance sheet, Black Sea Property had liabilities of kr28.5m due within 12 months, and liabilities of kr70.7m due beyond 12 months. Offsetting this, it had kr1.42m in cash and kr15.1m in receivables that were due within 12 months. So its liabilities total kr82.7m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's kr77.8m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Black Sea Property will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

It seems likely shareholders hope that Black Sea Property can significantly advance the business plan before too long, because it doesn't have any significant revenue at the moment.

Caveat Emptor

Over the last twelve months Black Sea Property produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping kr8.2m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. It's fair to say the loss of kr15m didn't encourage us either; we'd like to see a profit. In the meantime, we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Black Sea Property is showing 4 warning signs in our investment analysis , and 3 of those can't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Black Sea Property might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BSP

Black Sea Property

Engages in the operation of holiday resort under the Aheloy Beach Resort name in Bulgaria.

Slight with weak fundamentals.