More money in the bank for insiders who divested kr7.1m worth of Tomra Systems ASA (OB:TOM) shares last year

Last week, Tomra Systems ASA's (OB:TOM) stock jumped 4.0%, but insiders who sold kr7.1m worth of stock in over the past year are likely to be in a better position. Selling at an average price of kr510, which is higher than the current price might have been the right call as holding on to stock would have meant their investment would be worth less now than it was at the time of sale.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

View our latest analysis for Tomra Systems

Tomra Systems Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Executive VP & Head of Business Area Collection Solutions, Harald Henriksen, sold kr7.1m worth of shares at a price of kr510 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The good news is that this large sale was at well above current price of kr355. So it may not shed much light on insider confidence at current levels. Harald Henriksen was the only individual insider to sell shares in the last twelve months.

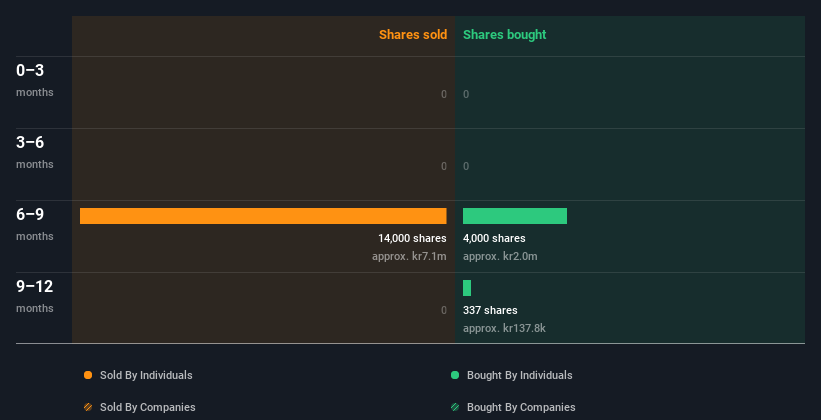

Over the last year, we can see that insiders have bought 4.34k shares worth kr2.2m. But they sold 14.00k shares for kr7.1m. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Insider Ownership of Tomra Systems

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Tomra Systems insiders have about 0.08% of the stock, worth approximately kr40m. I generally like to see higher levels of ownership.

So What Do The Tomra Systems Insider Transactions Indicate?

The fact that there have been no Tomra Systems insider transactions recently certainly doesn't bother us. We don't take much encouragement from the transactions by Tomra Systems insiders. But we do like the fact that insiders own a fair chunk of the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. You'd be interested to know, that we found 1 warning sign for Tomra Systems and we suggest you have a look.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tomra Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:TOM

Tomra Systems

Provides sensor-based solutions for optimal resource productivity worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion