- Norway

- /

- Commercial Services

- /

- OB:SSG

Here's Why We Think Self Storage Group (OB:SSG) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Self Storage Group (OB:SSG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Self Storage Group with the means to add long-term value to shareholders.

Check out the opportunities and risks within the NO Commercial Services industry.

How Quickly Is Self Storage Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Self Storage Group has grown EPS by 45% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Self Storage Group did well to grow revenue over the last year, EBIT margins were dampened at the same time. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

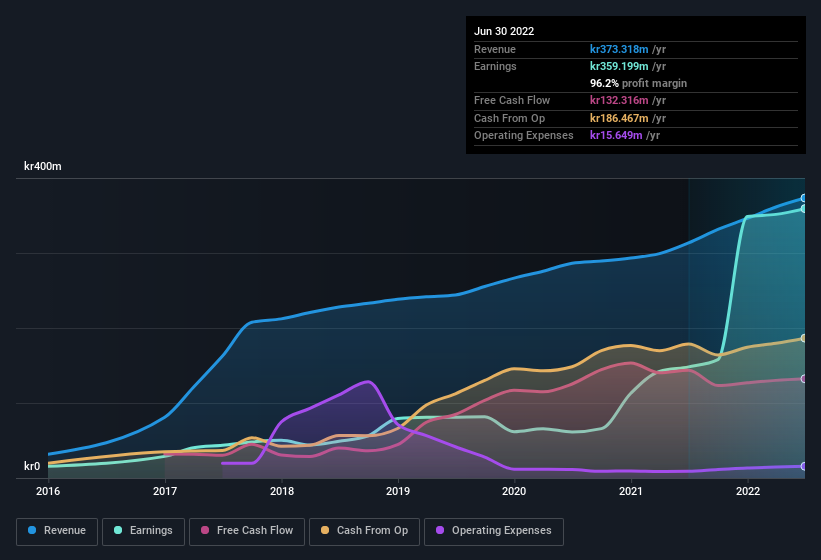

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Self Storage Group is no giant, with a market capitalisation of kr2.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Self Storage Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

In the last twelve months Self Storage Group insiders spent kr127k on stock; good news for shareholders. While this investment may be modest, it is great considering the lack of insider selling.

It's commendable to see that insiders have been buying shares in Self Storage Group, but there is more evidence of shareholder friendly management. Namely, Self Storage Group has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Self Storage Group with market caps between kr1.1b and kr4.3b is about kr4.8m.

Self Storage Group's CEO took home a total compensation package of kr855k in the year prior to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Self Storage Group Deserve A Spot On Your Watchlist?

Self Storage Group's earnings per share growth have been climbing higher at an appreciable rate. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Self Storage Group may be at an inflection point. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. Even so, be aware that Self Storage Group is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

The good news is that Self Storage Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SSG

Self Storage Group

Self Storage Group ASA engages in the rental of self-storage units to private individuals and businesses in Norway, Sweden, and Denmark.

Worrying balance sheet with weak fundamentals.

Market Insights

Community Narratives